Investors Appear Satisfied With Sumitomo Metal Mining Co., Ltd.'s (TSE:5713) Prospects As Shares Rocket 29%

Despite an already strong run, Sumitomo Metal Mining Co., Ltd. (TSE:5713) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 75% in the last year.

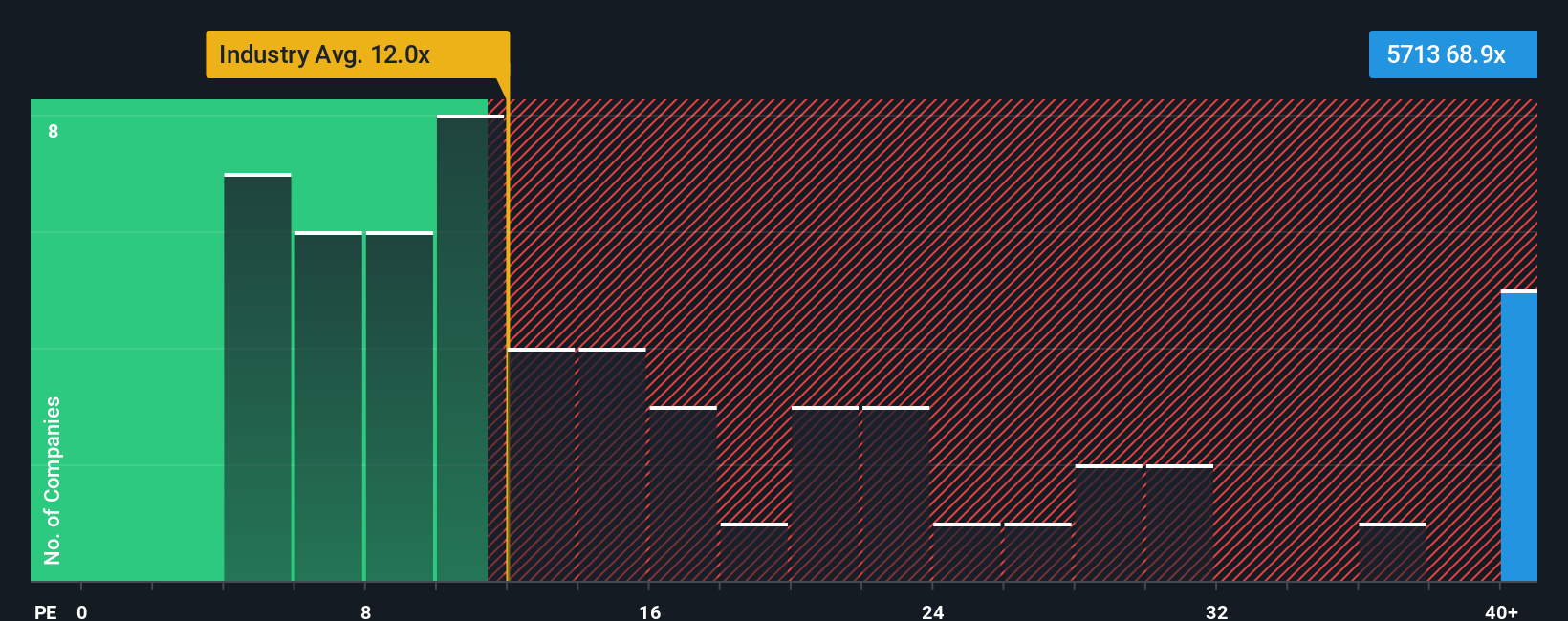

After such a large jump in price, Sumitomo Metal Mining's price-to-earnings (or "P/E") ratio of 68.9x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 10x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Sumitomo Metal Mining could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Sumitomo Metal Mining

How Is Sumitomo Metal Mining's Growth Trending?

Sumitomo Metal Mining's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 64%. This means it has also seen a slide in earnings over the longer-term as EPS is down 92% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 66% per year as estimated by the eight analysts watching the company. With the market only predicted to deliver 9.0% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Sumitomo Metal Mining is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Sumitomo Metal Mining's P/E

Sumitomo Metal Mining's P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sumitomo Metal Mining maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sumitomo Metal Mining (at least 1 which is concerning), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Sumitomo Metal Mining. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报