How Investors May Respond To CBRE Group (CBRE) Centralizing Real Estate Investments Leadership Under Andy Glanzman

- Earlier this month, CBRE announced a series of leadership changes effective January 1, 2026, promoting Andy Glanzman to CEO of Real Estate Investments, elevating Adam Nims to CEO of Trammell Crow Company, and appointing Adam Saphier as Global COO of Advisory Services, while Danny Queenan moves into an Executive Group President role.

- These promotions consolidate oversight of CBRE’s development and investment management arms under Glanzman and tighten global operational control in Advisory Services, potentially influencing how the group prioritizes capital deployment, development pipelines, and cross-border client execution.

- Next, we’ll examine how concentrating Real Estate Investments leadership under Andy Glanzman could influence CBRE’s broader investment narrative and outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CBRE Group Investment Narrative Recap

To own CBRE, you generally need to believe in its ability to convert global real estate activity into fee-based revenue across investment management, development, and advisory, despite economic and rate uncertainty. The latest leadership reshuffle centralizing Real Estate Investments under Andy Glanzman looks more like continuity than a short term catalyst, and it does not materially change near term sensitivities to interest rates, large leasing volumes, or capital markets activity.

The Glanzman promotion is the most relevant recent move here, since it ties Trammell Crow Company and CBRE Investment Management more tightly together at the segment level, which matters for how capital raising and development pipelines respond to shifts in transaction volumes. While that could influence how CBRE positions its Real Estate Investments segment over time, the bigger immediate swing factor still appears to be how interest rate volatility affects deal timing and client project decisions.

However, investors should also be aware that if interest rate volatility persists, it could...

Read the full narrative on CBRE Group (it's free!)

CBRE Group's narrative projects $50.0 billion revenue and $2.3 billion earnings by 2028. This requires 9.5% yearly revenue growth and about a $1.2 billion earnings increase from $1.1 billion today.

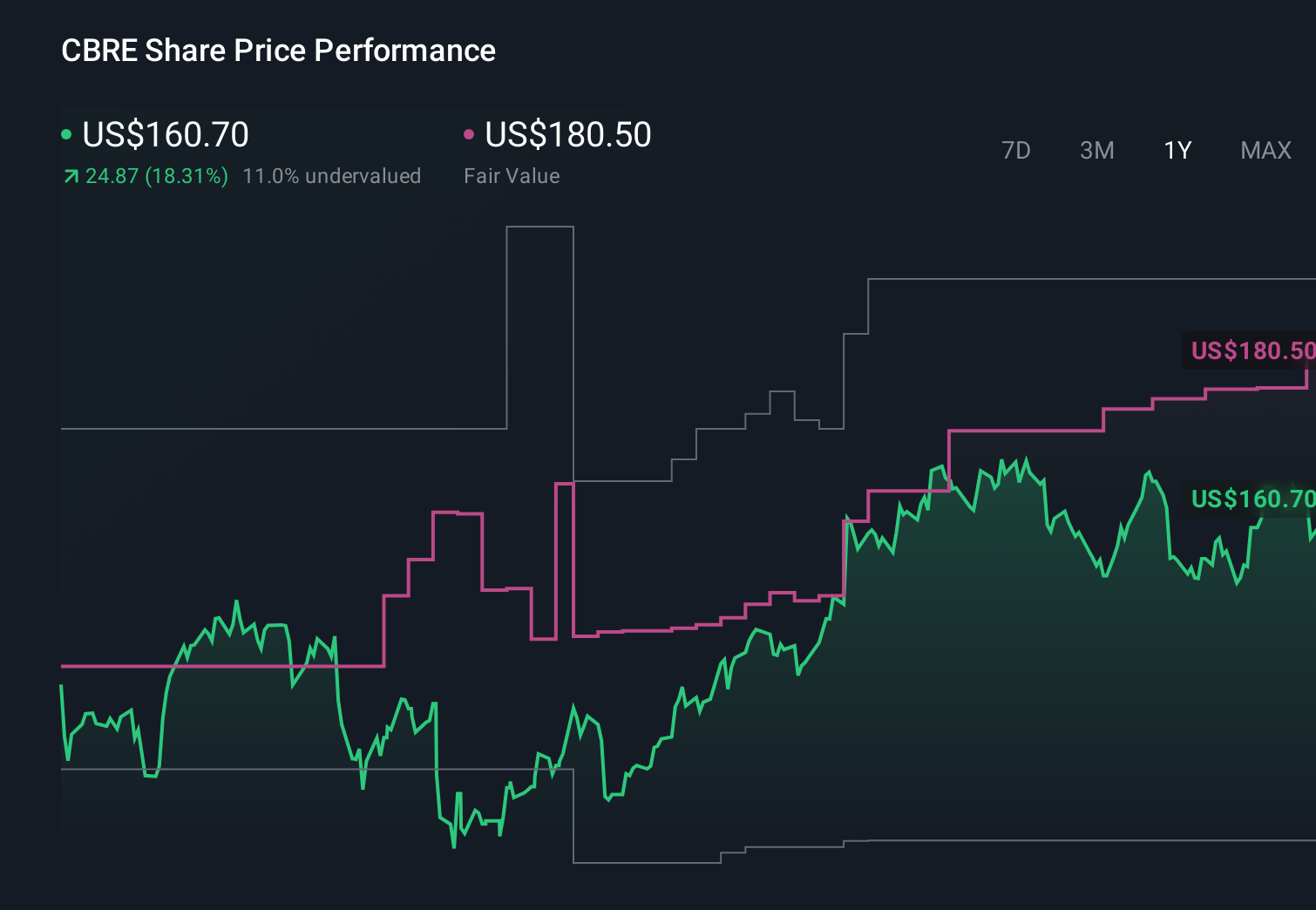

Uncover how CBRE Group's forecasts yield a $182.58 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently value CBRE between US$145.62 and US$218.54, showing how far individual views can stretch. Set against this spread, the risk that prolonged interest rate volatility delays capital raising and large projects is a key factor that could shape how those expectations play out over time.

Explore 3 other fair value estimates on CBRE Group - why the stock might be worth 11% less than the current price!

Build Your Own CBRE Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CBRE Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBRE Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报