CNX Resources (CNX): Reassessing Valuation After Debt Exchange, Moody’s Outlook Upgrade and New CFO Appointment

CNX Resources (CNX) just wrapped up a $122 million convertible note exchange, secured a positive outlook from Moody’s, and announced a new CFO, a trio of moves that directly reshapes its balance sheet and leadership.

See our latest analysis for CNX Resources.

These moves land at a time when CNX’s share price has eased slightly in the very short term but still carries a solid 90 day share price return of 22.72 percent, supported by a hefty 117.86 percent three year total shareholder return that hints momentum is still broadly intact.

If this kind of balance sheet cleanup has your attention, it could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

Yet with the stock trading slightly above the average analyst price target, but at a steep discount to some intrinsic value estimates, investors face a key question: Is CNX still mispriced, or is future growth already baked in?

Most Popular Narrative: 10.8% Overvalued

Compared with the narrative fair value of about $33.57, CNX Resources at $37.21 is priced above the level implied by its long term cash flow story.

Favorable policy and regulatory shifts towards cleaner burning natural gas including programs like 45Z tax credits and renewable energy attribute markets are creating new, high margin revenue streams (e.g., RMG sales, environmental credits). These may enhance both net margins and free cash flow. Expansion into differentiated products (RNG, blue hydrogen, carbon linked derivatives) and flexible participation in voluntary and compliance environmental markets position CNX to capture diversified, premium priced revenue streams, supporting its long term top line and earnings growth narrative.

Want to see what kind of revenue mix and margin profile could justify paying above that fair value today? The narrative leans on unusually strong earnings expansion, disciplined capital returns, and a future profit multiple that looks closer to a growth story than a traditional gas producer. Curious which assumptions really move the dial on that valuation gap?

Result: Fair Value of $33.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty around tax credits and speculative AI driven gas demand could undermine the bullish cash flow narrative that investors are leaning on.

Find out about the key risks to this CNX Resources narrative.

Another Angle on Valuation

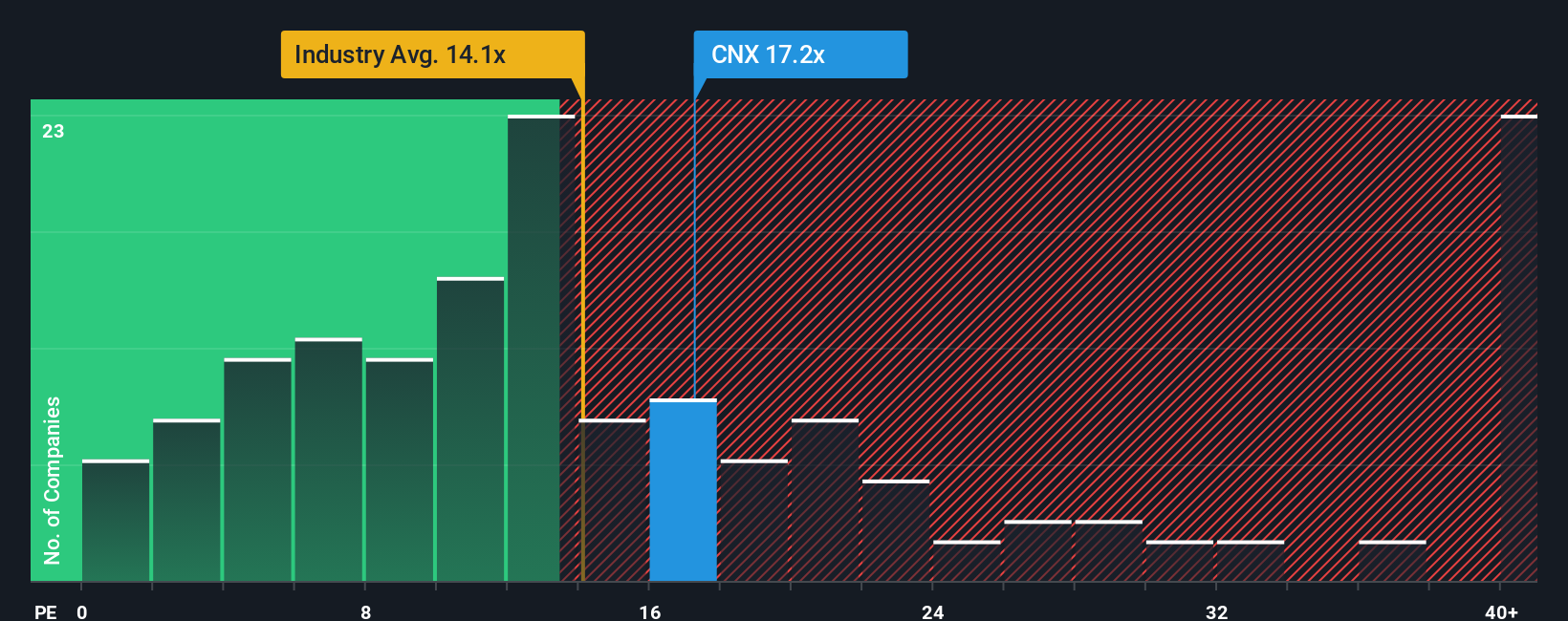

Step back from the narrative fair value, and CNX looks inexpensive on an earnings basis. It trades at about 17.2 times earnings versus a peer average near 49.9 times, while our fair ratio sits closer to 20.1 times. This suggests there may be room for upside if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CNX Resources Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a full narrative in minutes: Do it your way.

A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities with targeted stock lists on Simply Wall St, built to uncover what most investors overlook.

- Capture potential turnaround opportunities by targeting beaten down businesses trading at compelling valuations through these 898 undervalued stocks based on cash flows.

- Focus on machine driven innovation by examining companies involved in AI through these 24 AI penny stocks.

- Explore companies that offer income streams with these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报