Discover Asian Market Opportunities With These 3 Stocks Estimated Below Fair Value

As the Asian markets navigate a complex economic landscape marked by Japan's significant interest rate hike and China's mixed growth indicators, investors are increasingly looking for opportunities in stocks that may be trading below their intrinsic value. Identifying undervalued stocks often involves assessing factors such as strong fundamentals and resilience to broader market volatility, which can offer potential advantages in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.56 | CN¥303.10 | 49% |

| Meitu (SEHK:1357) | HK$7.36 | HK$14.66 | 49.8% |

| Kuraray (TSE:3405) | ¥1590.00 | ¥3166.29 | 49.8% |

| KIYO LearningLtd (TSE:7353) | ¥692.00 | ¥1378.17 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5540.00 | ¥10934.79 | 49.3% |

| Global Security Experts (TSE:4417) | ¥2871.00 | ¥5706.25 | 49.7% |

| FIT Hon Teng (SEHK:6088) | HK$5.70 | HK$11.24 | 49.3% |

| Daiichi Sankyo Company (TSE:4568) | ¥3285.00 | ¥6544.37 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.88 | HK$55.51 | 49.8% |

| Andes Technology (TWSE:6533) | NT$244.50 | NT$483.93 | 49.5% |

We'll examine a selection from our screener results.

Wanguo Gold Group (SEHK:3939)

Overview: Wanguo Gold Group Limited is an investment holding company involved in mining, ore processing, and the sale of concentrate products in the People’s Republic of China and Solomon Islands, with a market cap of HK$35.40 billion.

Operations: The company's revenue is primarily derived from its operations in the Yifeng Project, generating CN¥597.84 million, and the Solomon Project, contributing CN¥1.59 billion.

Estimated Discount To Fair Value: 36.2%

Wanguo Gold Group is trading at HK$8, significantly below its estimated fair value of HK$12.54, suggesting it may be undervalued based on cash flows. The company's earnings grew by 108.3% last year and are expected to grow at 35.68% annually over the next three years, outpacing the Hong Kong market's growth rate. Recent feasibility studies for the Gold Ridge Mine in Solomon Islands could bolster future revenues and enhance cash flow stability.

- Upon reviewing our latest growth report, Wanguo Gold Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Wanguo Gold Group.

ANYCOLOR (TSE:5032)

Overview: ANYCOLOR Inc. is an entertainment company with operations in Japan and internationally, and it has a market cap of approximately ¥291.82 billion.

Operations: ANYCOLOR Inc. generates its revenue through various segments, including content production and distribution, live events, merchandise sales, and digital platform services.

