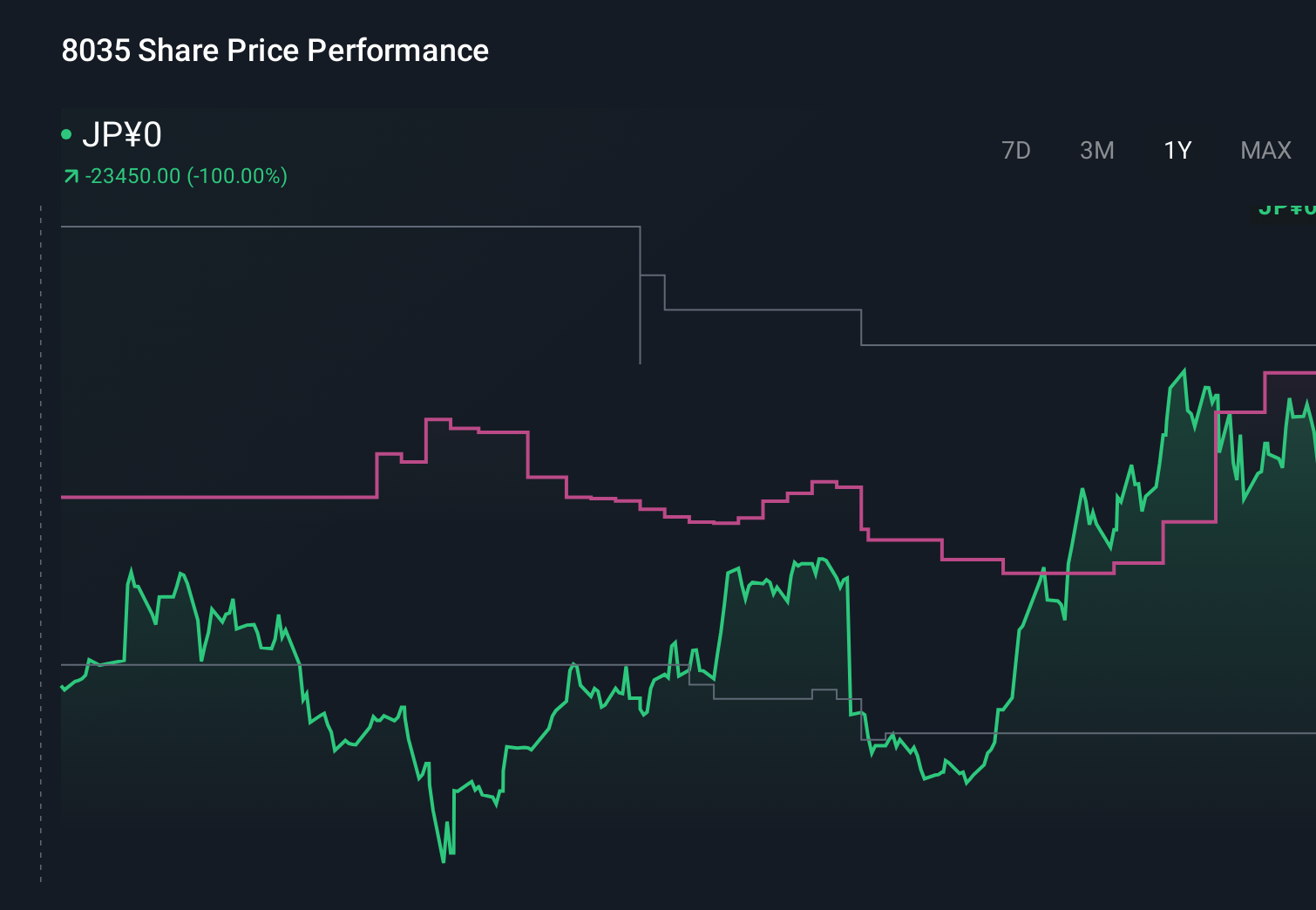

Why Tokyo Electron (TSE:8035) Is Up 6.5% After AI-Fueled Equipment Demand Triggers Morgan Stanley Upgrade – And What's Next

- Morgan Stanley recently upgraded Tokyo Electron to Overweight, pointing to a clear recovery in front-end semiconductor equipment demand tied to AI-related investment and increased orders from Taiwan foundries, alongside supply shortages in DRAM.

- This shift suggests that AI-driven semiconductor spending is beginning to translate into concrete equipment demand, potentially reinforcing Tokyo Electron’s role in advanced chip production capacity build-outs.

- We’ll now examine how this AI-linked rebound in front-end equipment demand may influence Tokyo Electron’s existing investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Tokyo Electron Investment Narrative Recap

To own Tokyo Electron, you need to believe that long term demand for advanced semiconductor equipment will support sustained orders across logic, memory and AI focused capacity. Morgan Stanley’s upgrade suggests the short term catalyst of an AI led recovery in front end tools is gaining traction, though the biggest risk remains a pause or pullback in customer capital spending that could quickly cool this upswing. If AI orders stall or export controls tighten, equipment demand could still prove uneven.

Against this backdrop, Tokyo Electron’s October 31 guidance raise for FY ending March 31, 2026, with net sales now projected at ¥2,380,000 million and operating income at ¥586,000 million, is one of the more relevant recent updates. It aligns with signs of improving conditions in wafer fab equipment, but expectations still sit within an industry known for sharp cycles, where customer spending priorities can change faster than order books or forecasts.

Yet behind this AI driven optimism, investors should also be aware of how heavily Tokyo Electron still depends on customer capex discipline and...

Read the full narrative on Tokyo Electron (it's free!)

Tokyo Electron's narrative projects ¥2,966.7 billion revenue and ¥666.1 billion earnings by 2028.

Uncover how Tokyo Electron's forecasts yield a ¥34725 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community value Tokyo Electron between ¥17,321 and ¥35,063, reflecting wide variation in growth and risk assumptions. As you weigh these views, consider how fragile front end equipment demand can be if customers shift from expansion to yield and efficiency focused spending.

Explore 6 other fair value estimates on Tokyo Electron - why the stock might be worth as much as 6% more than the current price!

Build Your Own Tokyo Electron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tokyo Electron research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tokyo Electron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tokyo Electron's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报