Is Iovance (IOVA) Turning Talent Incentives and TIL Optimism Into a Durable Competitive Edge?

- Iovance Biotherapeutics recently strengthened its position by granting inducement stock options to new employees while benefiting from fresh analyst coverage and renewed optimism toward its Amtagvi cell therapy and broader pipeline.

- This combination of talent incentives and improving sentiment around tumor-infiltrating lymphocyte therapies, including potential expansion into non-small cell lung cancer, is reframing how investors view the company’s long-term prospects.

- We’ll now explore how renewed sector optimism and growing interest in Iovance’s TIL pipeline may influence the company’s existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Iovance Biotherapeutics Investment Narrative Recap

To own Iovance, you need to believe that Amtagvi can scale commercially while its tumor infiltrating lymphocyte pipeline broadens beyond melanoma, without exhausting cash or running into major regulatory roadblocks. The latest analyst attention and sector optimism support sentiment but do not materially change the key near term catalyst, which remains execution on Amtagvi uptake, or the main risk, which is ongoing cash burn and funding needs in a volatile biotech market.

The recent inducement stock option grants to new employees underline Iovance’s focus on building the team needed to commercialize Amtagvi and advance lifileucel in non small cell lung cancer. These hires sit against a backdrop of rising interest in potential TIL expansion, which could be important for offsetting Iovance’s heavy dependence on a single approved product and its currently low gross margins if future indications eventually reach the market.

Yet beneath the improving sentiment, one issue investors should be aware of is the combination of high cash burn and...

Read the full narrative on Iovance Biotherapeutics (it's free!)

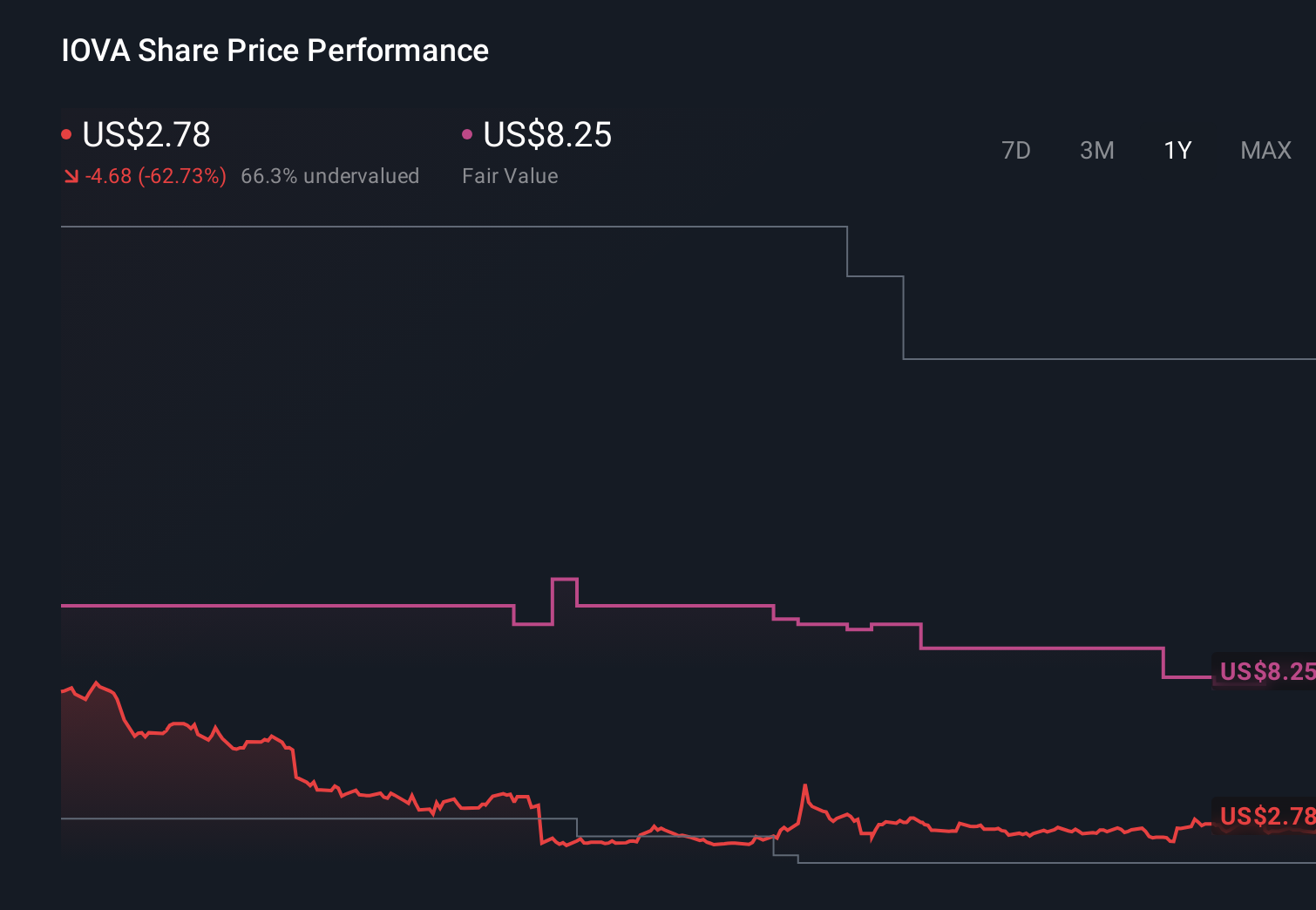

Iovance Biotherapeutics' narrative projects $744.8 million revenue and $35.6 million earnings by 2028. This requires 45.6% yearly revenue growth and about a $425.5 million earnings increase from -$389.9 million today.

Uncover how Iovance Biotherapeutics' forecasts yield a $8.25 fair value, a 197% upside to its current price.

Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span a wide range, from US$3.97 up to about US$28.05 per share. As you compare those views, keep in mind that Iovance’s reliance on Amtagvi and ongoing losses could amplify the impact of any future slowdown in uptake or pricing pressure on overall performance.

Explore 10 other fair value estimates on Iovance Biotherapeutics - why the stock might be worth just $3.97!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报