Charles River Laboratories (CRL): Valuation Check After SEC Clearance and BofA Upgrade Lift the Stock

Charles River Laboratories International (CRL) just got a double dose of good news, with the U.S. SEC closing its investigation without enforcement action and BofA Securities upgrading the stock, helping shares climb about 3%.

See our latest analysis for Charles River Laboratories International.

That relief rally builds on strong recent momentum, with a 30 day share price return of about 21 percent and a 90 day gain above 35 percent, even though the five year total shareholder return remains negative. This suggests sentiment is improving from a still cautious longer term base.

If this kind of rebound has you rethinking your healthcare exposure, it could be a good time to explore other potential opportunities across healthcare stocks.

Yet with the shares now trading near recent highs, a slight premium to Wall Street’s target but still at a large intrinsic value discount, the real question is whether this is a fresh buying opportunity or if markets are already pricing in future growth.

Most Popular Narrative: 7.5% Overvalued

With the narrative fair value sitting below the latest close of $203.02, the story leans cautious on upside and hangs on a few big assumptions.

The analysts have a consensus price target of $177.067 for Charles River Laboratories International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $211.0, and the most bearish reporting a price target of just $151.0.

If you are curious why a slow revenue ramp, a sharp margin rebuild and a disciplined discount rate can still support a premium earnings multiple in 2028, you can explore the full narrative to see how those moving parts connect.

Result: Fair Value of $188.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant shifts toward non animal testing and renewed funding pressure on smaller biotechs could derail the assumed recovery in Charles River’s core segments.

Find out about the key risks to this Charles River Laboratories International narrative.

Another View: Market Ratios Point the Other Way

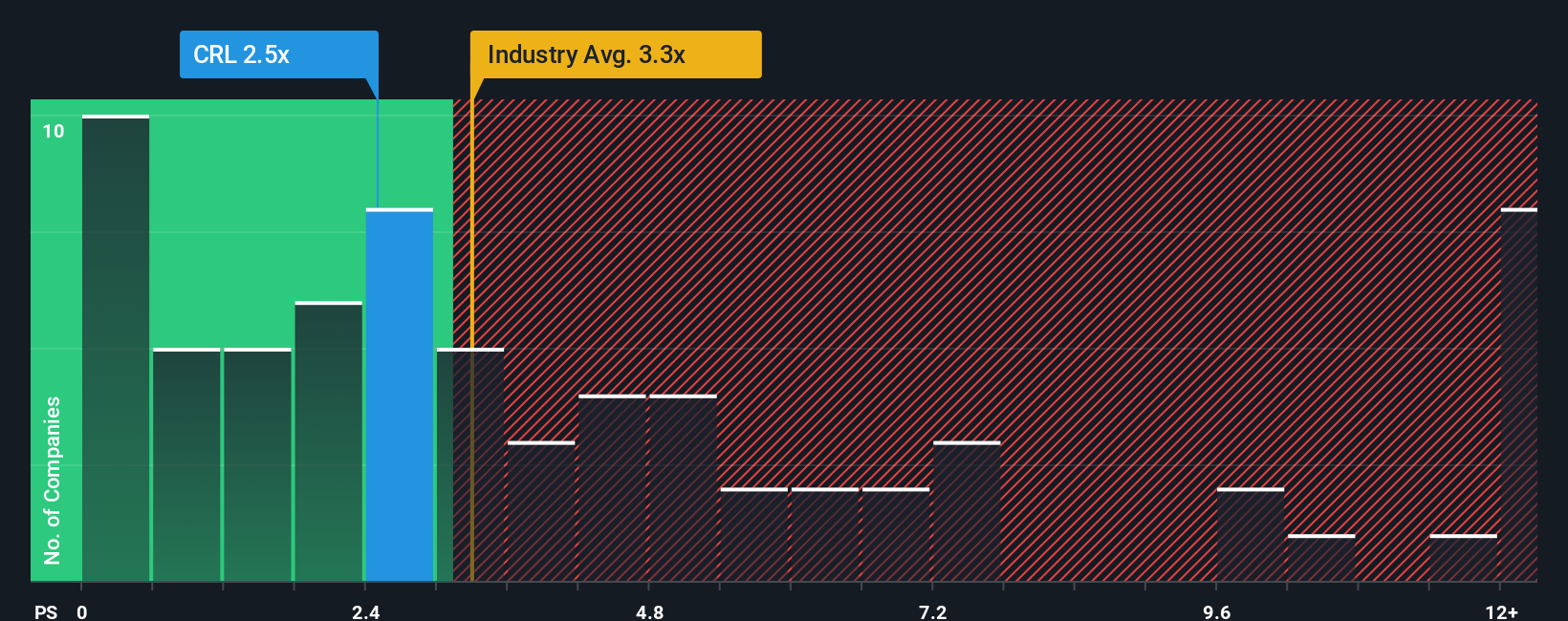

While the narrative model flags CRL as about 7.5 percent overvalued, the price to sales ratio of 2.5 times versus 3.5 times for the US Life Sciences industry and 7.2 times for peers, and a fair ratio of 3.1 times, suggests the market may still be underpricing its recovery story. Which signal do you trust when the next pullback comes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Charles River Laboratories International Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, make your research work harder by scanning powerful stock ideas on Simply Wall Street that many investors will only notice much later.

- Unlock potential turnaround opportunities by targeting beaten down companies showing strong cash flow support through these 898 undervalued stocks based on cash flows.

- Ride structural shifts in automation and productivity by backing innovators at the intersection of healthcare and machine learning via these 29 healthcare AI stocks.

- Capture income and stability potential by focusing on businesses sharing more of their profits with shareholders using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报