Does Sirius XM Still Offer Opportunity After Steep Multi Year Share Price Declines?

- If you are wondering whether Sirius XM Holdings is a bargain or a value trap at today’s price, you are not alone. This breakdown is designed to address that question directly.

- The stock has slipped about 4% over the last week and is roughly flat over the last month. However, longer term holders are still facing steep drawdowns of more than 60% over three and five years, which naturally raises questions about both risk and potential upside from here.

- Recent headlines have focused on Sirius XM’s ongoing efforts to refresh its streaming experience and expand in-car partnerships. These moves are aimed at defending its dominant position in satellite radio while encouraging growth in digital listening. At the same time, investors are weighing broader media sector pressures and competition from large technology-backed audio platforms, which helps explain why sentiment and the share price have been so volatile.

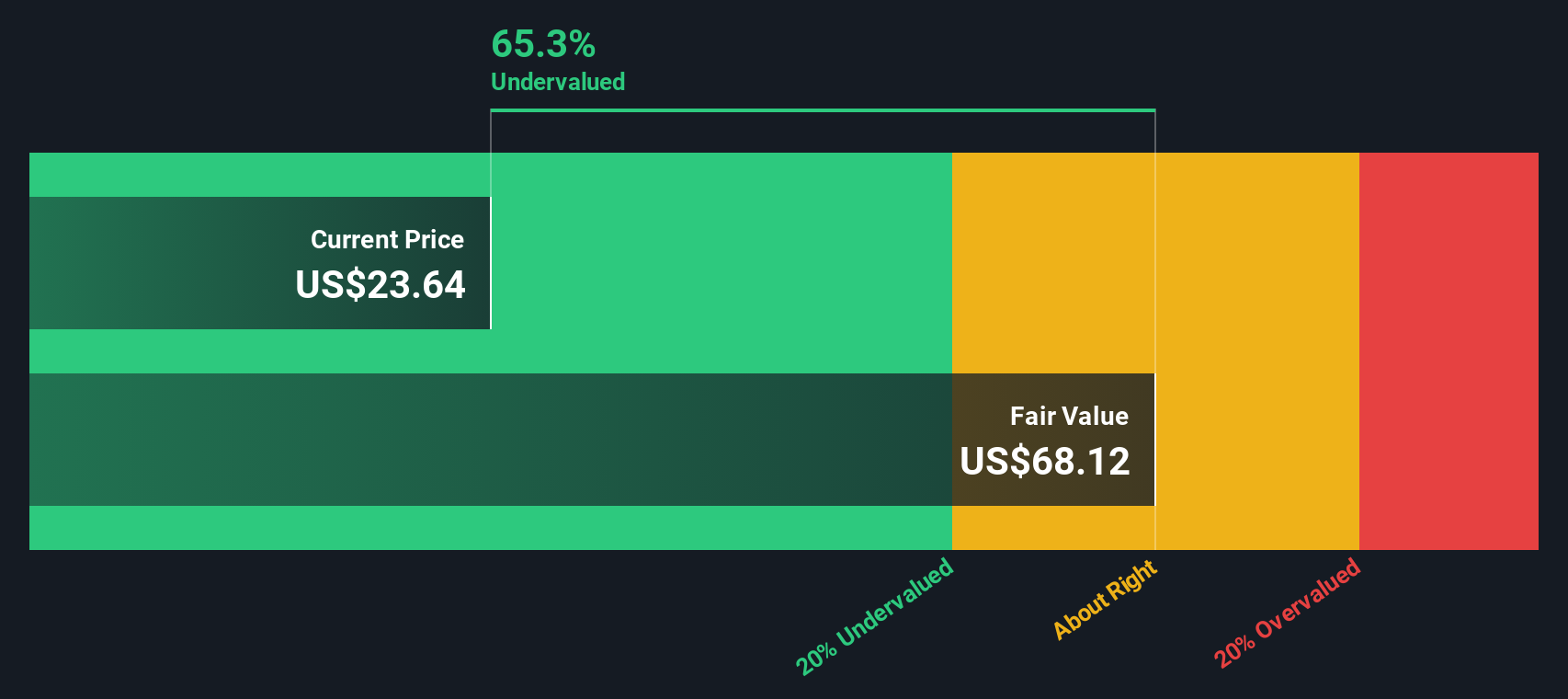

- On our framework, Sirius XM scores a 4 out of 6 valuation score, suggesting it appears undervalued on most, but not all, of our checks. Next we will unpack what that looks like under different valuation lenses before circling back at the end with a more holistic way to think about what the stock may be worth.

Approach 1: Sirius XM Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Sirius XM Holdings, the model uses a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections in $.

The company generated trailing twelve month free cash flow of about $1.24 billion. Analysts, along with Simply Wall St extrapolations beyond the formal forecast period, see this rising gradually over time. By 2035, projected free cash flow is around $1.73 billion, reflecting modest but steady growth as the business matures.

