Has JPMorgan Run Too Far After Its 2024 Surge and Strong Excess Returns Outlook?

- If you are wondering whether JPMorgan Chase is still worth buying after such a strong run, you are not alone. This is exactly the question we will unpack here.

- The stock has climbed 1.0% over the last week, 8.4% in the past month, and is now up 34.6% year to date, building on hefty gains of 38.4% over 1 year, 165.0% over 3 years, and 193.5% over 5 years.

- Behind those moves, investors have been reacting to a mix of macro headlines, from shifting interest rate expectations to ongoing discussions around banking regulation and capital requirements. JPMorgan Chase has also stayed in the spotlight with strategic initiatives in digital banking and payments that reinforce its position as a global financial heavyweight.

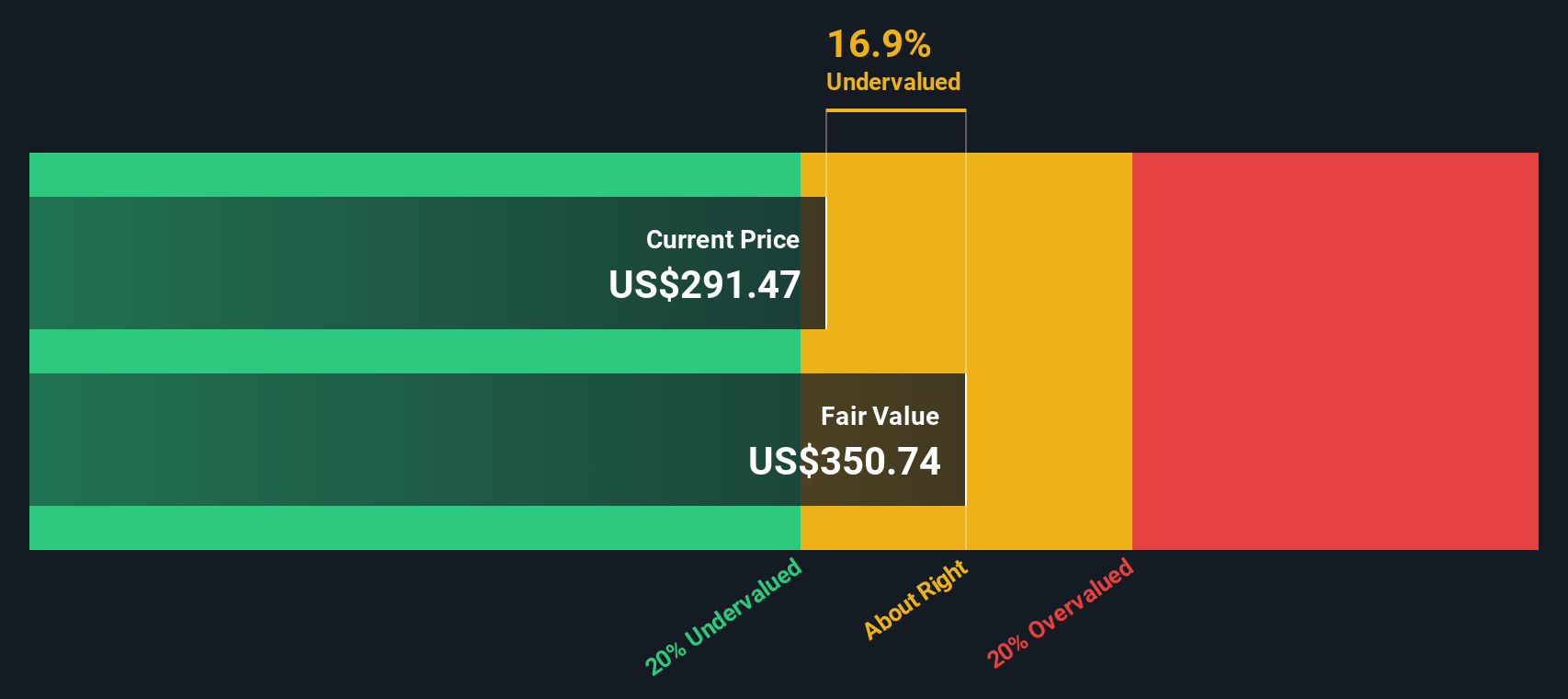

- Even with that backdrop, JPMorgan Chase only scores a 1 out of 6 on our valuation checks, which raises the stakes for how we judge whether the current price still makes sense. Next we will walk through the standard valuation approaches before finishing with a more nuanced way to think about what the stock is really worth.

