Asian Dividend Stocks To Enhance Your Portfolio

As the Asian markets navigate a complex landscape marked by Japan's significant interest rate hikes and China's mixed economic signals, investors are increasingly looking toward dividend stocks as a reliable source of income. In such an environment, selecting stocks with strong dividend yields can offer stability and enhance portfolio resilience amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.76% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.21% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.92% | ★★★★★★ |

| NCD (TSE:4783) | 3.94% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.30% | ★★★★★★ |

Click here to see the full list of 1026 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Business Online (SET:BOL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Business Online Public Company Limited, with a market cap of THB4.35 billion, develops and provides local and global financial information systems in Thailand.

Operations: Business Online Public Company Limited generates revenue from its online financial information provider segment, amounting to THB796.85 million.

Dividend Yield: 5.8%

Business Online Public Company Limited reported improved earnings for Q3 2025, with revenue and net income rising to THB 244.67 million and THB 92.16 million, respectively. While dividends have been stable and growing over the past decade, the current dividend yield of 5.85% is not well-covered by free cash flows or earnings due to high payout ratios (184.5% from cash flow), indicating potential sustainability concerns despite reliable payment history.

- Dive into the specifics of Business Online here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Business Online shares in the market.

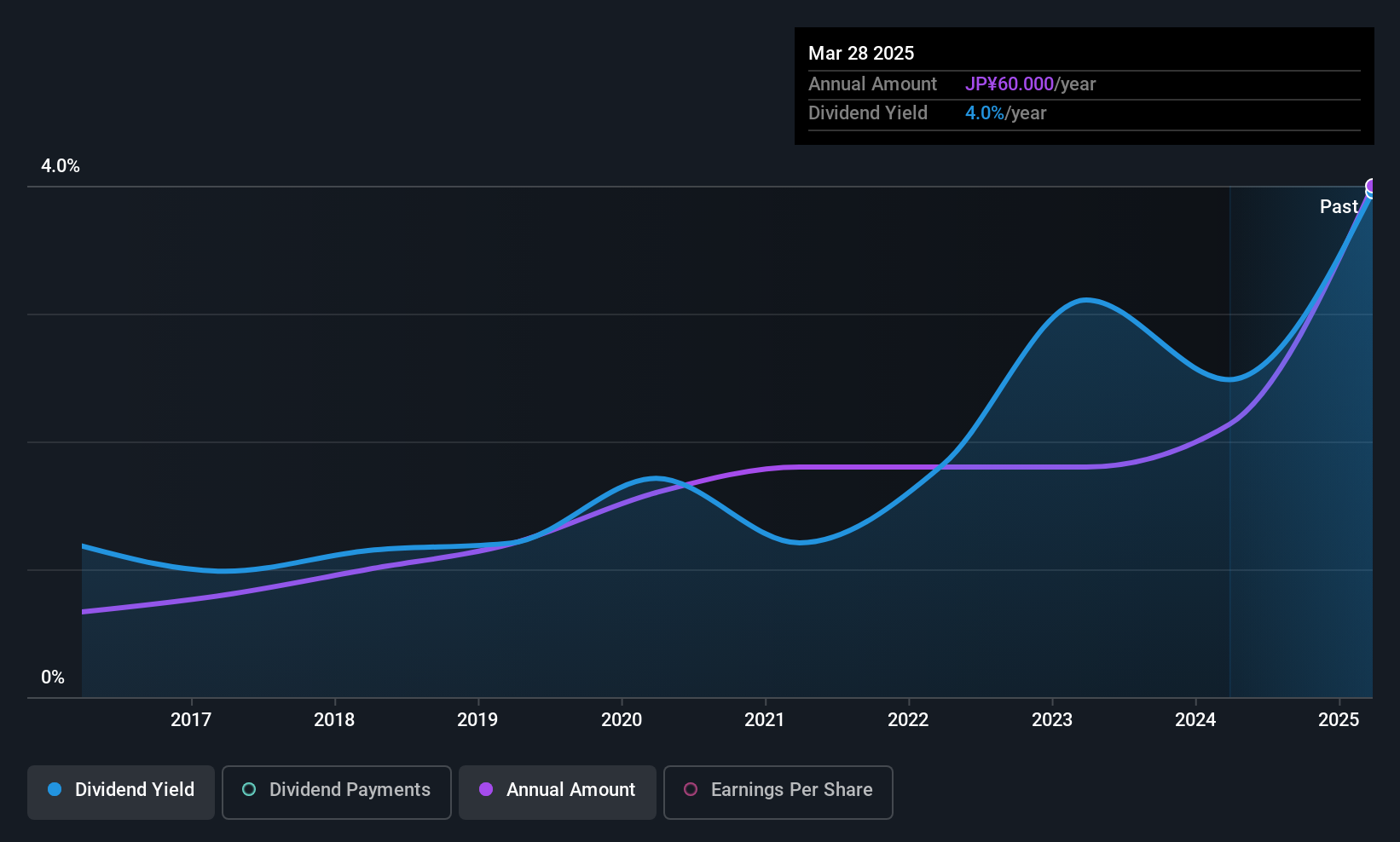

Nippon RietecLtd (TSE:1938)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Rietec Co., Ltd. operates in the railway electrical equipment construction sector in Japan and has a market capitalization of ¥56.99 billion.

Operations: Nippon Rietec Co., Ltd.'s revenue is primarily derived from its Electrical Equipment Construction Business, which accounts for ¥66.85 billion, complemented by its Side Line Segment at ¥5.32 billion and Real Estate Leasing Business at ¥446.49 million.

Dividend Yield: 3.6%

Nippon Rietec Ltd.'s dividend yield of 3.57% is slightly below the top quartile in Japan, but its dividends have been stable and growing over the past decade. Despite a low payout ratio of 38.1%, suggesting earnings coverage, the lack of free cash flow raises concerns about sustainability. The company's Price-To-Earnings ratio at 11.4x indicates potential undervaluation compared to the market average, while earnings have shown significant growth recently, enhancing its appeal for cautious dividend investors.

- Click here to discover the nuances of Nippon RietecLtd with our detailed analytical dividend report.

- The analysis detailed in our Nippon RietecLtd valuation report hints at an inflated share price compared to its estimated value.

First Financial Holding (TWSE:2892)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Financial Holding Co., Ltd. operates through its subsidiaries to offer a range of financial products and services globally, with a market cap of NT$432.82 billion.

Operations: First Financial Holding Co., Ltd. generates revenue through its Banking Sector (NT$60.15 billion), Insurance Sector (NT$5.33 billion), and Securities Sector (NT$3.13 billion).

Dividend Yield: 3.1%

First Financial Holding's dividend yield of 3.08% is below Taiwan's top quartile, with dividends covered by a payout ratio of 50.8%. Despite earnings growth of 8.2% annually over five years, its dividends have been volatile and unreliable over the past decade, experiencing drops over 20%. Recent earnings showed net income at TWD 7.75 billion for Q3 2025, up from TWD 7.08 billion the previous year, reflecting solid financial performance yet raising concerns about dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of First Financial Holding.

- Our comprehensive valuation report raises the possibility that First Financial Holding is priced higher than what may be justified by its financials.

Summing It All Up

- Embark on your investment journey to our 1026 Top Asian Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报