Rolling all of these projected cash flows into the DCF framework yields an estimated intrinsic value of roughly $71.72 per share. Compared with the current market price, this implies the stock is trading at about a 71.2% discount to its DCF fair value. This indicates potential upside if these cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sirius XM Holdings is undervalued by 71.2%. Track this in your watchlist or portfolio, or discover 898 more undervalued stocks based on cash flows.

Approach 2: Sirius XM Holdings Price vs Earnings

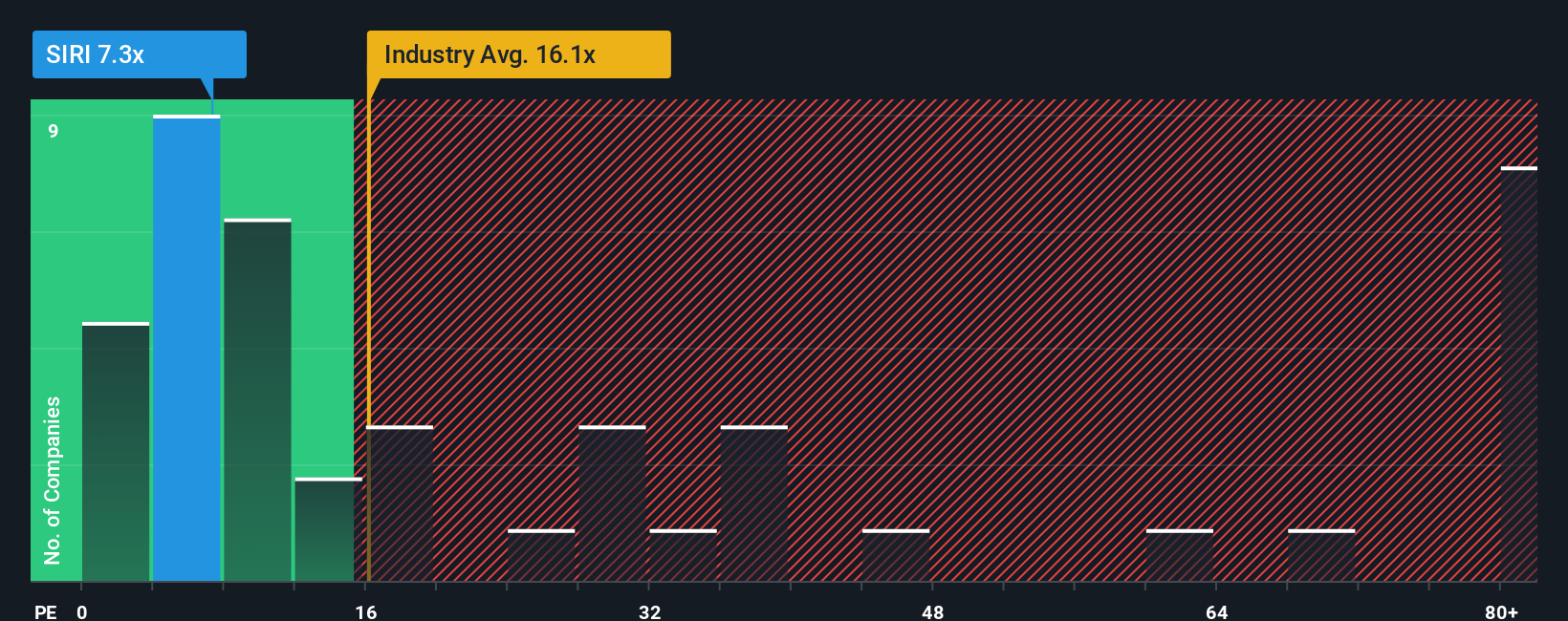

For profitable businesses like Sirius XM Holdings, the price to earnings, or PE, ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In broad terms, faster growth and lower perceived risk usually justify a higher “normal” PE, while slower growth or higher risk typically warrant a lower multiple.

Sirius XM currently trades on a PE of about 7.0x. That is above the average of its direct peers at roughly 5.4x, but well below the broader Media industry average of around 16.1x. On the surface, this might suggest the market is giving the company a modest premium to close peers, but a steep discount to the overall sector.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a “deserved” PE should be after factoring in Sirius XM’s earnings growth outlook, profitability, risk profile, industry, and market cap. On this basis, the stock’s Fair Ratio is 17.1x, materially higher than the current 7.0x multiple. That gap implies the market is not fully recognising the company’s fundamentals, pointing to an undervalued share price on a PE basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sirius XM Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind its future revenue, earnings and margins, and ultimately its fair value. A Narrative on Simply Wall St is an easy, guided forecast that lives on the Community page, where millions of investors translate their thesis about a business into a set of assumptions that produce a fair value they can compare with today’s share price to decide whether to buy, hold, or sell. Because Narratives update dynamically as new information like earnings, guidance or major news arrives, your fair value view evolves alongside the business rather than staying stuck on old data. For Sirius XM Holdings, one investor Narrative might see strong moats and cash returns that support a fair value near $50 per share, while another, more cautious Narrative might point to competitive and growth risks and land closer to $24, showing how different perspectives on the same facts lead to different, but transparent, valuations.

Do you think there's more to the story for Sirius XM Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报