Assessing Berkshire Hathaway’s Valuation After Strong Multi Year Gains and Portfolio Shifts

How Has Berkshire Hathaway Stock Been Performing?

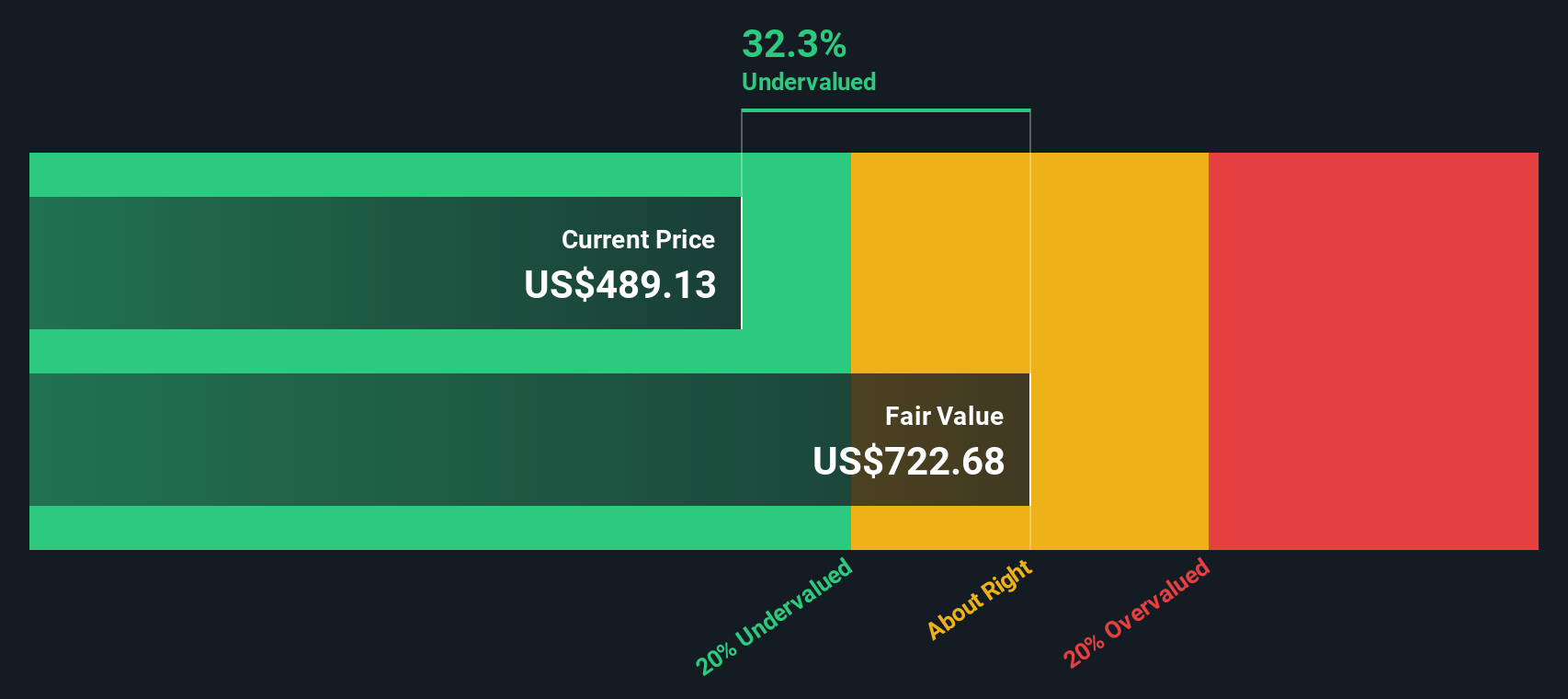

Berkshire Hathaway might look expensive at first glance given its share price, but the real question for long term investors is whether the underlying business is still trading for less than it is worth.

Over the last few years, the share price has climbed steadily, delivering returns of 63.1% over 3 years and 118.9% over 5 years, even though the last month has been relatively flat with a 0.8% pullback and the last week down 1.3%.

Recent headlines have focused on Warren Buffett and his team continuing to shuffle the portfolio toward cash and high conviction positions, while also stepping up buybacks when the stock trades close to or below their estimate of intrinsic value.

At the same time, markets are watching how Berkshire is positioned for interest rate shifts and broader economic uncertainty. That helps explain why the stock has still gained 10.8% year to date and 10.0% over the last year despite short term bumps.

On our checks, Berkshire scores a 4 out of 6 on valuation, suggesting it looks undervalued on several key metrics but not all. Next we will break down those methods one by one before finishing with a more intuitive way to think about what the stock is really worth.

Approach 1: Berkshire Hathaway Excess Returns Analysis

The Excess Returns model looks at how effectively Berkshire Hathaway turns shareholder equity into profits above its cost of capital, and then projects how long those superior returns can persist.

On this view, Berkshire’s underlying engine remains powerful. Its average return on equity sits at 12.85%, producing an estimated Stable EPS of $66,154.88 per share on a Book Value base of $485,274.36 per share. Against a Cost of Equity of $38,973.82 per share, that implies an Excess Return of $27,181.06 per share, a sizable economic profit stream that the market may be underpricing.

Looking ahead, analysts expect Book Value to keep compounding, with a Stable Book Value estimate of $514,986.06 per share, based on weighted forecasts from two analysts. Feeding these inputs into the Excess Returns framework yields an intrinsic value of about $763.88 per share, implying the stock is roughly 34.6% undervalued versus its current trading price.

