European Dividend Stocks To Consider For Your Portfolio

As European markets show signs of steady economic growth and benefit from looser monetary policies, the pan-European STOXX Europe 600 Index has risen by 1.60%, reflecting a positive sentiment across major stock indexes like Italy’s FTSE MIB and France’s CAC 40. In such an environment, dividend stocks can offer investors a blend of income and potential capital appreciation, making them an attractive consideration for those looking to enhance their portfolios with reliable returns amidst evolving market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.11% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.58% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.02% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| Evolution (OM:EVO) | 4.89% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.13% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.17% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.26% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.87% | ★★★★★☆ |

Click here to see the full list of 200 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

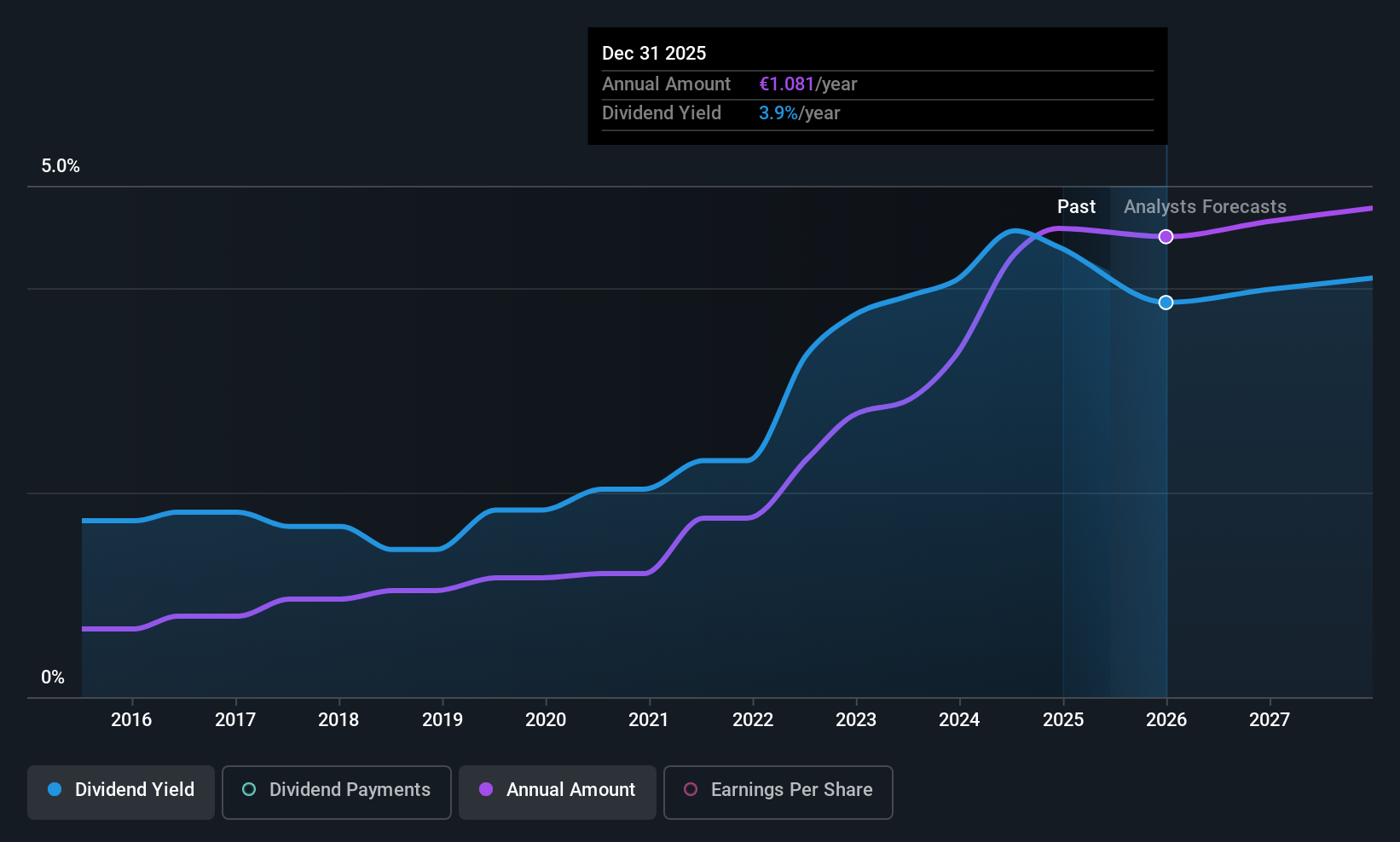

Cementos Molins (BDM:CMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cementos Molins, S.A. manufactures and markets construction materials and solutions, with a market cap of €1.80 billion.

Operations: Cementos Molins, S.A. generates its revenue through the manufacture and marketing of construction materials and solutions.

