Morningstar (MORN) Extends AI Reach With ChatGPT Apps: A Fresh Look at the Stock’s Valuation

Morningstar (MORN) just took another step into AI, rolling out new Morningstar and PitchBook apps inside ChatGPT that let licensed users query its research and data through plain language, directly in the interface.

See our latest analysis for Morningstar.

The move into ChatGPT comes during a mixed stretch for Morningstar, with the share price at $216.76 and a year-to-date share price return of negative 34.79 percent. However, a modestly positive three-year total shareholder return suggests the longer term story may be more resilient than recent volatility implies.

If this AI push has you thinking about where else innovation and data driven models might create upside, consider exploring high growth tech and AI stocks as a way to spot other potential winners early.

With shares now trading well below analyst targets but profitability still inching higher, is Morningstar quietly slipping into undervalued territory, or are markets already pricing in the full payoff from its AI driven expansion?

Price-to-Earnings of 23.7x: Is it justified?

Morningstar trades on a price-to-earnings ratio of 23.7x at the last close of $216.76, sitting slightly below many close peers yet still implying a premium to the broader market.

The price-to-earnings multiple compares today’s share price with the company’s earnings per share. It is a straightforward way to gauge how much investors are paying for each dollar of profit in an information-heavy, asset-light business like Morningstar.

Here, the 23.7x P/E looks high against an estimated fair P/E of 14.2x. The SWS fair ratio suggests the market could eventually re-rate the stock lower, even though it currently screens as cheaper than the Capital Markets industry average of roughly 25x and below a peer group average closer to 28x.

Relative to both its industry and peer set, Morningstar’s valuation sits in a middle ground. It is discounted versus similar capital markets names but still well above what the fair ratio indicates could be a more sustainable longer-term earnings multiple if sentiment cools.

Explore the SWS fair ratio for Morningstar

Result: Price-to-Earnings of 23.7x (OVERVALUED)

However, Morningstar still faces risks from slowing revenue growth and potential missteps integrating AI tools across segments. These factors could weigh on margins and sentiment.

Find out about the key risks to this Morningstar narrative.

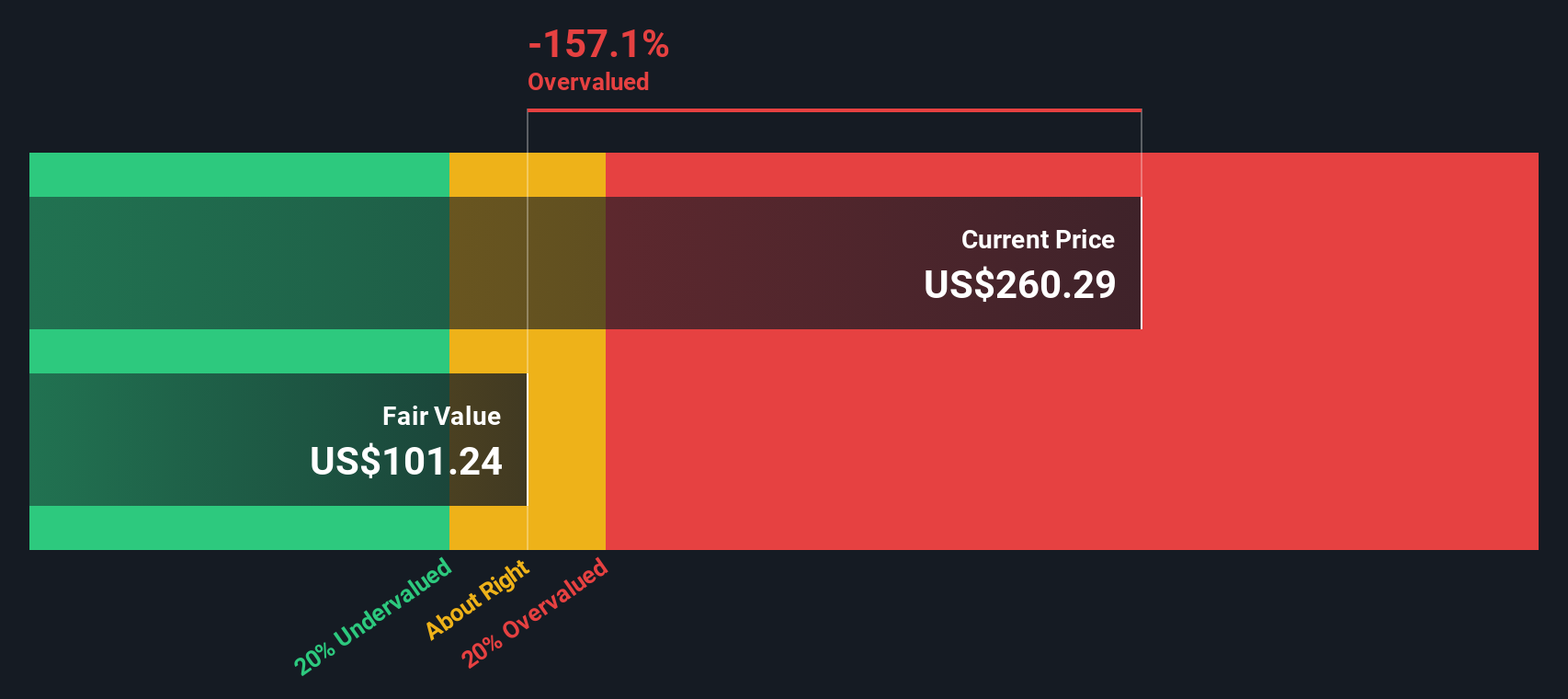

Another View: DCF Flags a Very Different Story

While the earnings multiple hints at a mild premium, our DCF model paints a starker picture. With Morningstar trading at $216.76 against a DCF fair value estimate of $94.52, the stock screens as heavily overvalued. Is the market overpaying for future AI promise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morningstar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morningstar Narrative

If you see the numbers differently or want to stress test your own thesis using the same data, you can build a full view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Morningstar.

Ready for your next investing move?

Before you stop at Morningstar, set yourself up for the next opportunity by scanning fresh ideas others may be overlooking in today’s shifting market.

- Explore potentially mispriced opportunities by screening for companies that appear inexpensive relative to estimated future cash flows using these 898 undervalued stocks based on cash flows.

- Focus on powerful technological shifts by identifying innovators involved in automation and intelligence with these 24 AI penny stocks.

- Evaluate ways to strengthen your income stream by screening for companies with a history of paying dividends and offering attractive yields using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报