Take Care Before Jumping Onto Lamb Weston Holdings, Inc. (NYSE:LW) Even Though It's 26% Cheaper

The Lamb Weston Holdings, Inc. (NYSE:LW) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

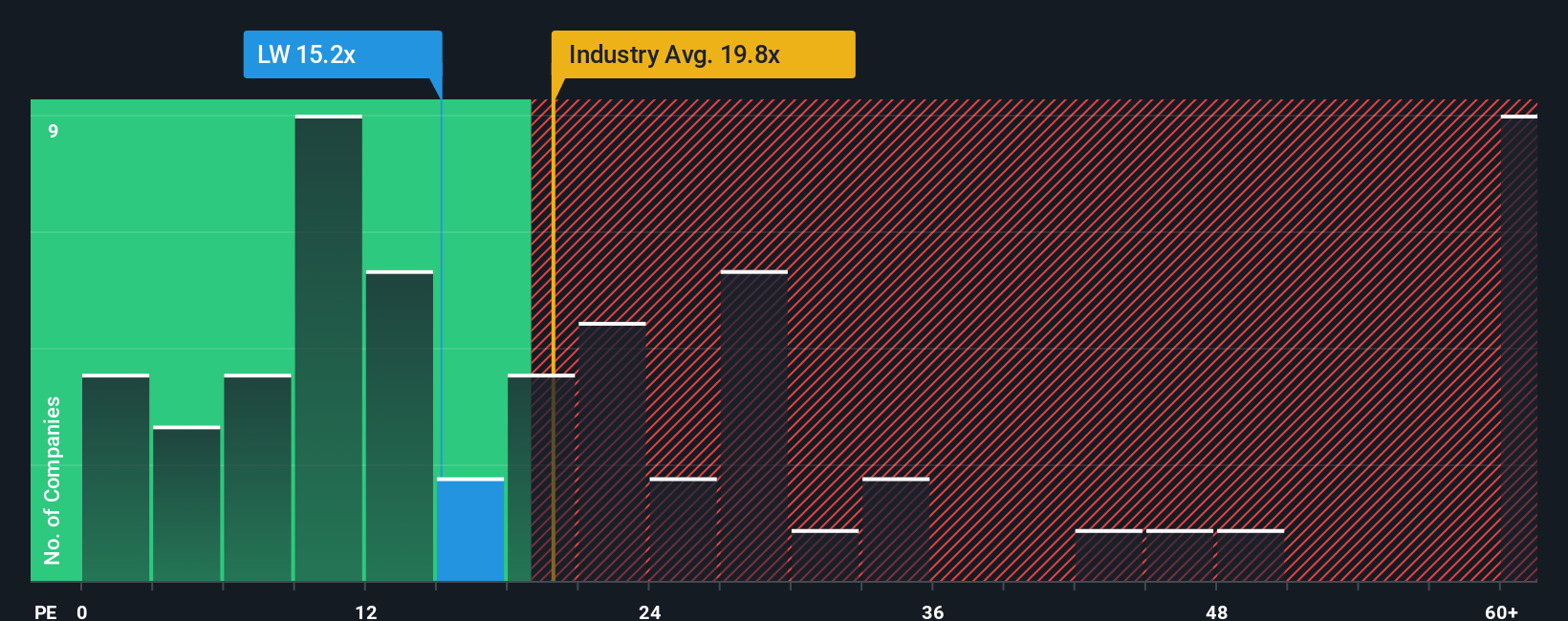

Although its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Lamb Weston Holdings as an attractive investment with its 15.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's inferior to most other companies of late, Lamb Weston Holdings has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Lamb Weston Holdings

Is There Any Growth For Lamb Weston Holdings?

In order to justify its P/E ratio, Lamb Weston Holdings would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.8%. However, this wasn't enough as the latest three year period has seen an unpleasant 14% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 13% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 11% per annum, which is not materially different.

With this information, we find it odd that Lamb Weston Holdings is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Lamb Weston Holdings' P/E

The softening of Lamb Weston Holdings' shares means its P/E is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lamb Weston Holdings currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Lamb Weston Holdings that you should be aware of.

Of course, you might also be able to find a better stock than Lamb Weston Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报