Agility Capital Holding Inc. (AMS:AGIL) Soars 36% But It's A Story Of Risk Vs Reward

Agility Capital Holding Inc. (AMS:AGIL) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 5.4% isn't as attractive.

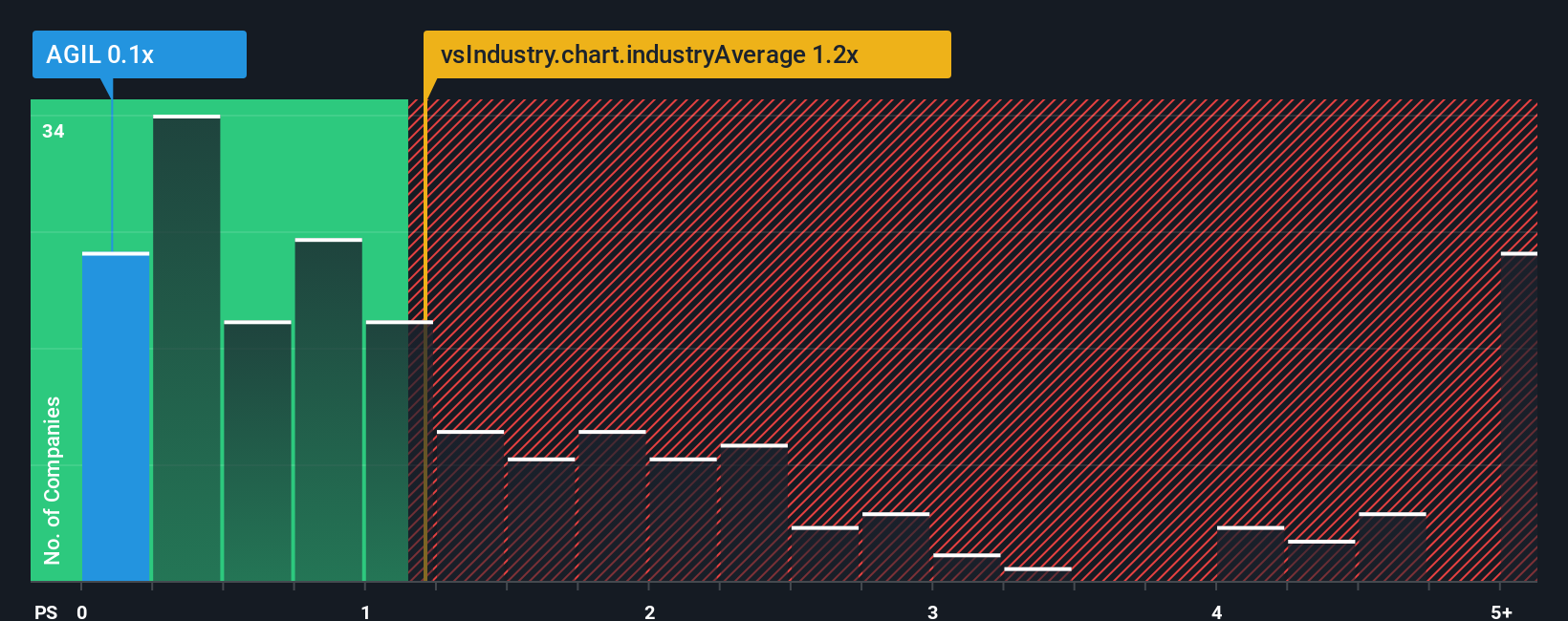

In spite of the firm bounce in price, it would still be understandable if you think Agility Capital Holding is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the Netherlands' Hospitality industry have P/S ratios above 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Agility Capital Holding

What Does Agility Capital Holding's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Agility Capital Holding, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. Those who are bullish on Agility Capital Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Agility Capital Holding will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Agility Capital Holding's to be considered reasonable.

Retrospectively, the last year delivered a decent 2.6% gain to the company's revenues. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 10% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Agility Capital Holding's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Agility Capital Holding's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Agility Capital Holding currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Agility Capital Holding that you need to be mindful of.

If you're unsure about the strength of Agility Capital Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报