Assessing U.S. Physical Therapy’s Valuation After Sector Upgrade Sparks Renewed Investor Interest

U.S. Physical Therapy (USPH) caught a lift after RBC Capital upgraded the broader health care sector to Overweight, as investors warmed to what they see as better value and improving earnings across the group.

See our latest analysis for U.S. Physical Therapy.

The pop in U.S. Physical Therapy’s share price fits into a broader pattern, with a 1 month share price return of 12.31 percent helping to offset a negative year to date share price return and a slightly negative 1 year total shareholder return. This suggests momentum could be rebuilding as investors reassess sector risks and valuations.

If this move has you rethinking opportunities across the space, it is worth scanning other names in the sector through healthcare stocks to spot similar risk reward setups.

With shares still trading well below analyst targets despite solid revenue and earnings growth, the setup looks intriguing. But is U.S. Physical Therapy genuinely undervalued, or is the market already pricing in its next leg of expansion?

Most Popular Narrative: 24.7% Undervalued

With U.S. Physical Therapy last closing at $80.45 against a most popular narrative fair value of about $106.83, the upside case leans firmly positive.

Analysts are assuming U.S. Physical Therapy's revenue will grow by 8.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 4.8% today to 5.7% in 3 years time.

Want to know what kind of earnings power those growth and margin upgrades imply, and why the narrative leans on a premium future multiple? The full story unpacks how steady expansion, improving profitability, and a rich valuation all mesh together to support that higher fair value.

Result: Fair Value of $106.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter reimbursement policies and persistent labor shortages could quickly pressure margins and stall the growth narrative that investors are starting to price in.

Find out about the key risks to this U.S. Physical Therapy narrative.

Another View: Rich on Earnings

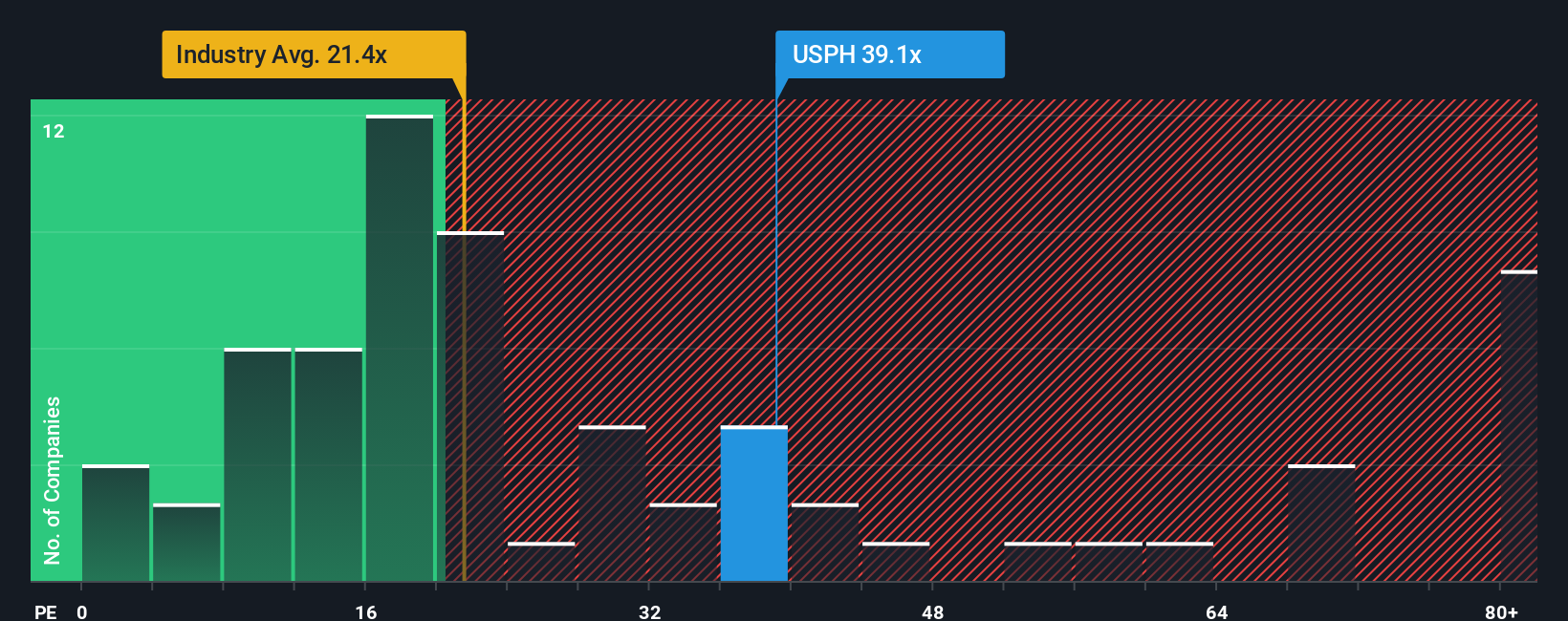

While the narrative and analyst targets point to upside, the earnings lens sends a different message. U.S. Physical Therapy trades at about 34 times earnings versus roughly 23.7 times for the U.S. healthcare sector and a fair ratio near 18.6 times. That premium could compress quickly if growth underwhelms, leaving less room for error than the story implies. Is the multiple signaling confidence or complacency?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U.S. Physical Therapy Narrative

If the current storyline does not quite match your view, dive into the numbers yourself and shape a fresh take in minutes, Do it your way.

A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock lists on Simply Wall St’s screener, built to surface high conviction ideas fast.

- Capture value potential early by reviewing these 898 undervalued stocks based on cash flows that may be trading below what their cash flows justify.

- Target powerful long term income potential with these 10 dividend stocks with yields > 3% delivering yields above 3 percent.

- Position yourself ahead of the next digital wave by assessing these 79 cryptocurrency and blockchain stocks reshaping finance and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报