Improved Earnings Required Before Rolex Rings Limited (NSE:ROLEXRINGS) Stock's 26% Jump Looks Justified

Those holding Rolex Rings Limited (NSE:ROLEXRINGS) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

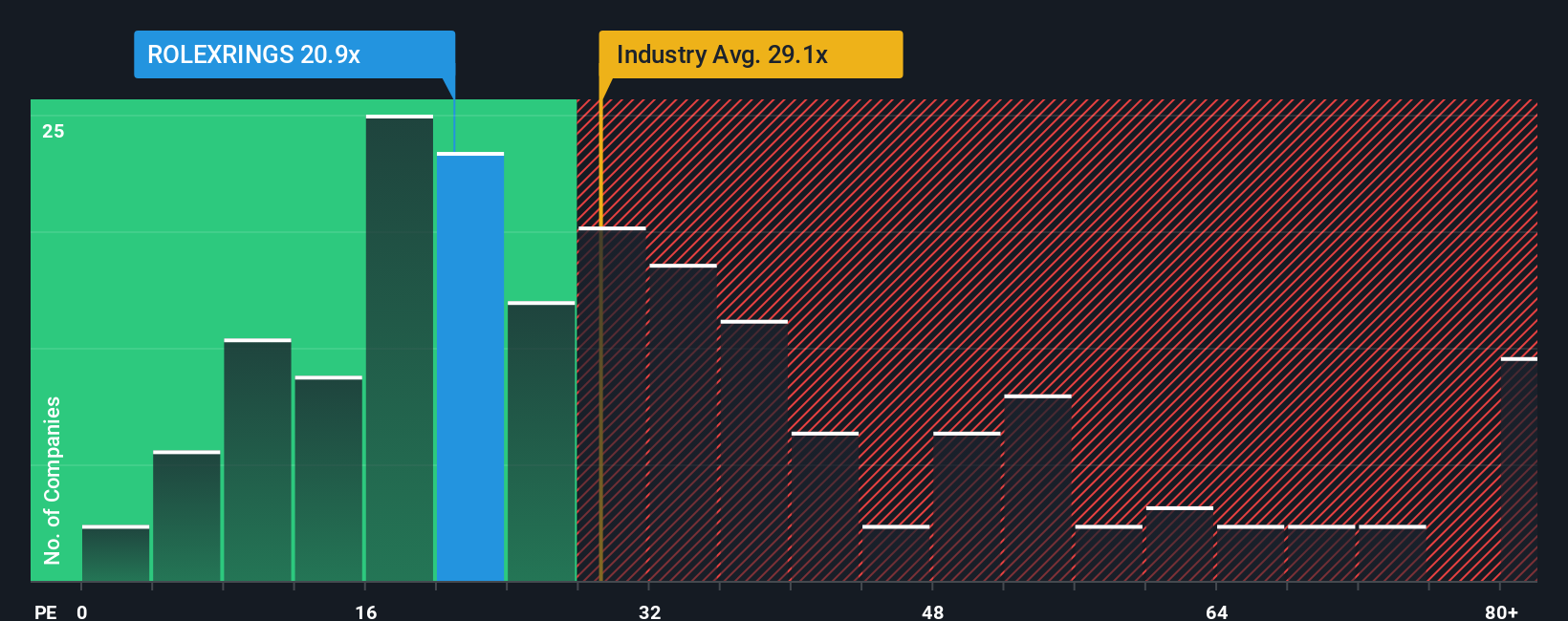

Even after such a large jump in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 26x, you may still consider Rolex Rings as an attractive investment with its 20.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Rolex Rings as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Rolex Rings

Does Growth Match The Low P/E?

Rolex Rings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 6.8% gain to the company's bottom line. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 8.5% per annum as estimated by the three analysts watching the company. With the market predicted to deliver 20% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Rolex Rings is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Rolex Rings' P/E

Rolex Rings' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Rolex Rings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Rolex Rings with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报