European Companies Priced Below Estimated Value

As the pan-European STOXX Europe 600 Index recently rose by 1.60%, buoyed by signs of steady economic growth and looser monetary policy, investors are keenly observing opportunities in the region. In this context, identifying undervalued stocks can be particularly appealing, as these companies may offer potential value based on current market conditions and economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vinext (BIT:VNXT) | €3.28 | €6.56 | 50% |

| Redelfi (BIT:RDF) | €11.68 | €23.30 | 49.9% |

| PVA TePla (XTRA:TPE) | €22.08 | €43.64 | 49.4% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.266 | €8.50 | 49.8% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.15 | NOK65.88 | 49.7% |

| Hemnet Group (OM:HEM) | SEK168.70 | SEK337.03 | 49.9% |

| EcoUp Oyj (HLSE:ECOUP) | €1.32 | €2.61 | 49.4% |

| Dynavox Group (OM:DYVOX) | SEK102.20 | SEK202.79 | 49.6% |

| Artifex Mundi (WSE:ART) | PLN12.36 | PLN24.34 | 49.2% |

| Aker BioMarine (OB:AKBM) | NOK89.40 | NOK176.71 | 49.4% |

Let's dive into some prime choices out of the screener.

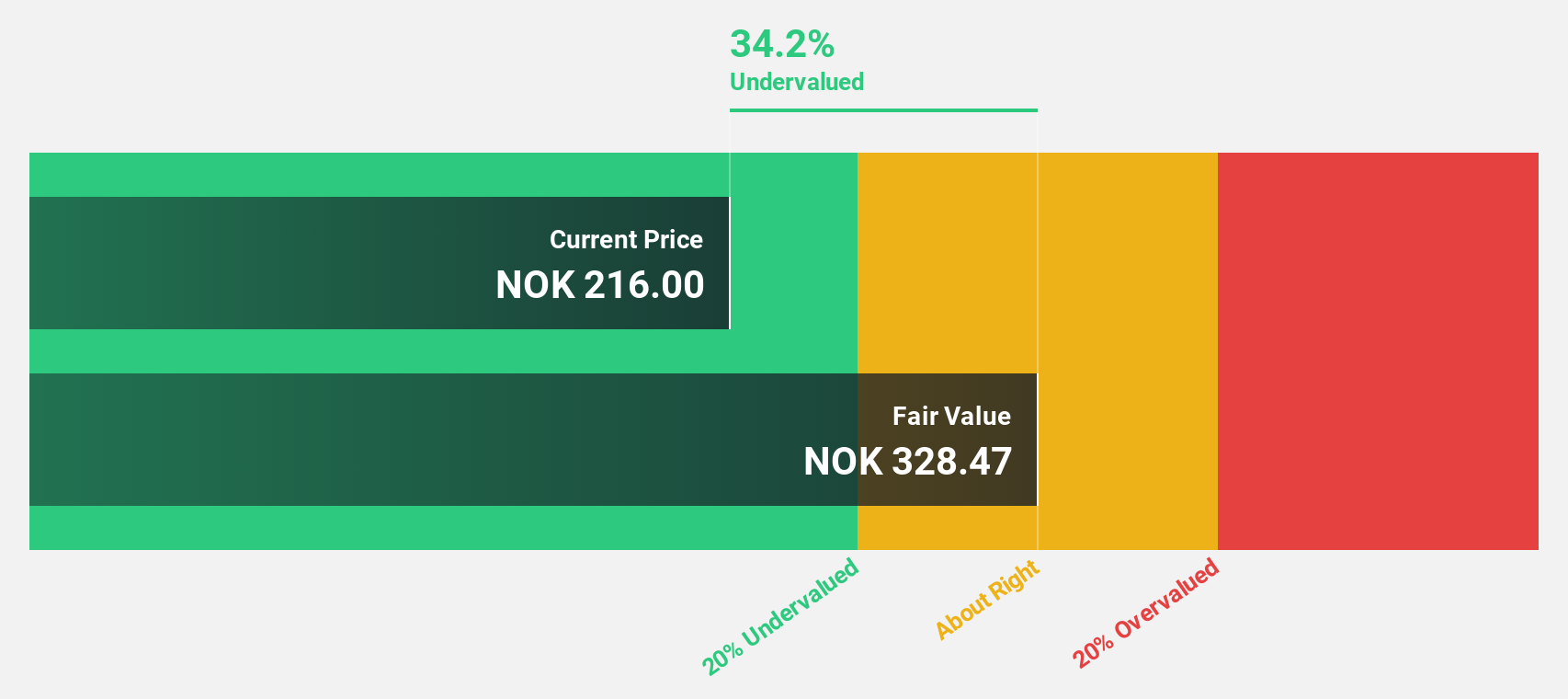

Norbit (OB:NORBT)

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK11.57 billion.

Operations: The company generates revenue from its Oceans segment with NOK933.50 million, Connectivity at NOK575.90 million, and Product Innovation and Realization (PIR) contributing NOK826.90 million.

Estimated Discount To Fair Value: 10.4%

Norbit ASA is trading at NOK 181.4, below its estimated fair value of NOK 202.45, indicating potential undervaluation based on cash flows. The company has shown strong financial performance with a significant earnings growth of 110% over the past year and forecasts suggest continued robust earnings growth of 21.86% annually over the next three years, outpacing the Norwegian market's expected growth rate. Recent orders in connectivity and defense sectors further bolster its revenue prospects.

- In light of our recent growth report, it seems possible that Norbit's financial performance will exceed current levels.