In plain terms, the model suggests Berkshire is still generating strong, above hurdle returns on its capital, and the market has not fully caught up yet.

Result: UNDERVALUED

Our Excess Returns analysis suggests Berkshire Hathaway is undervalued by 34.6%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

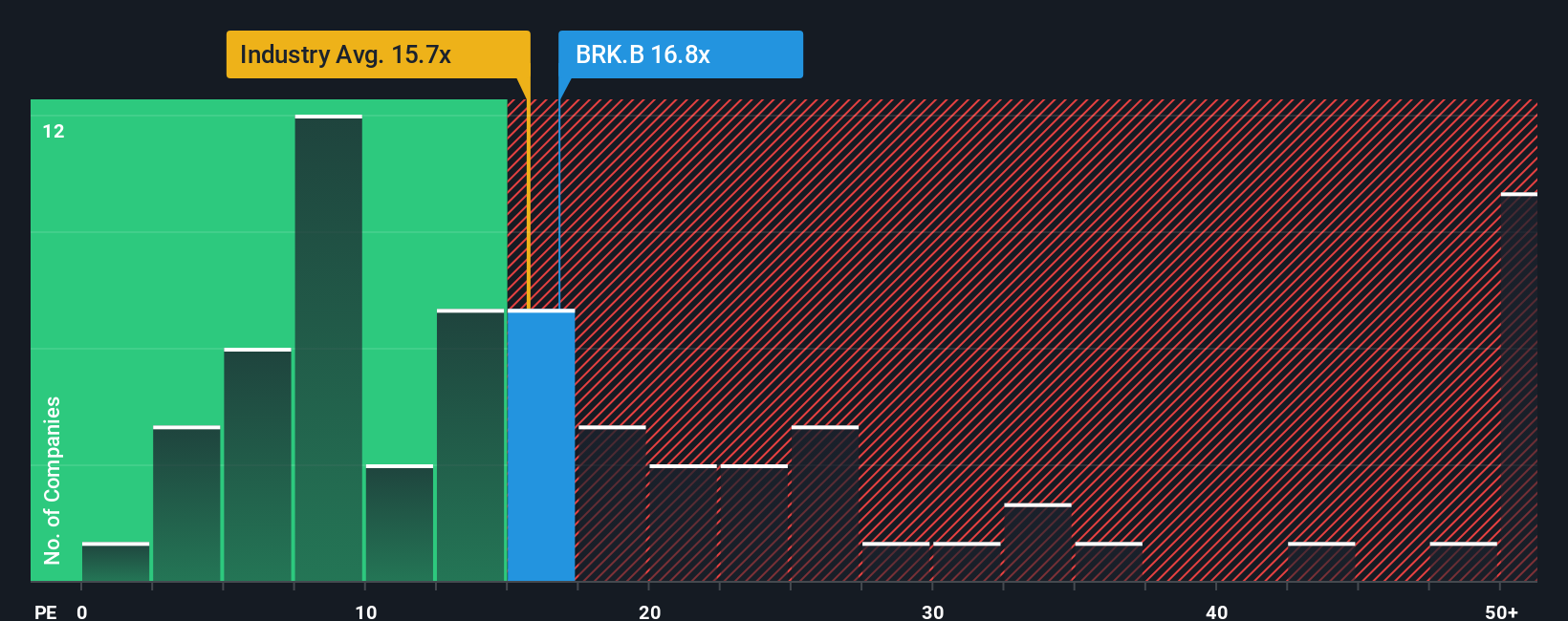

Approach 2: Berkshire Hathaway Price vs Earnings

For a consistently profitable business like Berkshire Hathaway, the price to earnings (PE) ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. It links today’s share price directly to the company’s profit engine, which is ultimately what should drive long term value.

What counts as a “normal” PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and lower perceived risk usually justify a higher multiple, while slower or more volatile earnings typically deserve a lower one. Berkshire currently trades on a PE of about 16.0x, slightly above the Diversified Financial industry average of roughly 13.7x, but well below the 26.6x average for its broader peer group.

Simply Wall St’s Fair Ratio for Berkshire sits at around 16.9x. This is the platform's proprietary estimate of what a reasonable PE should be given its earnings growth profile, risk, profit margins, industry and market cap. This tailored benchmark is more informative than a simple peer or industry comparison because it adjusts for Berkshire’s specific fundamentals rather than assuming all financials deserve the same multiple. With the Fair Ratio only modestly above the current 16.0x, the stock screens as slightly undervalued on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Berkshire Hathaway Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company translated into explicit numbers like fair value, future revenue, earnings and margins.

On Simply Wall St’s Community page, used by millions of investors, a Narrative links three things together in an easy, visual way: the company’s story, the financial forecast that flows from that story, and the resulting fair value estimate.

Once you have a Narrative, you can quickly compare your fair value to Berkshire Hathaway’s current share price. This can help you decide whether it looks like a buy, a hold, or a sell based on your own assumptions rather than someone else’s rule of thumb.

Narratives are also dynamic. They automatically update when fresh information like earnings reports, major news, or guidance changes come in, so your view of Berkshire’s value is always grounded in the latest data instead of a stale spreadsheet.

For example, one Berkshire Narrative on the Community page might assume a much higher fair value than another, because it incorporates stronger long term revenue growth. A more cautious investor might use lower growth and a higher discount rate to arrive at a meaningfully lower fair value.

Do you think there's more to the story for Berkshire Hathaway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报