PPL (PPL) Valuation Check After Storm Outages and Controversial Rate Hike Proposal

PPL (PPL) is back in focus after severe storms knocked out power to tens of thousands of customers, just as the utility seeks a sizable rate increase to fund grid upgrades and bolster long term reliability.

See our latest analysis for PPL.

Against that backdrop, investors have seen a steady, if unspectacular, climb, with PPL’s share price at $34.68 and a solid year to date share price return alongside a multi year total shareholder return that signals momentum is still broadly constructive rather than fading.

If this kind of regulated utility story has you thinking about where else resilience and growth might show up, it could be worth exploring fast growing stocks with high insider ownership as your next discovery stop.

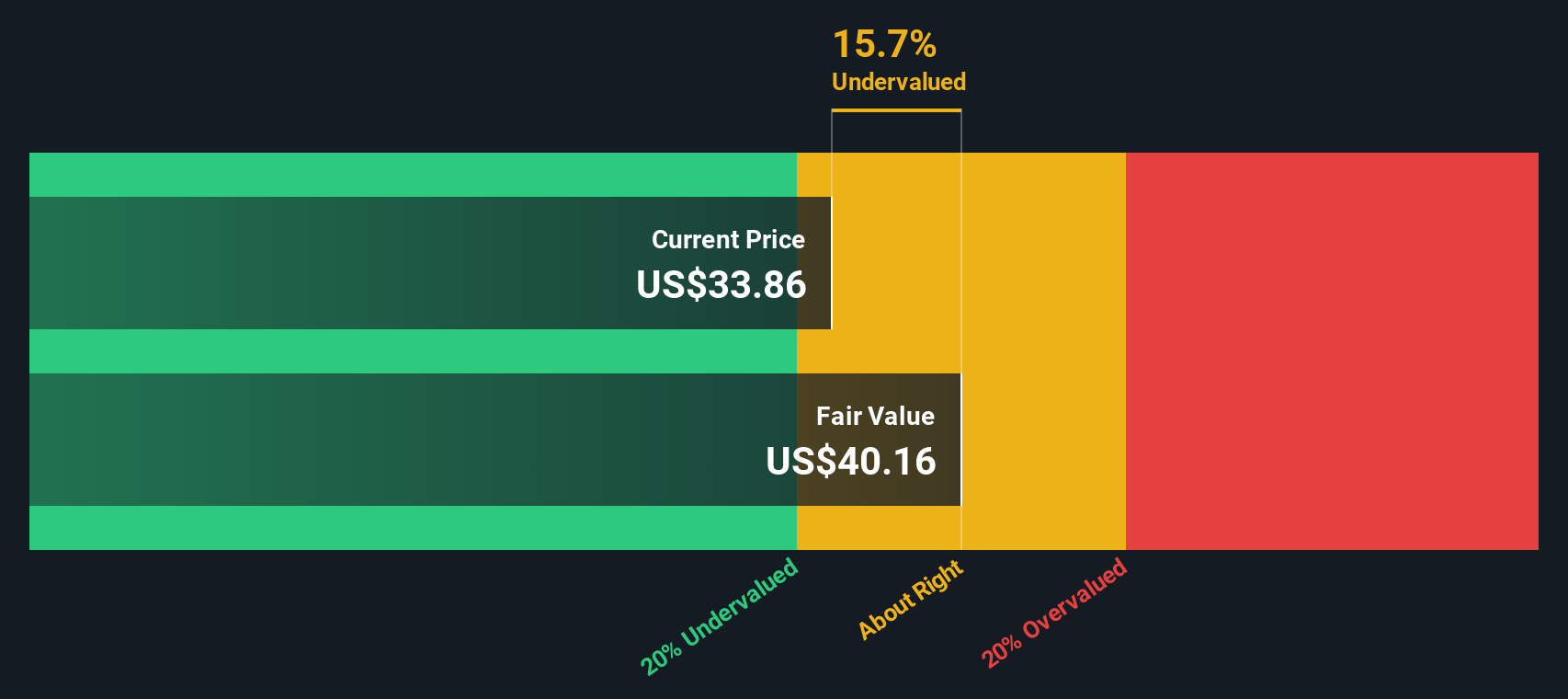

With shares still trading at a discount to analyst targets despite steady growth and storm driven scrutiny, should investors see PPL as an underappreciated grid modernisation play, or assume the market is already pricing in its future gains?

Most Popular Narrative: 13% Undervalued

With PPL last closing at $34.68 against a narrative fair value near $39.87, the story leans toward upside potential driven by long term grid investment.

The accelerating growth in data center construction and new economic development (particularly in Pennsylvania and Kentucky) is driving unprecedented electricity demand, positioning PPL for outsized long-term rate base and revenue growth as it invests to serve these large new loads.

Curious how steady, regulated earnings turn into a premium style valuation, with margins, growth and future multiples doing most of the heavy lifting? Dig into the full narrative to see which assumptions really power that $39 plus fair value.

Result: Fair Value of $39.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that potential upside still depends on regulators backing PPL’s hefty grid spending and on data center demand actually materializing instead of stalling or shifting elsewhere.

Find out about the key risks to this PPL narrative.

Another Angle on Valuation

Our SWS DCF model paints a cooler picture, putting PPL’s fair value nearer $27.31, which makes today’s $34.68 price look overvalued and leaves less margin for missteps on regulation, capex or data center demand. Which story do you trust more when the cycle turns?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PPL for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PPL Narrative

If this perspective does not quite match your own or you would rather dig into the numbers yourself, you can build a fresh view in just a few minutes, Do it your way.

A great starting point for your PPL research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Before you move on, put Simply Wall St’s screener to work so you are not leaving high potential opportunities on the table while you focus on PPL.

- Capitalize on potential market mispricings by scanning these 898 undervalued stocks based on cash flows where strong cash flows could signal bargain entries before the crowd catches on.

- Ride the next wave of innovation by targeting these 24 AI penny stocks that may benefit from powerful tailwinds in automation, machine learning, and data driven business models.

- Strengthen your income stream by filtering for these 10 dividend stocks with yields > 3% that can bolster returns with reliable, higher yielding payouts through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报