Dividend Yield: 3.7%

Cementos Molins offers a reliable dividend history with stable and growing payouts over the past decade. However, its dividend yield of 3.65% is below top-tier Spanish payers, and despite a low earnings payout ratio of 41%, dividends are not well covered by cash flows due to a high cash payout ratio of 109.9%. Recent earnings showed a decline in sales and net income compared to last year, potentially impacting future dividend sustainability.

- Dive into the specifics of Cementos Molins here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Cementos Molins is priced higher than what may be justified by its financials.

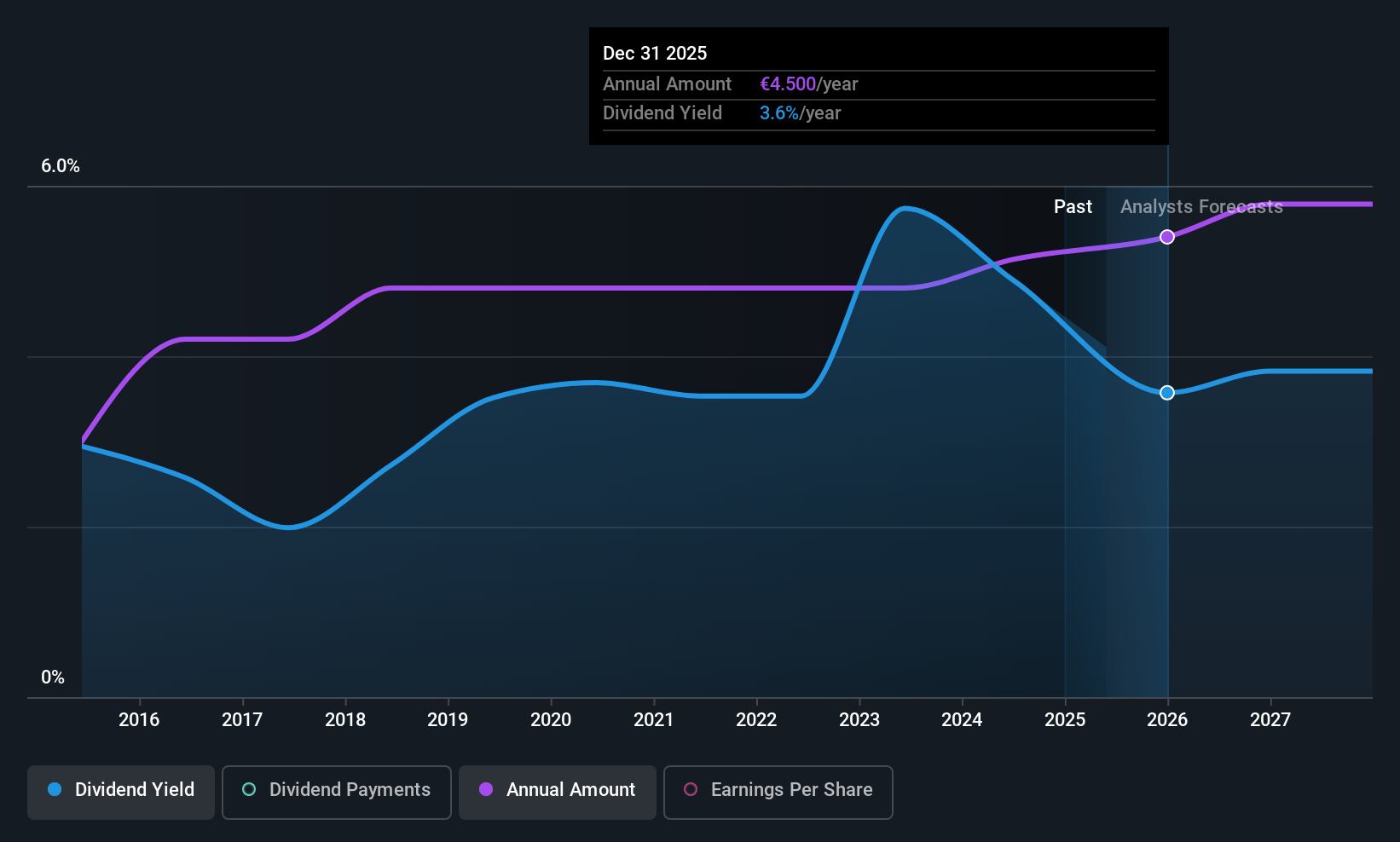

What's Cooking Group (ENXTBR:WHATS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: What's Cooking Group NV, with a market cap of €205.11 million, operates by producing and selling meat products and ready meals through its subsidiaries.

Operations: The company's revenue is primarily derived from its Ready Meals segment, which generated €429.84 million.

Dividend Yield: 4.1%

What's Cooking Group has a stable dividend history with consistent growth over the past decade. However, its dividend yield of 4.07% falls short of top-tier Belgian payers. The dividends are not well covered by cash flows, indicated by a high cash payout ratio of 121.6%, though they are covered by earnings with a payout ratio of 63.6%. Despite trading at good value and strong recent earnings growth, profit margins have declined from last year.

- Navigate through the intricacies of What's Cooking Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that What's Cooking Group is priced lower than what may be justified by its financials.

