US Stock Market Today: S&P 500 Futures Flat Amid Split Fed Rate Cut Outlook

The Morning Bull - US Market Morning Update Tuesday, Dec, 23 2025

US stock futures are flat to slightly lower this morning, with E mini S&P 500 contracts barely in the red as investors weigh calm bond markets against mixed global growth signals. The benchmark 10 year US Treasury yield is holding near 4.16 percent, which means borrowing costs for mortgages and companies are still elevated but not shooting higher. At the same time, a surge of nearly 40 percent in Taiwan export orders highlights strong demand for electronics feeding into the US, while Federal Reserve officials remain split on how soon to cut rates. That tension keeps rate sensitive areas such as banks and real estate, along with growth focused tech names, firmly in the spotlight as investors decide whether resilient demand can offset the drag from higher for longer borrowing costs.

With rates staying stubbornly high and volatility brewing, our undervalued stocks based on cash flows could reveal resilient winners before Wall Street catches on.

Top Movers

- AST SpaceMobile (ASTS) surged 14.03% as investors piled into speculative satellite communications plays.

- Rocket Lab (RKLB) jumped 9.97% after another successful Electron launch and upbeat analyst commentary.

- First Solar (FSLR) gained 6.60% as investors rotated into solar names ahead of potential policy support.

Is First Solar still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

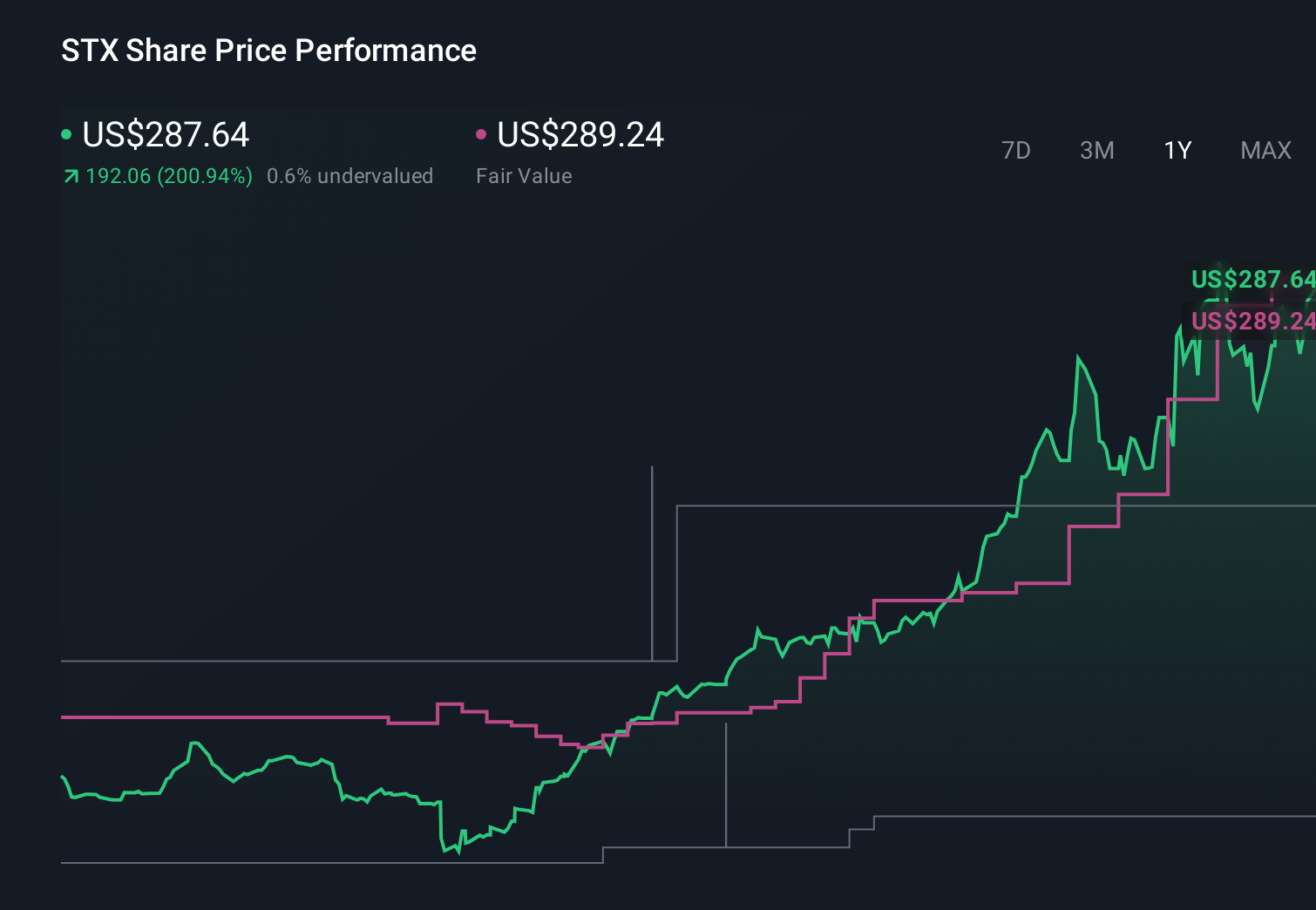

- Seagate Technology Holdings (STX) slipped 4.56% after recent NASDAQ 100 inclusion, which sparked profit taking from momentum traders.

- Dollar Tree (DLTR) declined 4.18% as investors rotated out of discount retail amid shifting consumer spending worries.

- Dominion Energy (D) fell 3.72% following headlines about federal lease pauses that weighed on utility sentiment.

Look past the noise - uncover the top narrative that explains what truly matters for Dollar Tree's long-term success.

On The Radar

Fixed income takes the spotlight as Treasury auctions and diverging global rate paths shape the backdrop for US risk assets.

- US Treasuries: Upcoming 2, 5, and 7 year auctions on Tuesday will test demand as markets price only modest 2026 Fed cuts.

- Fed policy outlook: Split Fed commentary on Tuesday and Wednesday keeps debate alive over how quickly inflation cools toward target.

- Global yields: Rising France and Italy 10 year yields through Thursday highlight Europe’s fiscal strains and reinforce the US duration premium.

- China growth policy: Five Year Plan housing support discussions midweek will signal how aggressively Beijing backstops global demand for commodities.

- Critical minerals trade: Indonesia US tariff deal progress into Wednesday supports long term supply security for US EV and battery manufacturers.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

How To Act On Today's Market

Everyone chases yesterday’s winners, but the smartest moves happen before the headlines hit. This window will not stay open long; our deep dive into dividend stocks with yields > 3% uncovers durable cash generators built to keep paying investors even if volatility returns.

Ready to take control of your portfolio? Use our stock screener to run custom searches that fit your unique style and set timely alerts so you never miss the next hidden opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报