JPMorgan Chase scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: JPMorgan Chase Excess Returns Analysis

The Excess Returns model looks at how much profit a bank can generate above the return that equity investors require, and then projects how long those superior returns can last. For JPMorgan Chase, this approach starts with an estimated book value of $124.96 per share and a stable earnings power of about $22.25 per share, based on forward looking return on equity estimates from 12 analysts.

With an average return on equity of 16.43% and a cost of equity of $11.11 per share, the bank is expected to generate excess returns of roughly $11.14 per share. These excess profits are then capitalized over time using a stable book value assumption of $135.42 per share, informed by estimates from 13 analysts, to arrive at an intrinsic value of about $360.66 per share.

Compared with the current share price, this implies roughly a 10.4% discount. This suggests that the market is not fully pricing in JPMorgan Chase ongoing ability to earn above its cost of capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests JPMorgan Chase is undervalued by 10.4%. Track this in your watchlist or portfolio, or discover 898 more undervalued stocks based on cash flows.

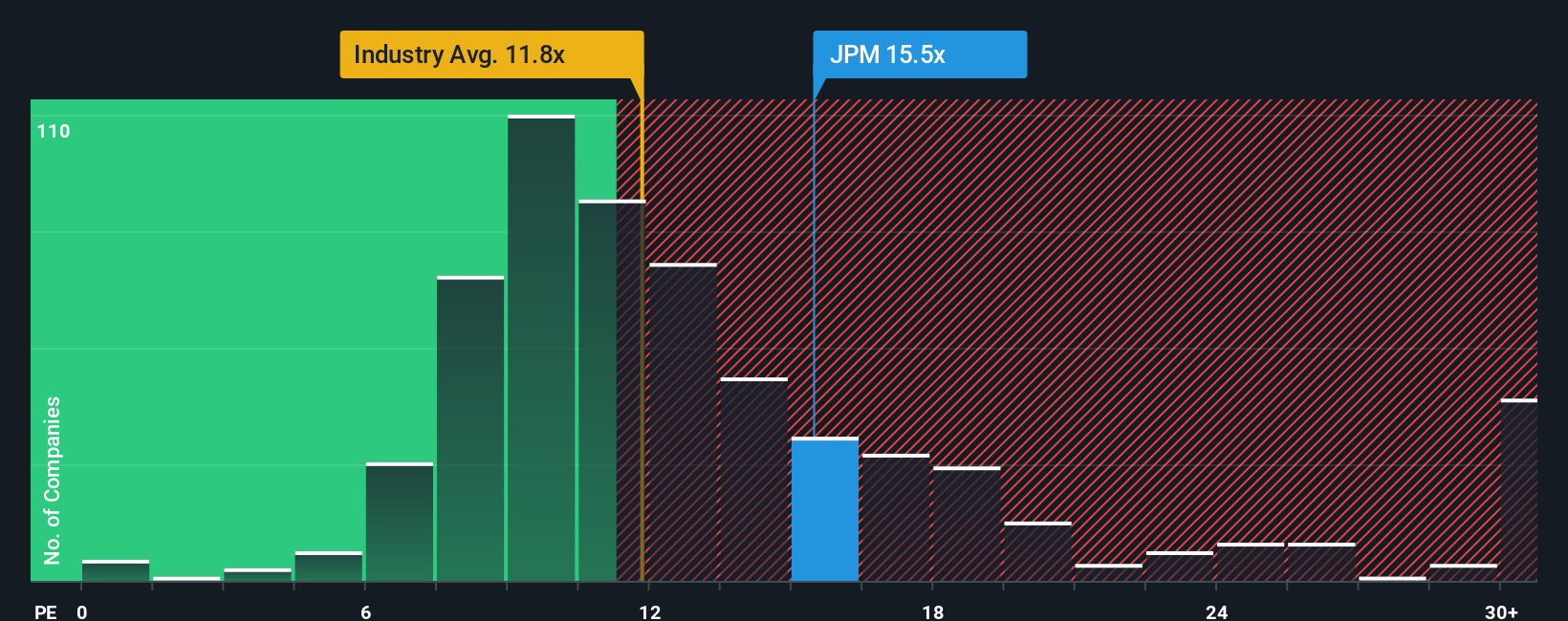

Approach 2: JPMorgan Chase Price vs Earnings

For consistently profitable companies like JPMorgan Chase, the price to earnings (PE) ratio is a practical way to judge valuation because it links what investors pay today to the profits the business is generating right now. A higher PE can be justified when a company has stronger growth prospects or lower perceived risk, while slower growth or higher risk typically calls for a lower, more conservative PE.

JPMorgan Chase currently trades on a PE of about 15.5x, which sits above the broader Banks industry average of roughly 11.9x and slightly above the peer group average of 14.4x. On the surface, that premium suggests investors are willing to pay up for JPMorgan earnings.

Simply Wall St fair PE ratio for JPMorgan, at around 15.5x, is a more tailored benchmark. This Fair Ratio estimates the multiple the stock should trade on after considering its earnings growth outlook, profitability, risk profile, industry positioning, and market cap. Because it incorporates these company specific factors rather than relying only on blunt peer or industry comparisons, it provides a more nuanced yardstick. With the actual PE almost exactly in line with the Fair Ratio, JPMorgan appears fairly valued on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JPMorgan Chase Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you create about where a company is heading, backed up by your own assumptions for future revenue, earnings, margins, and what you think is a reasonable fair value.

