Does Oceaneering’s Planned CFO Succession Shape a Stronger Long‑Term Governance Story for OII?

- Oceaneering International has announced that Michael W. Sumruld will become Senior Vice President and Chief Financial Officer on January 1, 2026, succeeding retiring CFO Alan R. Curtis, who will remain as an adviser to support the handover.

- This planned CFO transition, with Curtis staying involved in an advisory role, points to an emphasis on continuity in financial oversight and corporate decision‑making.

- We’ll now examine how this planned CFO handover and emphasis on continuity could influence Oceaneering International’s existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Oceaneering International Investment Narrative Recap

To own Oceaneering International, you need to believe it can keep turning its subsea expertise and growing ADTech work into resilient cash flows despite exposure to offshore oil and gas cycles. The planned CFO handover to Michael Sumruld, with Alan Curtis staying on in an advisory role, does not materially change the near term catalysts around contract execution or the key risk tied to demand for traditional energy services.

The earlier June 2025 CFO succession announcement already signaled this transition path, giving markets time to absorb the change in financial leadership. That context, combined with recently secured multi year bp and U.S. Navy contracts, keeps the conversation focused on how reliably Oceaneering can convert its backlog and subsea robotics strengths into sustained earnings and cash generation rather than on leadership uncertainty.

But while continuity at the top supports the story, investors should still be aware of how dependent Oceaneering remains on cyclical offshore spending and what happens if...

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's narrative projects $3.1 billion revenue and $185.9 million earnings by 2028. This requires 4.2% yearly revenue growth and a $16.3 million earnings decrease from $202.2 million today.

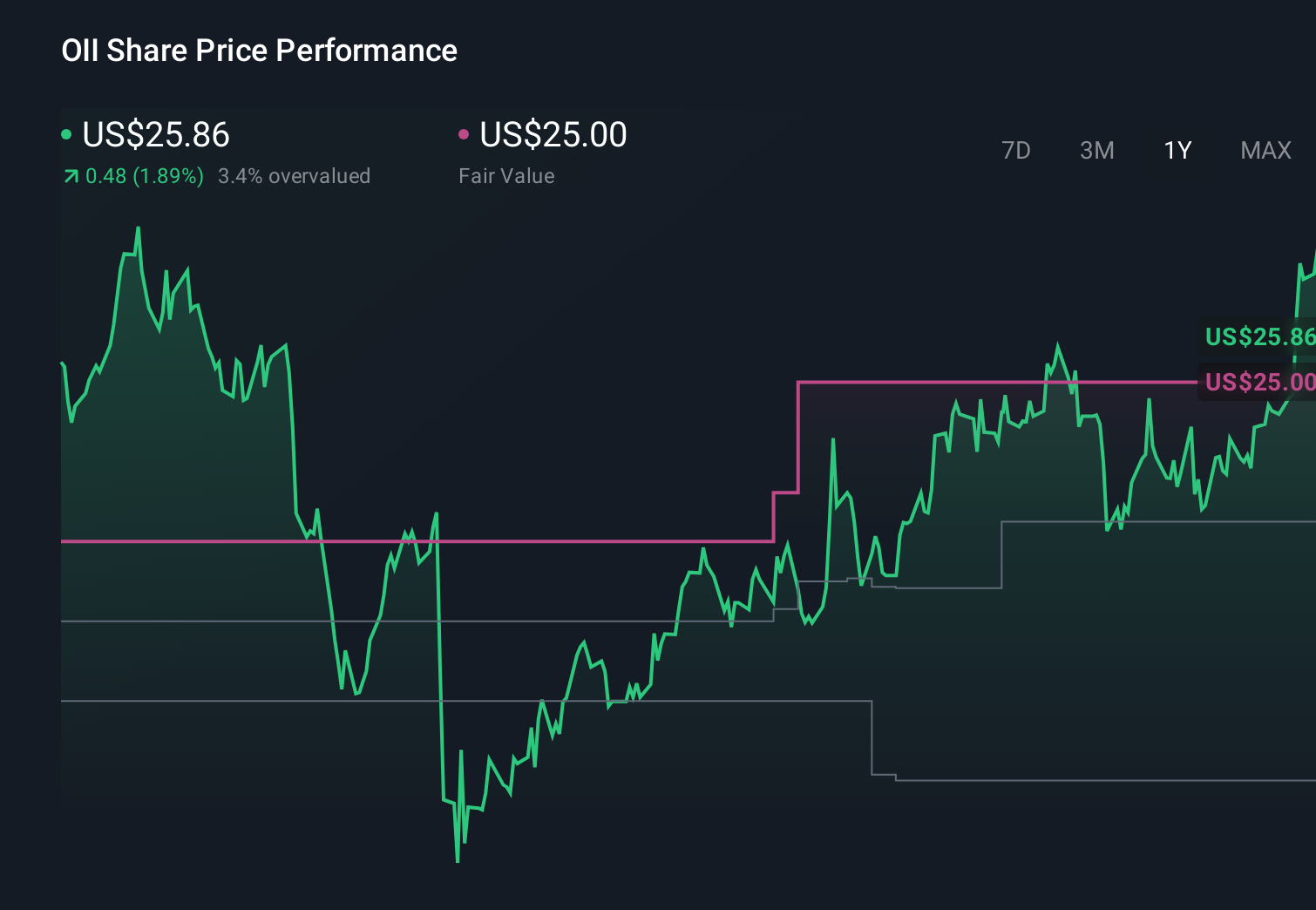

Uncover how Oceaneering International's forecasts yield a $22.38 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place Oceaneering’s fair value between US$21.43 and US$50.95, highlighting a wide spread in expectations. When you weigh those opinions against the company’s reliance on cyclical offshore oil and gas spending, it can be useful to compare several viewpoints before deciding how that risk might affect future performance.

Explore 4 other fair value estimates on Oceaneering International - why the stock might be worth 14% less than the current price!

Build Your Own Oceaneering International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报