- Dive into the specifics of Norbit here with our thorough financial health report.

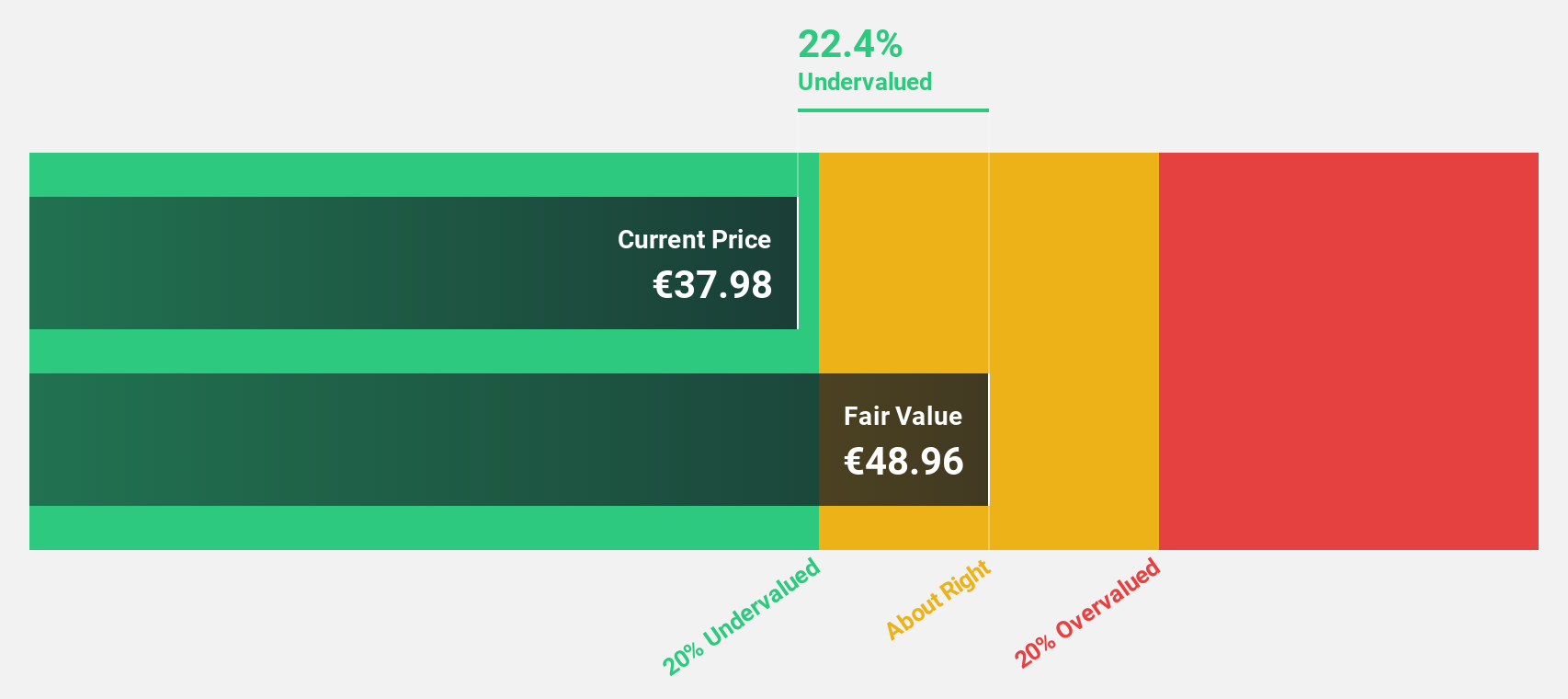

Infineon Technologies (XTRA:IFX)

Overview: Infineon Technologies AG is a global company that develops, manufactures, and markets semiconductors and semiconductor-based solutions across various regions including Germany, Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of €47.84 billion.

Operations: The company's revenue is segmented into Automotive (€7.40 billion), Green Industrial Power (€1.63 billion), Power & Sensor Systems (€4.21 billion), and Connected Secure Systems (€1.42 billion).

Estimated Discount To Fair Value: 32.9%

Infineon Technologies, trading at €36.67, is undervalued with a fair value estimate of €54.63, offering potential based on cash flows. Despite a dip in profit margins from 11.7% to 6.7%, earnings are expected to grow significantly at 25.54% annually over the next three years, surpassing the German market's growth rate of 16.8%. Recent patent victories and product innovations in GaN technology and AI-enhanced robotics highlight its strategic advancements and technological leadership.

- Our earnings growth report unveils the potential for significant increases in Infineon Technologies' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Infineon Technologies.

Nemetschek (XTRA:NEM)

Overview: Nemetschek SE offers software solutions for the architecture, engineering, construction, operation, and media industries globally and has a market cap of €10.90 billion.

Operations: The company's revenue is derived from its software solutions across various segments: Build (€453.38 million), Media (€121.29 million), Design (€534.37 million), and Manage (€51.07 million).

Estimated Discount To Fair Value: 16.3%

Nemetschek, priced at €94.40, is undervalued with a fair value estimate of €112.83, trading 16.3% below this mark. Recent earnings reports show substantial growth, with third-quarter net income rising to €55.26 million from €39.28 million year-over-year and annual earnings projected to grow 18.6%, outpacing the German market's 16.8%. Despite slower revenue growth forecasts of 12.5% annually compared to its peers, Nemetschek remains a solid cash flow investment opportunity in Europe.

- Insights from our recent growth report point to a promising forecast for Nemetschek's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Nemetschek.

Make It Happen

- Get an in-depth perspective on all 190 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报