Assessing Costco (COST) Valuation After a 10% Pullback in Shareholder Returns

Costco Wholesale (COST) has quietly pulled back, with the stock down about 10% over the past year even as its long term track record and steady revenue and income growth remain intact.

See our latest analysis for Costco Wholesale.

With the share price now around $849.81 and a roughly 10% 1 year total shareholder return decline, momentum has clearly cooled in the short term. However, that pulls back a stock that has still delivered exceptional multi year total shareholder returns.

If Costco’s recent wobble has you rethinking where to find durable compounders, it could be a good time to explore fast growing stocks with high insider ownership.

So with Costco’s fundamentals still compounding while the share price has stalled, is the recent pullback handing investors a rare entry point into a quality compounder, or is the market already baking in years of future growth?

Most Popular Narrative: 19.5% Undervalued

With Costco closing at $849.81 against a most popular narrative fair value near $1,056, the story leans toward upside but hinges on specific growth drivers.

The analysts have a consensus price target of $1072.667 for Costco Wholesale based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1225.0, and the most bearish reporting a price target of just $620.0.

Want to see what kind of earnings trajectory and margin lift are embedded here, and why the projected future multiple looks more like a market darling than a discounter? Dive in to unpack the full blueprint behind this valuation call.

Result: Fair Value of $1055.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures from higher wages and tariffs, combined with FX headwinds, could easily cap margins and challenge today’s premium valuation.

Find out about the key risks to this Costco Wholesale narrative.

Another Lens on Valuation

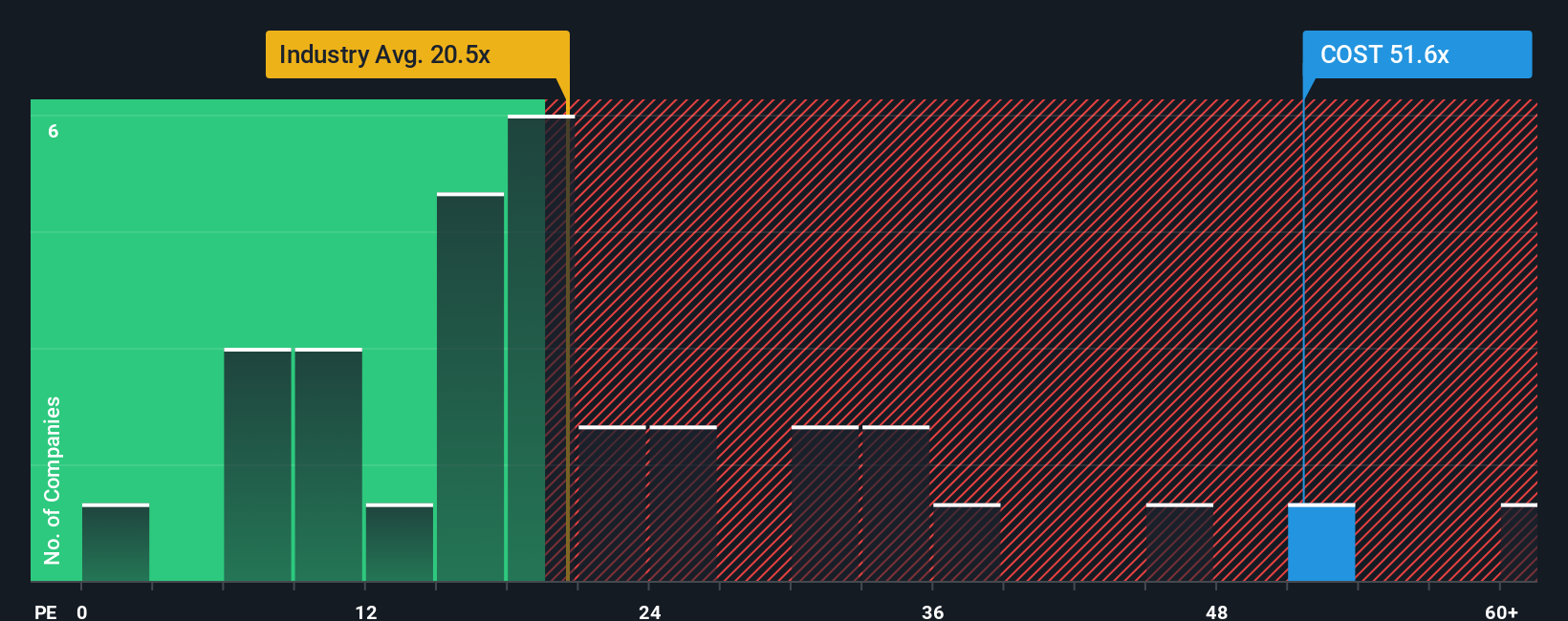

While the narrative fair value suggests Costco is around 19.5% undervalued, its current price tag tells a different story. Shares trade on a rich 45.4x earnings versus 21.5x for the US Consumer Retailing industry, 24x for peers, and a 34.4x fair ratio our work points to.

That gap implies investors are paying meaningfully more for Costco’s growth and resilience than the market usually rewards. This raises a simple question: how long can this premium stay this wide if growth cools even a little?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If your view differs or you would rather dig into the numbers yourself, you can build a custom Costco story in minutes: Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before Costco’s story fully plays out, consider your next moves by scanning fresh opportunities across sectors that could balance or even outperform your current holdings.

- Capture potential value rebounds by targeting these 899 undervalued stocks based on cash flows that the market may be mispricing today but could re rate sharply as fundamentals shine through.

- Ride powerful innovation trends by focusing on these 24 AI penny stocks that are reshaping entire industries with automation, machine learning, and data driven products.

- Strengthen your income stream by reviewing these 11 dividend stocks with yields > 3% that combine reliable payouts with the potential for long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报