Alnylam Pharmaceuticals (ALNY) Valuation Check After NASDAQ-100 Entry and $250m Manufacturing Expansion

Alnylam Pharmaceuticals (ALNY) just earned a spot in the NASDAQ 100, a move that can channel more passive money into the stock and highlights how far the RNAi pioneer has come with investors.

See our latest analysis for Alnylam Pharmaceuticals.

The NASDAQ 100 inclusion caps a strong run, with the share price up sharply year to date and a five year total shareholder return above 200 percent, as investors reward recent R and D progress and the 250 million dollar manufacturing expansion.

If Alnylam’s momentum has you rethinking your healthcare exposure, this is a good moment to explore other innovative healthcare stocks that could complement your watchlist.

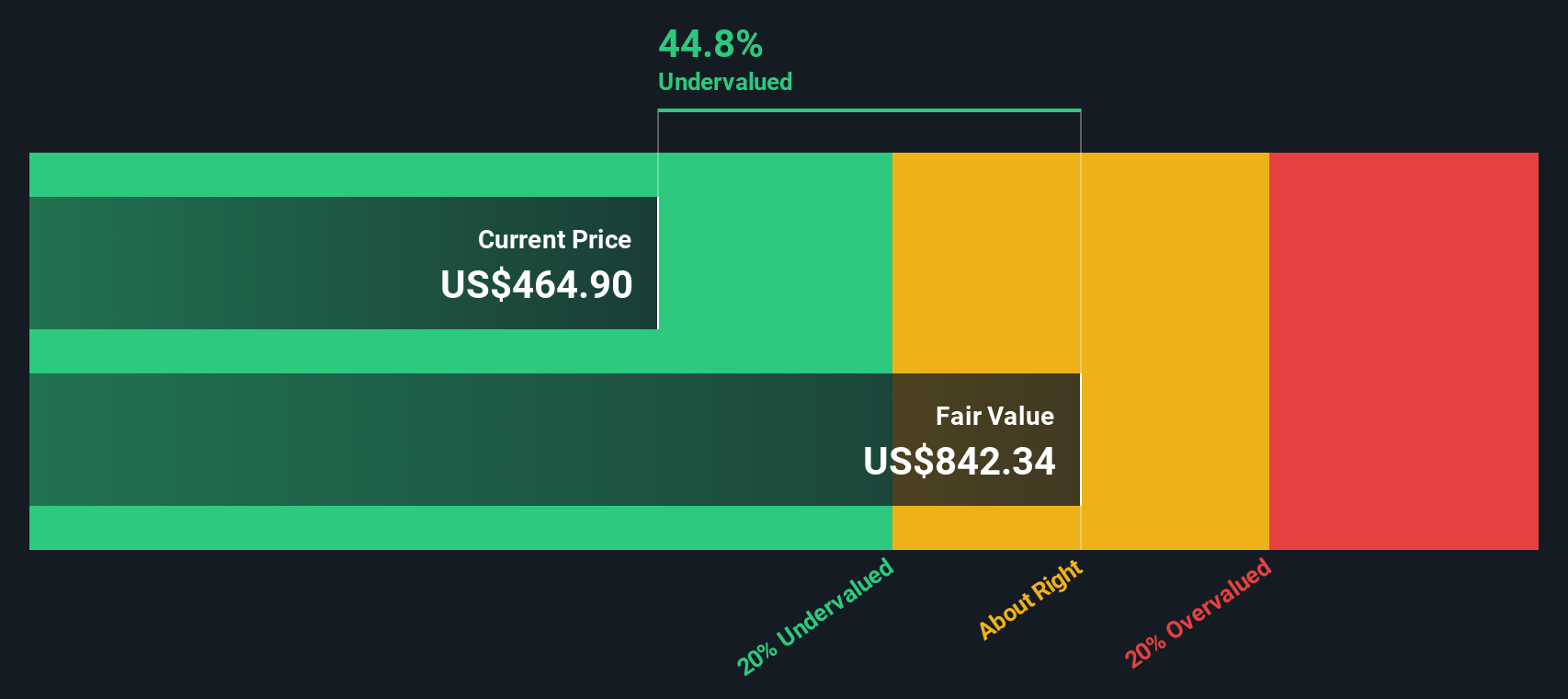

Yet with Alnylam trading near record highs and still showing a sizable intrinsic discount and upside to analyst targets, investors face a key dilemma: is this a fresh entry point, or is future growth already fully priced in?

Most Popular Narrative: 17.2% Undervalued

Compared with the last close at $407.73, the most followed narrative points to a materially higher fair value anchored in long term earnings power.

The rapid and robust uptake of AMVUTTRA for ATTR-CM in its first full quarter post-approval, combined with near-universal first-line payer access and minimal patient out-of-pocket costs, indicates a much larger addressable market for Alnylam's RNAi therapies as diagnostics and disease awareness improve, supporting sustained double-digit revenue growth.

Want to see how this launch momentum turns into a much bigger profit engine? The narrative leans on aggressive revenue ramps and sharply expanding margins, all discounted at a tightly calibrated rate. Curious which assumptions stretch furthest beyond today’s financials and help justify that higher fair value band?

Result: Fair Value of $492.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high R and D spending and heavy reliance on the TTR franchise mean that any launch stumbles or pricing pressure could quickly challenge that upside.

Find out about the key risks to this Alnylam Pharmaceuticals narrative.

Another Angle on Valuation

While the popular narrative sees Alnylam as 17.2 percent undervalued, our DCF model is far more optimistic and suggests fair value closer to $841 per share, a discount of about 51.5 percent. When one framework implies modest upside and another suggests a much larger difference, which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alnylam Pharmaceuticals Narrative

If you have a different view or want to stress test your own assumptions, you can build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing move?

Turn this momentum into a smarter portfolio shift by using the Simply Wall St Screener to spot high potential opportunities before the crowd notices them.

- Capture tomorrow’s potential standouts early by scanning these 3629 penny stocks with strong financials that already show solid financial strength instead of relying on hype.

- Ride powerful secular trends by targeting these 24 AI penny stocks positioned at the intersection of cutting edge technology and attractive long term growth.

- Lock in better risk reward setups by focusing on these 898 undervalued stocks based on cash flows where strong cash flows may not yet be fully reflected in current share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报