Chipotle Mexican Grill (CMG): Reassessing Valuation After a 20% One-Month Share Price Rebound

Chipotle Mexican Grill (CMG) has quietly outperformed the broader market over the past month, climbing about 20% even as its year to date performance remains sharply negative and longer term returns look mixed.

See our latest analysis for Chipotle Mexican Grill.

That 19.9% 30 day share price return has only just started to chip away at a tough year to date slide and weak 1 year total shareholder return, suggesting momentum is recovering rather than fully reset.

If Chipotle’s rebound has you reassessing what else might be setting up for a turn, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares still down heavily for the year despite solid double digit earnings and revenue growth, the debate now is simple: is Chipotle trading at a discount to its fundamentals, or is the market already pricing in its next leg of expansion?

Most Popular Narrative Narrative: 12.2% Undervalued

With Chipotle last closing at $37.92 against a narrative fair value of about $43.18, the story leans toward upside if the growth path holds.

The company is investing in technological innovations such as produce slicers and a new equipment package to improve operational efficiency and consistency, which can positively impact net margins by reducing labor costs and enhancing throughput. Chipotle aims to expand its catering business, currently 1.5% of sales, with a new test involving equipment and technology improvements.

Want to see why steady revenue gains, rising margins, and a richer earnings multiple all converge on that higher fair value line? The core growth assumptions might surprise you.

Result: Fair Value of $43.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer consumer spending and potential tariffs on key ingredients could pressure Chipotle’s margins and slow the earnings trajectory behind that undervaluation story.

Find out about the key risks to this Chipotle Mexican Grill narrative.

Another Angle on Valuation

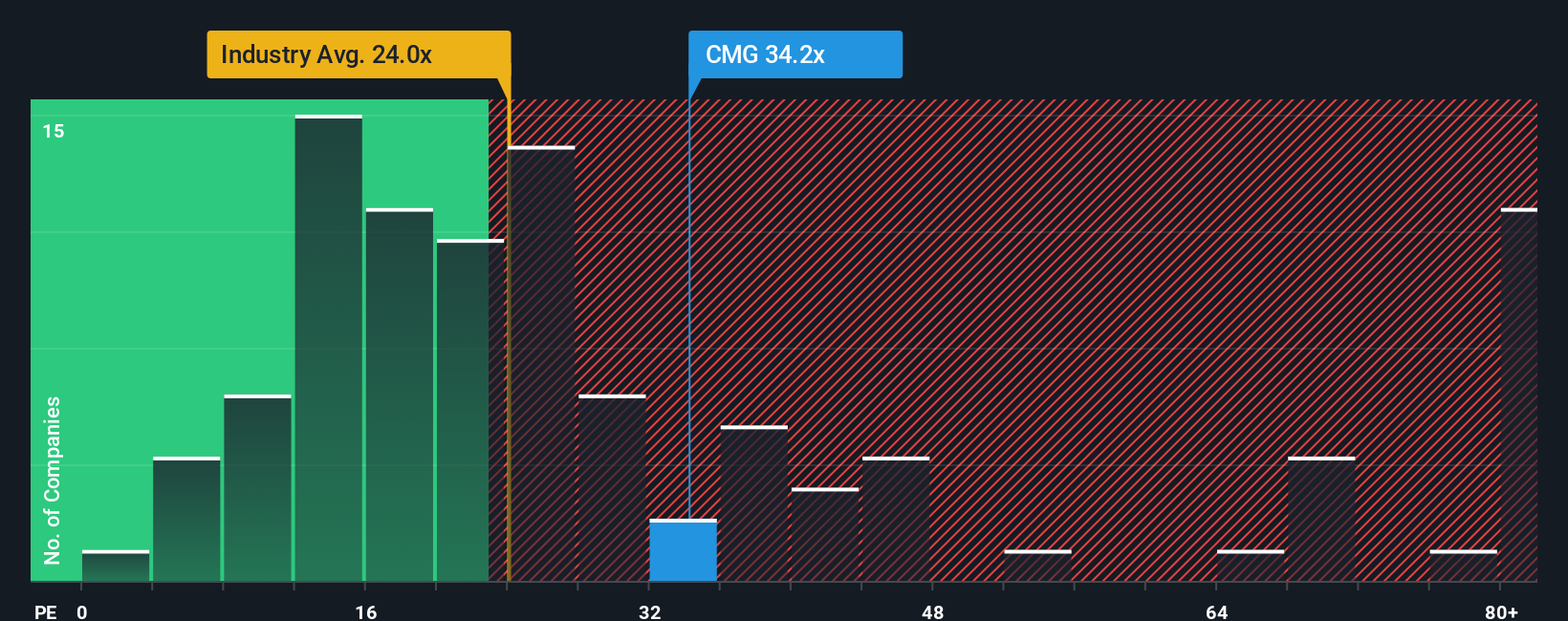

On earnings, Chipotle looks anything but cheap. Its 32.6x price to earnings ratio sits above both the US Hospitality average of 21.9x and peers at 31.7x, and even above a 26.6x fair ratio that the market could drift toward if growth disappoints. Is today’s price baking in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If this perspective does not quite align with your own or you prefer hands on research, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Chipotle Mexican Grill.

Ready for your next investing move?

Chipotle might be your starting point, but you will miss higher conviction opportunities if you ignore other focused stock ideas powered by the Simply Wall St Screener.

- Capture strong income potential as you evaluate these 10 dividend stocks with yields > 3% that can bolster your portfolio with consistent cash returns.

- Ride powerful megatrends by assessing these 24 AI penny stocks positioned at the intersection of software, automation, and real world adoption.

- Capitalize on mispriced opportunities by reviewing these 898 undervalued stocks based on cash flows where cash flows, not hype, drive the investment case.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报