A Narrative connects three pieces: the real world story around JPMorgan Chase, a structured financial forecast based on that story, and a resulting fair value that you can compare directly with today’s price to decide whether it looks like a buy, a hold, or a sell.

On Simply Wall St, Narratives live in the Community page used by millions of investors, where you can pick or tweak a Narrative that matches your view, and the platform will automatically keep it up to date as new information like earnings, news, or guidance changes come in.

For JPMorgan Chase, one investor might lean toward a higher fair value near $375 because they believe digital banking, global payments, and blockchain initiatives can support faster, higher quality growth. Another might anchor closer to $247 if they focus more on regulation, credit losses, and margin pressure. Narratives let you see exactly how those different views translate into numbers and fair values you can act on.

For JPMorgan Chase, here are previews of two leading JPMorgan Chase narratives:

Fair value: $328.09 per share

Implied undervaluation vs last close: 1.5%

Forecast revenue growth: 6.09%

- Assumes steady mid single digit revenue growth, with wealth management, payments, and digital banking driving higher fee income and long term earnings power.

- Sees JPMorgan reinvesting at high ROTCE into technology, tokenization, and international expansion, supporting durable margins and a premium valuation multiple.

- Flags risks from fintech disruption, tighter regulation, and product commoditization, but concludes these are manageable within a diversified, scale advantaged franchise.

Fair value: $247.02 per share

Implied overvaluation vs last close: 23.6%

Forecast revenue growth: 4.08%

- Focuses on rising credit loss allowances, reserve builds, and higher operating expenses as pressures on net and operating margins.

- Builds in slower top line growth from rate cuts, softer net interest income, and a cautious outlook for investment banking and advisory revenue.

- Accepts JPMorgan strengths in markets, asset management, and technology, but argues that at current prices market expectations for growth and returns are too high.

Do you think there's more to the story for JPMorgan Chase? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报