Foghorn Therapeutics Inc. (NASDAQ:FHTX) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Foghorn Therapeutics Inc. (NASDAQ:FHTX) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

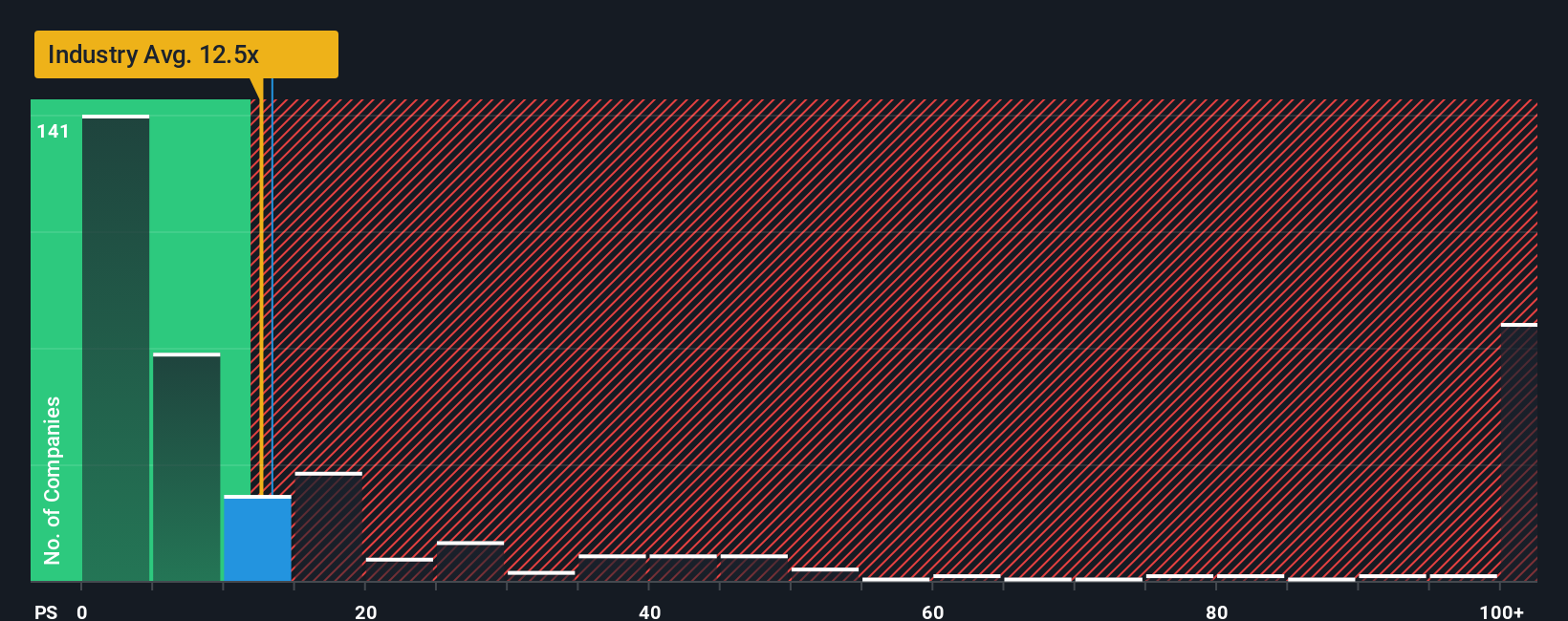

In spite of the firm bounce in price, there still wouldn't be many who think Foghorn Therapeutics' price-to-sales (or "P/S") ratio of 13.3x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 12.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Foghorn Therapeutics

What Does Foghorn Therapeutics' P/S Mean For Shareholders?

Foghorn Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Foghorn Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Foghorn Therapeutics?

Foghorn Therapeutics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.9%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 56% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 25% per year during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 120% per year growth forecast for the broader industry.

With this information, we find it interesting that Foghorn Therapeutics is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Foghorn Therapeutics' P/S

Foghorn Therapeutics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Foghorn Therapeutics' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with Foghorn Therapeutics (including 1 which is a bit unpleasant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报