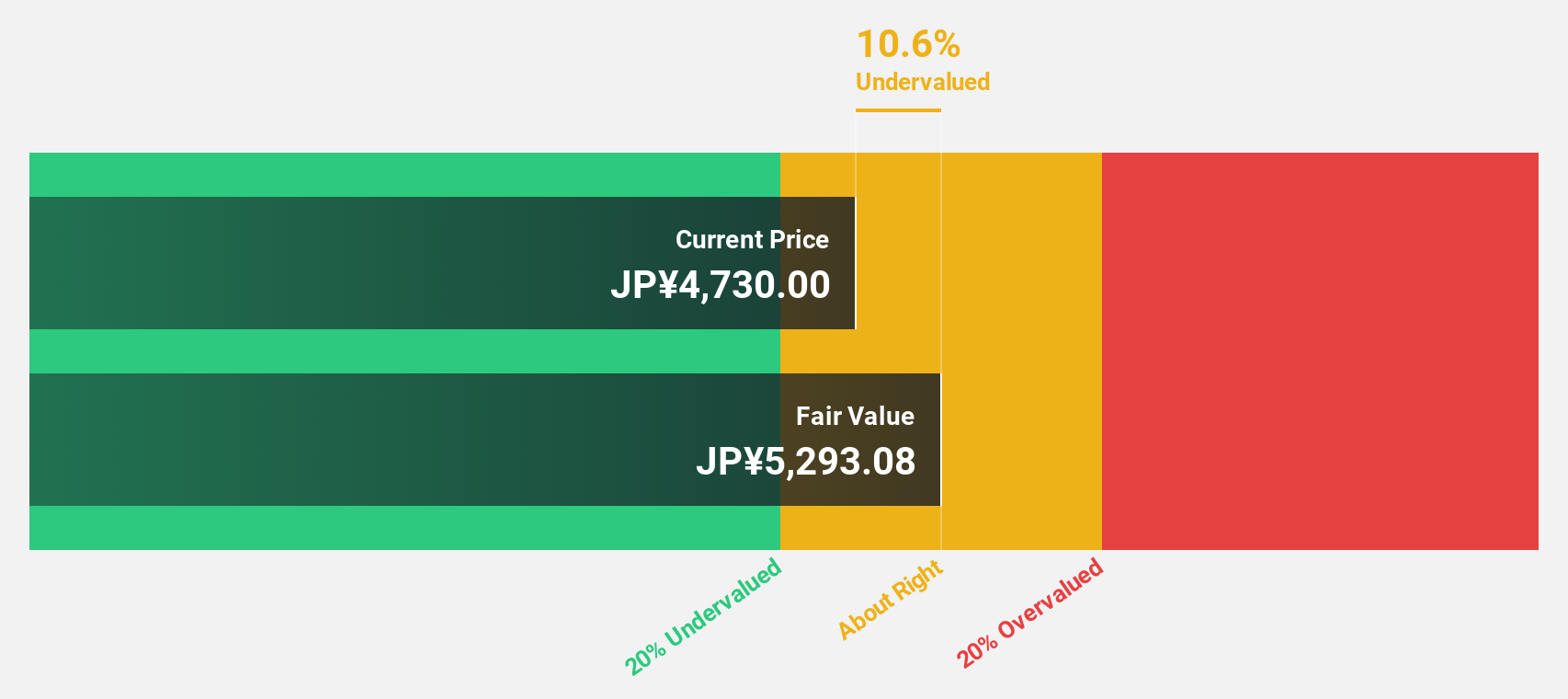

Estimated Discount To Fair Value: 29.9%

ANYCOLOR is trading at ¥4775, below its estimated fair value of ¥6808.72, highlighting potential undervaluation based on cash flows. While earnings grew 63.3% last year and are projected to grow 13.32% annually, surpassing the JP market's rate, revenue growth forecasts remain moderate at 12.4%. Analysts anticipate a 42% stock price increase despite recent share price volatility. A recent board meeting aimed to revise financial forecasts for fiscal year-end April 2026 could influence future valuations.

- The growth report we've compiled suggests that ANYCOLOR's future prospects could be on the up.

- Click here to discover the nuances of ANYCOLOR with our detailed financial health report.

GMO internet group (TSE:9449)

Overview: GMO Internet Group, Inc. offers a range of internet services globally and has a market cap of ¥400.71 billion.

Operations: The company's revenue is primarily generated from its Internet Infrastructure segment at ¥178.04 billion, followed by the Internet Finance Business at ¥39.85 billion, the Internet Advertising and Media Business at ¥34.89 billion, the Crypto Asset Business at ¥9.71 billion, and the Incubation Business at ¥1.43 billion.

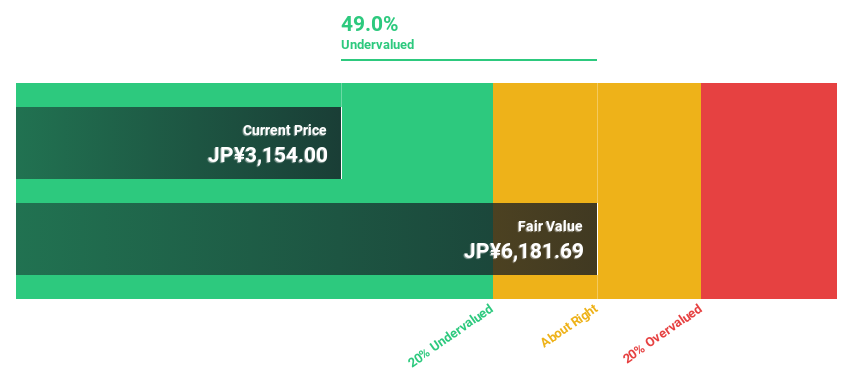

Estimated Discount To Fair Value: 36.7%

GMO internet group is trading at ¥3964, significantly below its estimated fair value of ¥6261.7, suggesting potential undervaluation based on cash flows. Earnings are projected to grow 16.47% annually, outpacing the JP market's 8.5%, while revenue growth is anticipated at 8.4%. A recent share buyback program aims to enhance capital efficiency and corporate value by repurchasing up to ¥10 billion worth of shares, aligning with their shareholder return policy and strategic objectives.

- The analysis detailed in our GMO internet group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of GMO internet group stock in this financial health report.

Next Steps

- Click through to start exploring the rest of the 268 Undervalued Asian Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报