3 European Growth Companies With Up To 26% Insider Ownership

As European markets show signs of steady economic growth and benefit from looser monetary policies, the pan-European STOXX Europe 600 Index has risen by 1.60%, reflecting investor optimism. In this environment, companies with high insider ownership can be particularly appealing to investors seeking alignment between management and shareholder interests, as such ownership often indicates confidence in the company's long-term potential.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 32.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's dive into some prime choices out of the screener.

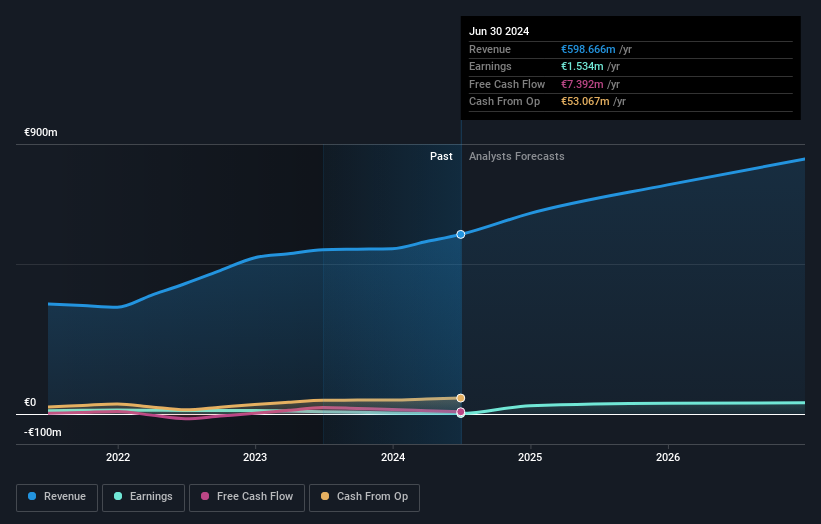

Floridienne (ENXTBR:FLOB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Floridienne S.A. operates through its subsidiaries in the life sciences, food, and chemistry sectors both in Belgium and internationally, with a market cap of €617.08 million.

Operations: The company's revenue segments are comprised of €530.26 million from the Life Sciences Division, €152.24 million from the Food segment, and €34.79 million from the Chemicals Division.

Insider Ownership: 15.8%

Floridienne exhibits strong growth potential with earnings forecasted to grow significantly at 40.21% annually, outpacing the Belgian market. Despite its volatile share price recently, it trades at a substantial discount to estimated fair value. Revenue growth is projected at 10.5% per year, exceeding local market expectations but below high-growth benchmarks. Upcoming events include a Special Shareholders Meeting on November 26 and Q3 earnings release on November 28, which could impact investor sentiment.

- Click to explore a detailed breakdown of our findings in Floridienne's earnings growth report.

- Our expertly prepared valuation report Floridienne implies its share price may be too high.

Gruvaktiebolaget Viscaria (OM:VISC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gruvaktiebolaget Viscaria is involved in the exploration and evaluation of mineral resources in Sweden, with a market cap of SEK2.64 billion.

Operations: The company generates revenue from the evaluation of mineral resources, amounting to SEK284.70 million.

Insider Ownership: 26.4%

Gruvaktiebolaget Viscaria demonstrates significant growth potential, with revenue expected to increase by 64.4% annually, surpassing the Swedish market. Despite recent share price volatility and substantial shareholder dilution from follow-on equity offerings totaling over SEK 1.65 billion, insider buying has been notable, indicating confidence in future prospects. The company is projected to achieve profitability within three years despite current losses and low return on equity forecasts. Recent financing efforts aim to support the Viscaria Project's development.

- Unlock comprehensive insights into our analysis of Gruvaktiebolaget Viscaria stock in this growth report.

- Our valuation report here indicates Gruvaktiebolaget Viscaria may be undervalued.

