Sanmina (SANM) valuation check as new Houston energy factory and Koncar partnership signal growth push

Sanmina (SANM) just put a brighter spotlight on its Energy segment by unveiling plans for a Houston factory dedicated to transformers and switchgear for the US grid, backed by early customer commitments and a fresh design partnership with Koncar.

See our latest analysis for Sanmina.

The move lands on top of already strong momentum, with Sanmina’s share price delivering a roughly 30 percent 90 day return and a near doubling year to date, while longer term total shareholder returns remain even more impressive. This suggests investors are warming to its growth story rather than pricing in peak optimism.

If this grid expansion has you thinking about where else growth and capital allocation might line up, it is a good moment to explore fast growing stocks with high insider ownership.

Yet even with rapid earnings growth, a surging share price and bullish new grid investments, Sanmina still trades below analyst targets. This raises the question: is this a genuine buying opportunity, or is future growth already fully priced in?

Most Popular Narrative Narrative: 19.5% Undervalued

With Sanmina last closing at $152.89 against a narrative fair value of $190, the current setup leans toward meaningful upside if projections land as expected.

The imminent acquisition of ZT Systems is expected to add $5-6 billion of annual run rate revenue, positioning Sanmina to double its net revenue within three years and capitalize on explosive growth in data center and AI infrastructure investment, this should provide a multi year boost to overall revenue and EPS accretion from synergies and integration.

Curious how ambitious revenue expansion, fatter margins, and a reset earnings multiple all mesh together to justify that higher value, the full narrative lays out the playbook in detail.

Result: Fair Value of $190 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant integration risk around the ZT Systems deal and heavy customer concentration could quickly challenge the upbeat growth and valuation narrative.

Find out about the key risks to this Sanmina narrative.

Another View on Value

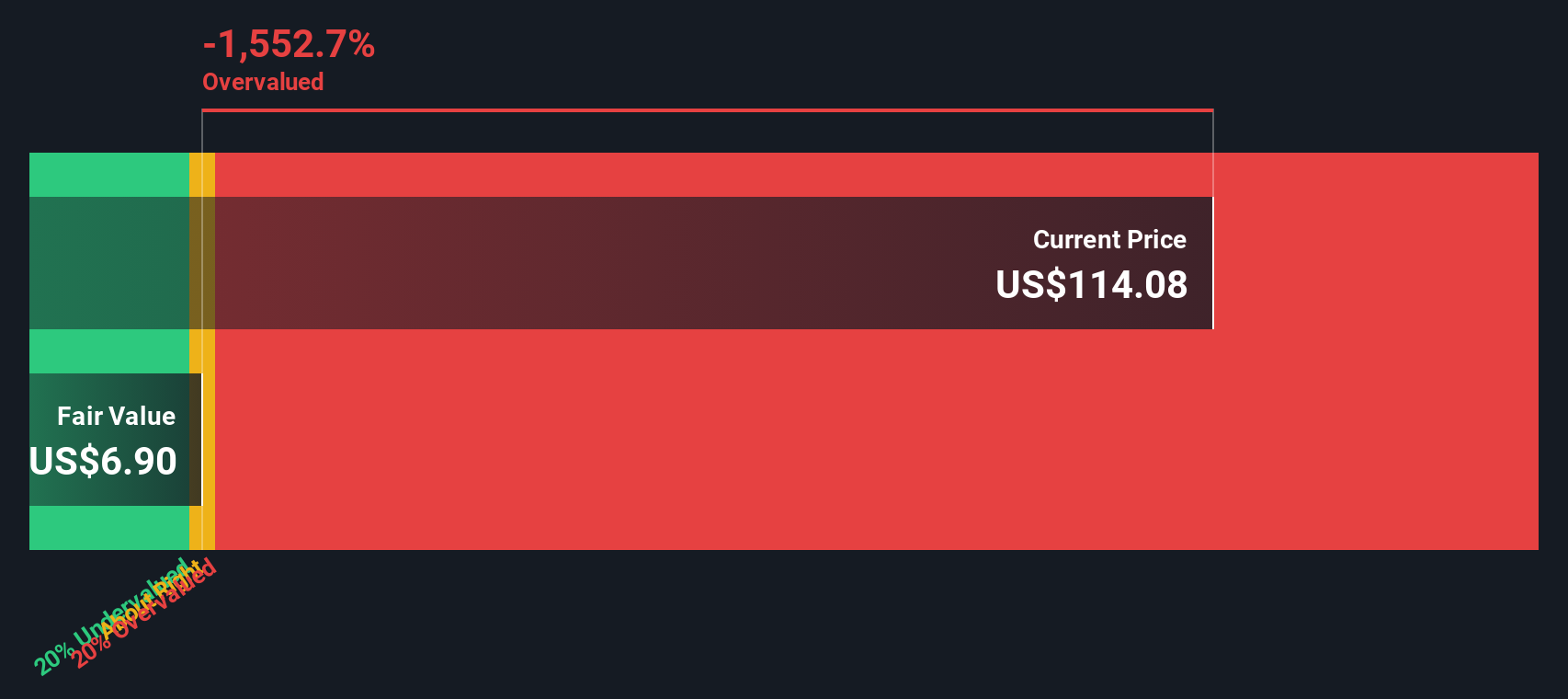

While the narrative fair value pins Sanmina at $190, our DCF model comes out closer to $98.55, implying the stock looks overvalued at current levels. That gap reflects very different assumptions about growth durability and risk, leaving investors to decide which story feels more realistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sanmina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sanmina Narrative

If you would rather lean on your own homework and judgment than any single storyline, you can craft a personalized view in under three minutes: Do it your way.

A great starting point for your Sanmina research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall St screener to explore a broader set of stocks while potential upside may still be underappreciated.

- Explore potential turnaround stories by targeting out of favor companies with strong cash flow support using these 898 undervalued stocks based on cash flows before sentiment fully shifts.

- Look for businesses involved in automation and software by scanning for innovative companies at the forefront of intelligent systems through these 24 AI penny stocks.

- Focus on income-oriented opportunities by considering companies with established payout profiles and resilient balance sheets via these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报