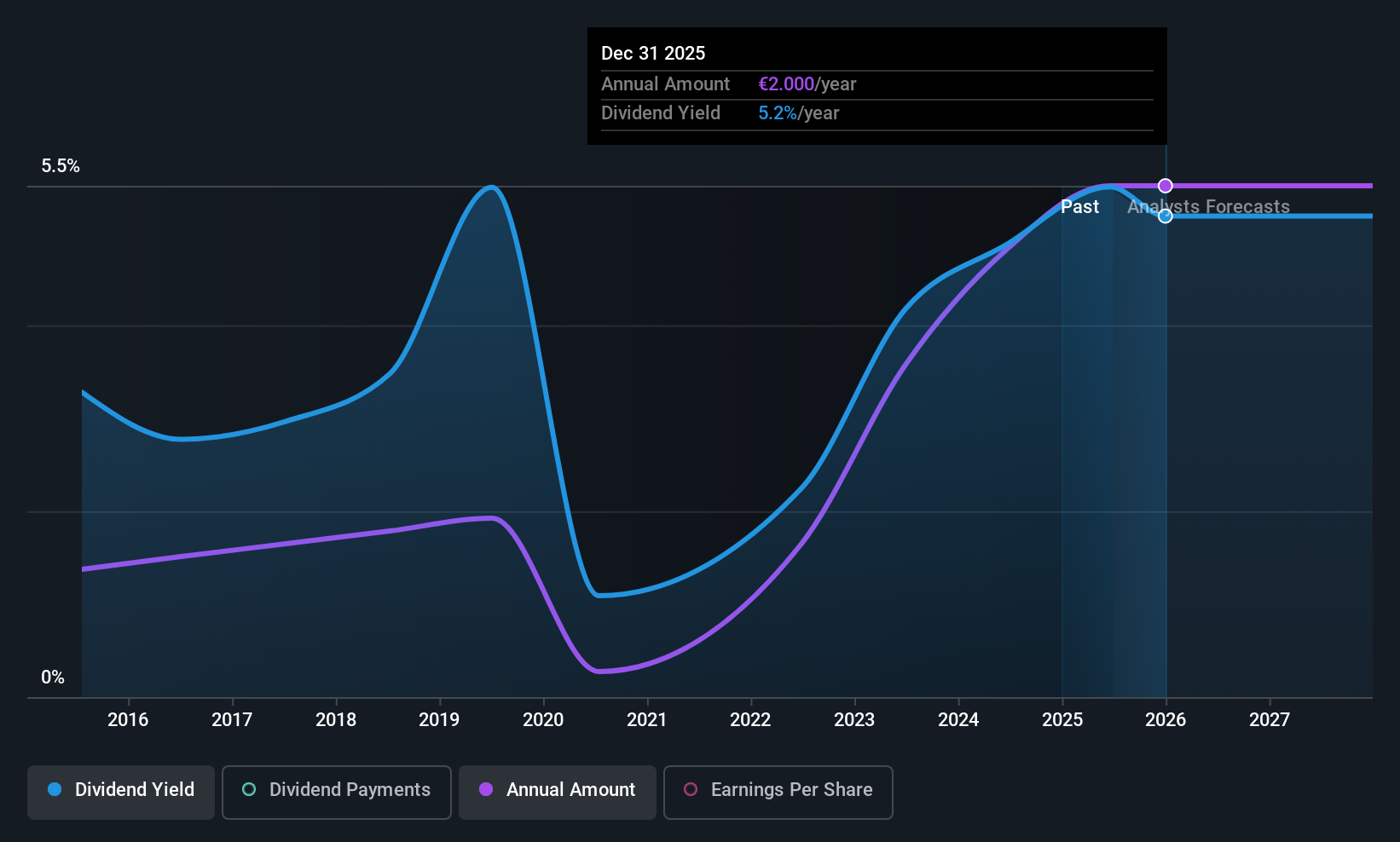

Deutsche Rohstoff (XTRA:DR0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Rohstoff AG, with a market cap of €227.83 million, is involved in the exploration and production of crude oil and natural gas across the United States, Australia, Western Europe, and South Korea.

Operations: Deutsche Rohstoff AG generates its revenue through the exploration and production of crude oil and natural gas in regions including the United States, Australia, Western Europe, and South Korea.

Dividend Yield: 4.2%

Deutsche Rohstoff's dividend history has been volatile, with payments increasing over the past decade but remaining unreliable. The current yield of 4.21% is below top-tier German payers. Despite a high debt level, dividends are sustainable due to low payout ratios—26.5% of earnings and 37.5% of cash flows cover them well. Recent earnings have declined, impacting profit margins which fell from 25% to 16.8%. The stock trades at good value relative to peers and industry benchmarks.

- Take a closer look at Deutsche Rohstoff's potential here in our dividend report.

- According our valuation report, there's an indication that Deutsche Rohstoff's share price might be on the cheaper side.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 197 Top European Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报