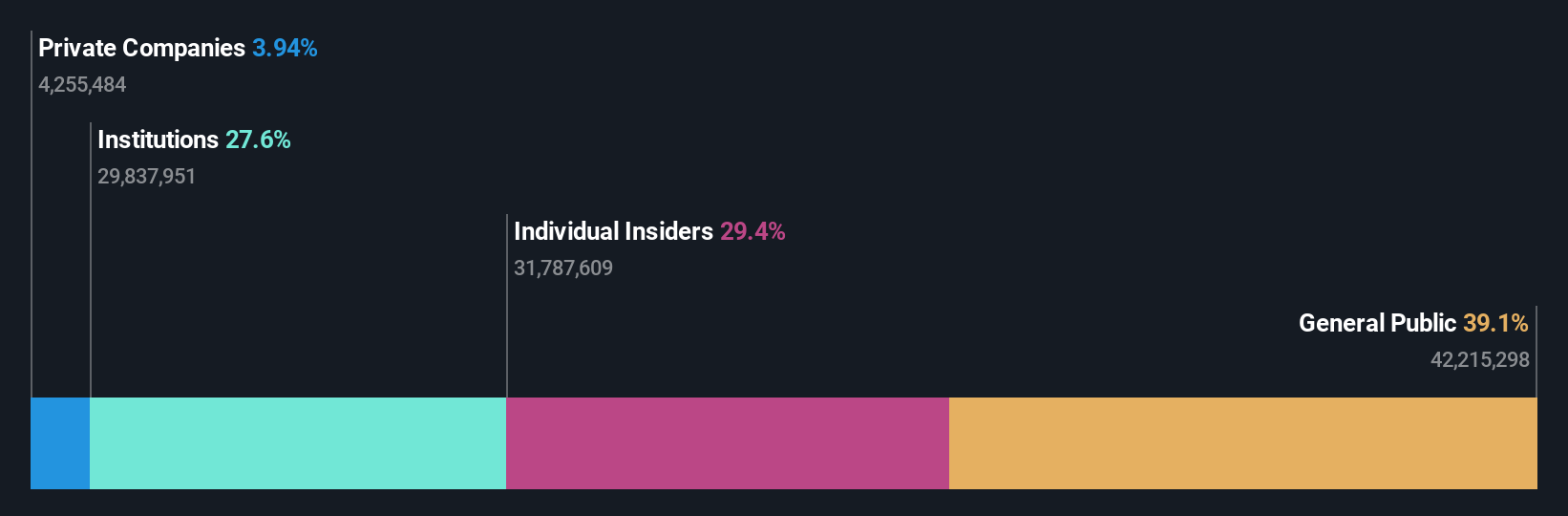

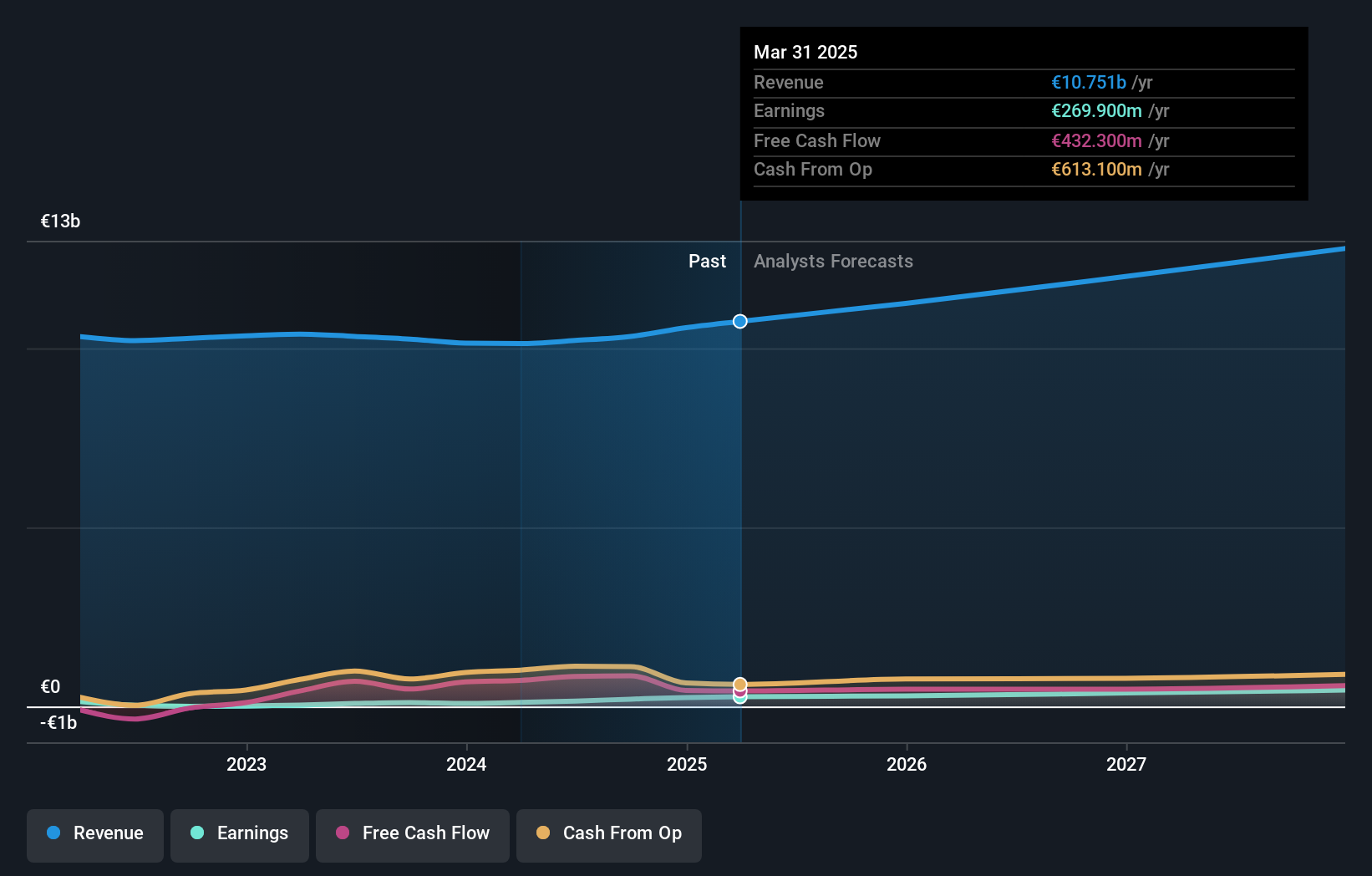

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products in Germany and internationally, with a market cap of €6.48 billion.

Operations: The company generates revenue from its B2B segment at €1.04 billion and its B2C segment at €10.58 billion.

Insider Ownership: 10.4%

Zalando's growth trajectory is underscored by its strategic share repurchase program, which began in November 2025 and aims to buy back up to €100 million worth of shares. This move reflects confidence in its future prospects despite a dip in net income for Q3 2025 compared to the previous year. Revenue is forecasted to grow at 9.1% annually, outpacing the German market. The recent appointment of Anna Dimitrova as CFO signals a focus on strengthening financial strategy and governance.

- Delve into the full analysis future growth report here for a deeper understanding of Zalando.

- Upon reviewing our latest valuation report, Zalando's share price might be too pessimistic.

Make It Happen

- Delve into our full catalog of 211 Fast Growing European Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报