Surf Air Mobility (SRFM): Revisiting Valuation After Q3 Beat, Upgraded Outlook and New Palantir Partnership

Surf Air Mobility (SRFM) is back on traders radar after Q3 results topped its own revenue guidance, and management raised the full year outlook while also unveiling a Palantir partnership that includes a sector specific exclusivity agreement.

See our latest analysis for Surf Air Mobility.

Even with the Palantir deal and stronger Q3 narrative giving the story fresh energy, Surf Air Mobility’s share price at $1.83 still reflects a bruising year. A sharp 90 day share price return of minus 58.97 percent and a 1 year total shareholder return of minus 46.33 percent suggest sentiment is cautious, but potentially primed for positive surprises if execution continues to improve.

If this kind of higher risk turnaround story interests you, it is worth widening the lens and exploring fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With shares still languishing after heavy losses but analysts’ targets implying big upside, is Surf Air Mobility now trading below its true potential, or is the market already factoring in every ounce of future growth?

Most Popular Narrative: 76.8% Undervalued

With Surf Air Mobility last closing at $1.83 against a narrative fair value near $7.88, the gap in expected upside is striking and demands context.

The accelerating demand for regional, point to point air mobility as urban congestion worsens is expected to increase the addressable market for Surf Air Mobility, especially as it expands scheduled service on new routes and accepts new aircraft deliveries in 2026, supporting future revenue growth. Widespread digitization and adoption of app driven travel is enabling Surf Air Mobility's software first approach including the commercial rollout of the SurfOS platform powered by Palantir in 2026 bringing new high margin recurring revenue streams and improved customer acquisition efficiency, supporting both revenue and net margin expansion.

Curious how ambitious revenue expansion, shifting margins, and a punchy future earnings multiple are stitched together to back that price gap? The underlying projections might surprise you.

Result: Fair Value of $7.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup could unravel if government contract exposure shrinks or SurfOS commercialization slips further, delaying the path to sustainable profitability.

Find out about the key risks to this Surf Air Mobility narrative.

Another View: Multiples Paint a Tougher Picture

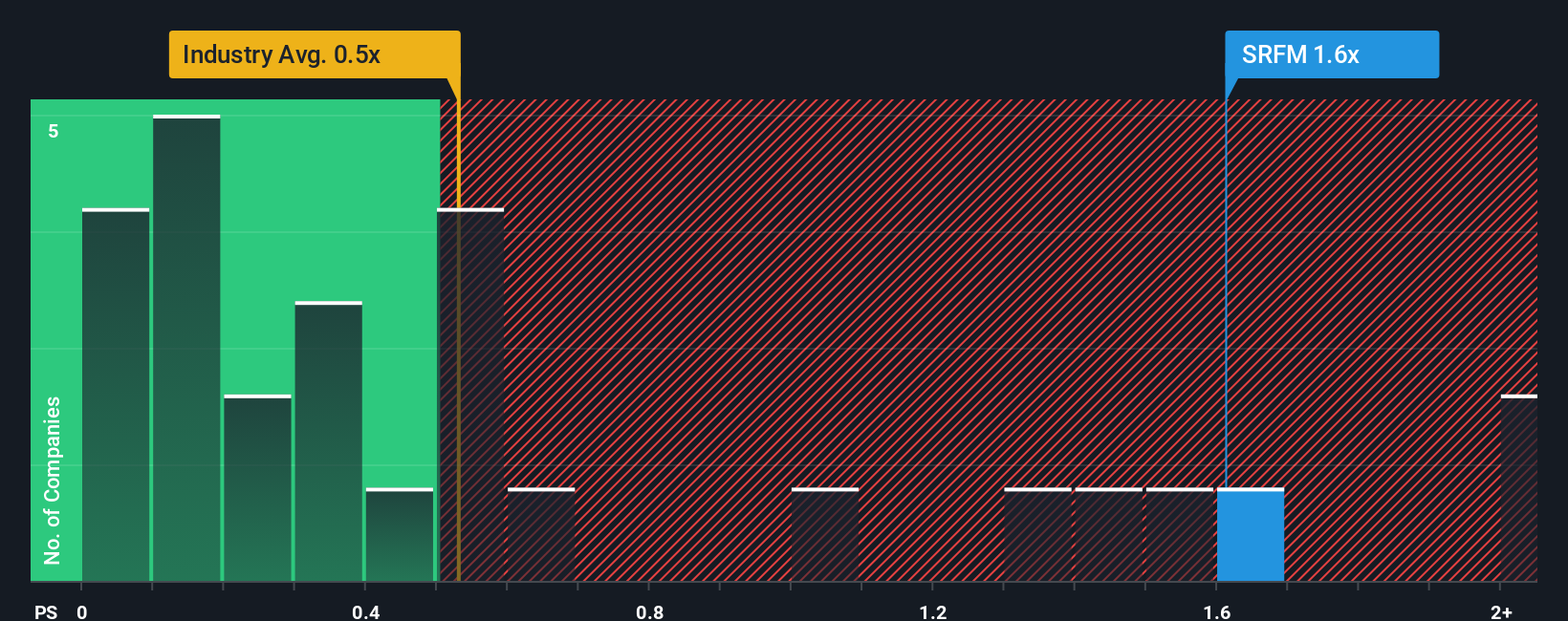

While the narrative fair value leans heavily bullish, Surf Air Mobility’s current price to sales ratio of 1.1 times looks steep versus the North American airlines industry at 0.6 times and a fair ratio closer to 0.4 times, hinting at valuation risk if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Surf Air Mobility Narrative

If you are not aligned with this perspective or simply prefer digging into the numbers yourself, you can craft a tailored view in minutes: Do it your way.

A great starting point for your Surf Air Mobility research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Surf Air Mobility might be on your radar, but you will leave serious opportunities on the table if you ignore other powerful ideas from our screeners.

- Capture potential upside in overlooked value opportunities by targeting these 899 undervalued stocks based on cash flows that trade below what their cash flows may justify.

- Ride structural growth trends in medicine and data by focusing on these 29 healthcare AI stocks that are reshaping diagnostics, treatment, and hospital efficiency.

- Boost your income strategy by prioritizing these 12 dividend stocks with yields > 3% that offer attractive yields with room for sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报