Does Arm’s Recent Share Price Slide Create a Long Term Opportunity in 2025?

- If you are wondering whether Arm Holdings is a bargain or a bubble at today’s price, you are not alone. This article unpacks what the numbers actually say about its value.

- Despite all the buzz around Arm and AI, the stock has pulled back recently, with the share price down 8.9% over the last week, 13.9% over the last month, and 11.6% year to date, leaving it about 10.7% lower than a year ago.

- Those moves have come as investors reassess high growth semiconductor names in light of shifting expectations for interest rates and risk appetite across tech. At the same time, Arm keeps appearing in headlines about AI infrastructure and licensing deals, which supports the long term growth story even as the share price cools in the short term.

- Right now, Arm has a valuation check score of 0 out of 6. In the next sections we will walk through the main valuation approaches behind that, before finishing with a more holistic way to think about what the stock may be worth.

Arm Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arm Holdings Discounted Cash Flow (DCF) Analysis

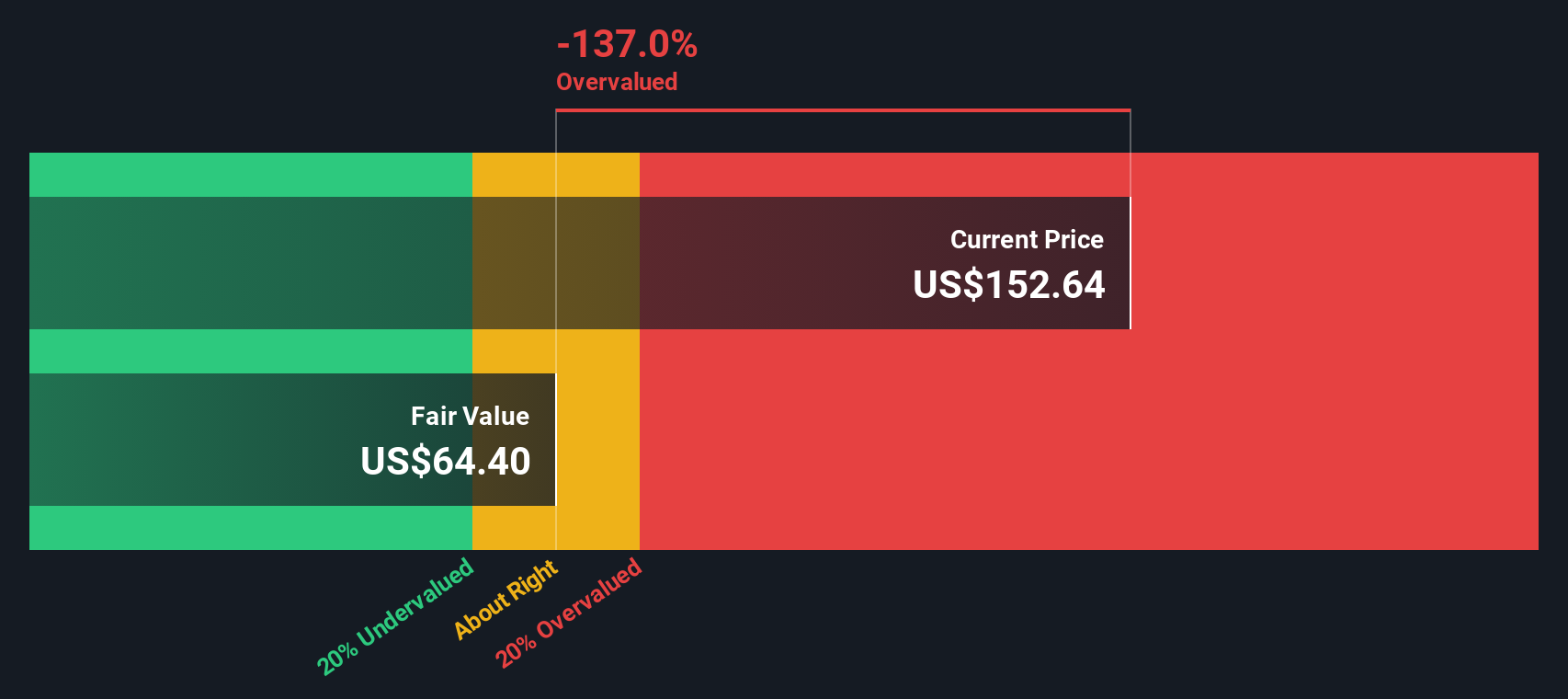

A Discounted Cash Flow model estimates what a company might be worth by projecting its future cash flows and then discounting those back to today in $ terms. For Arm Holdings, the model starts with last twelve month free cash flow of about $1.29 billion and uses analyst forecasts for the next few years, then extrapolates further growth out to 2035.

Under this 2 Stage Free Cash Flow to Equity approach, Arm’s free cash flow is projected to grow to roughly $5.27 billion by 2030, with growth rates moderating over time as the business matures. Simply Wall St converts this stream of projected cash flows into a present value and divides by the number of shares to arrive at an estimated intrinsic value.

That DCF fair value estimate is $63.81 per share, which implies the stock is about 77.6% above what the cash flow projections justify at today’s price. On this basis, Arm screens as significantly overvalued rather than a bargain.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arm Holdings may be overvalued by 77.6%. Discover 900 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arm Holdings Price vs Earnings

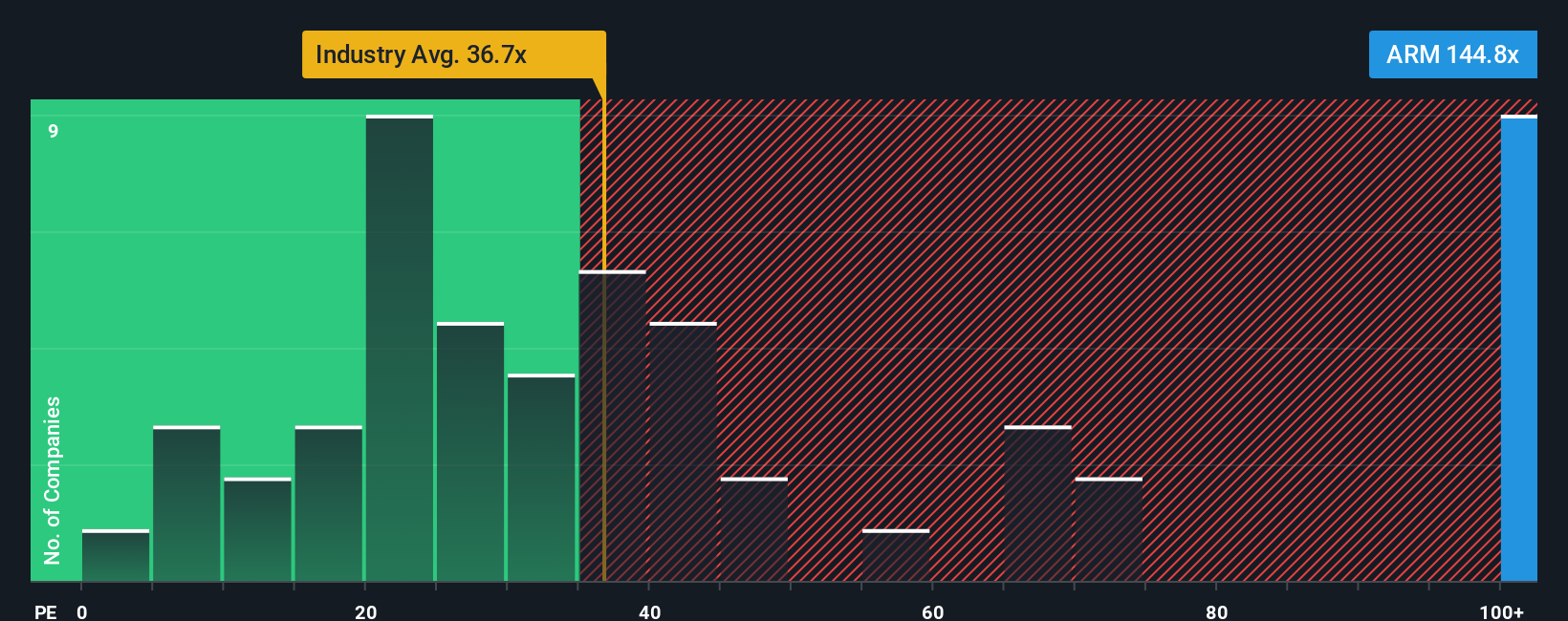

For a profitable company like Arm Holdings, the price to earnings ratio, or PE, is a useful way to judge whether investors are paying a sensible price for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty should mean a lower, more conservative multiple.

Arm currently trades on a PE of about 144.8x, which is far richer than the Semiconductor industry average of roughly 36.7x and also well above the peer group average of around 38.6x. On those comparisons alone, the stock looks extremely expensive, but simple peer and industry checks do not fully capture differences in growth, margins, scale, or risk.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric estimates what a reasonable PE should be for Arm, given its earnings growth profile, profitability, industry, market cap and company specific risks. For Arm, the Fair Ratio is 52.0x, which already bakes in strong growth expectations. Set against the current 144.8x, the shares screen as significantly overvalued on this framework.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arm Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, linked directly to your own assumptions for its future revenue, earnings, margins and fair value. A Narrative connects three pieces: what you believe Arm’s business story really is, how that translates into a financial forecast, and what fair value that implies, so you can quickly see whether today’s price looks attractive or stretched. On Simply Wall St, Narratives are an easy to use tool within the Community page, used by millions of investors to turn scattered opinions into structured, comparable views. Narratives also help you think about when to buy or sell by constantly comparing each Narrative’s Fair Value to the live market Price. They update dynamically as new earnings, news and guidance arrive, so your view stays current without you rebuilding a model from scratch. For Arm, one investor might see fair value near $70 per share while another might consider $210 justified, and Narratives make those different perspectives transparent, comparable and easier to work with.

For Arm Holdings however we will make it really easy for you with previews of two leading Arm Holdings Narratives:

Fair value in this narrative: $167.97 per share

Implied undervaluation vs last close of $113.29: 32.5%

Revenue growth assumption: 22.14%

- Views Arm as a prime beneficiary of rising custom silicon adoption, higher royalty rates, and premium IP that lifts per chip monetization and earnings.

- Leans on expanding AI, IoT, and edge demand plus a large developer ecosystem to support recurring licensing, growing royalties, and margin expansion.

- Accepts execution and concentration risks, but concludes that stronger AI driven growth and rising profitability justify a higher fair value than today’s price.

Fair value in this narrative: $70.00 per share

Implied overvaluation vs last close of $113.29: 61.8%

Revenue growth assumption: -4.25%

- Anchors valuation to a forward earnings yield framework tied to the 10 year U.S. Treasury, which indicates intrinsic value well below the current market price.

- Argues that recent trading levels reflect a bubble wave, with enthusiasm around AI and liquidity pushing the stock far beyond fundamentals and lowering its earnings yield below Treasuries.

- Warns that while a speculative surge to $170 to $213 is possible, such levels would leave little margin of safety and expose investors to sharp downside if rates, earnings, or sentiment shift.

Do you think there's more to the story for Arm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报