3 ASX Stocks Estimated To Be Trading Up To 47.4% Below Intrinsic Value

The Australian sharemarket has kicked off the last trading week of CY25 on a positive note, buoyed by gains in commodities and a festive spirit, with materials and energy sectors leading the charge. In this environment of strong sectoral performances, identifying undervalued stocks can be particularly rewarding as they offer potential opportunities for growth when market conditions are favorable.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$1.29 | A$2.26 | 43% |

| Resolute Mining (ASX:RSG) | A$1.28 | A$2.43 | 47.4% |

| NRW Holdings (ASX:NWH) | A$5.12 | A$8.98 | 43% |

| Lynas Rare Earths (ASX:LYC) | A$12.48 | A$23.46 | 46.8% |

| LGI (ASX:LGI) | A$3.94 | A$7.66 | 48.6% |

| Guzman y Gomez (ASX:GYG) | A$22.32 | A$38.45 | 42% |

| Cromwell Property Group (ASX:CMW) | A$0.49 | A$0.87 | 43.7% |

| Betmakers Technology Group (ASX:BET) | A$0.185 | A$0.34 | 45.1% |

| Atturra (ASX:ATA) | A$0.65 | A$1.15 | 43.3% |

| Alkane Resources (ASX:ALK) | A$1.26 | A$2.39 | 47.2% |

We'll examine a selection from our screener results.

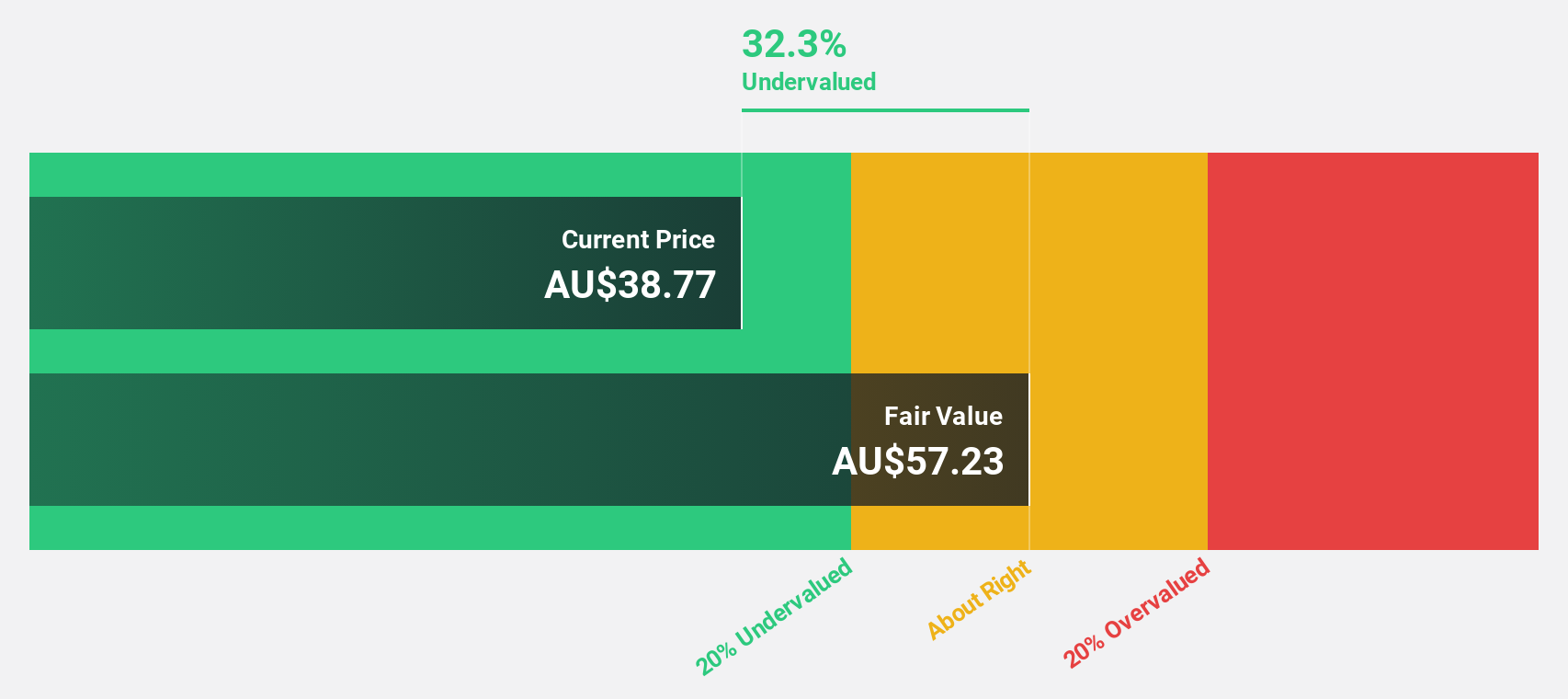

James Hardie Industries (ASX:JHX)

Overview: James Hardie Industries plc manufactures and sells fiber cement, fiber gypsum, and cement bonded boards across the United States, Australia, Europe, and New Zealand with a market cap of A$17.69 billion.

Operations: The company's revenue segments include $524.40 million from Europe and $490.70 million from Australia & New Zealand.

Estimated Discount To Fair Value: 18%

James Hardie Industries shows potential as an undervalued stock based on cash flows, trading at 18% below its fair value estimate of A$37.19. However, its debt coverage by operating cash flow is a concern. Recent executive changes and the company's drop from major indices may impact investor confidence. Despite these challenges, earnings are forecast to grow significantly at 35.93% annually over the next three years, outpacing the broader Australian market growth rate of 12.1%.

- In light of our recent growth report, it seems possible that James Hardie Industries' financial performance will exceed current levels.

- Dive into the specifics of James Hardie Industries here with our thorough financial health report.

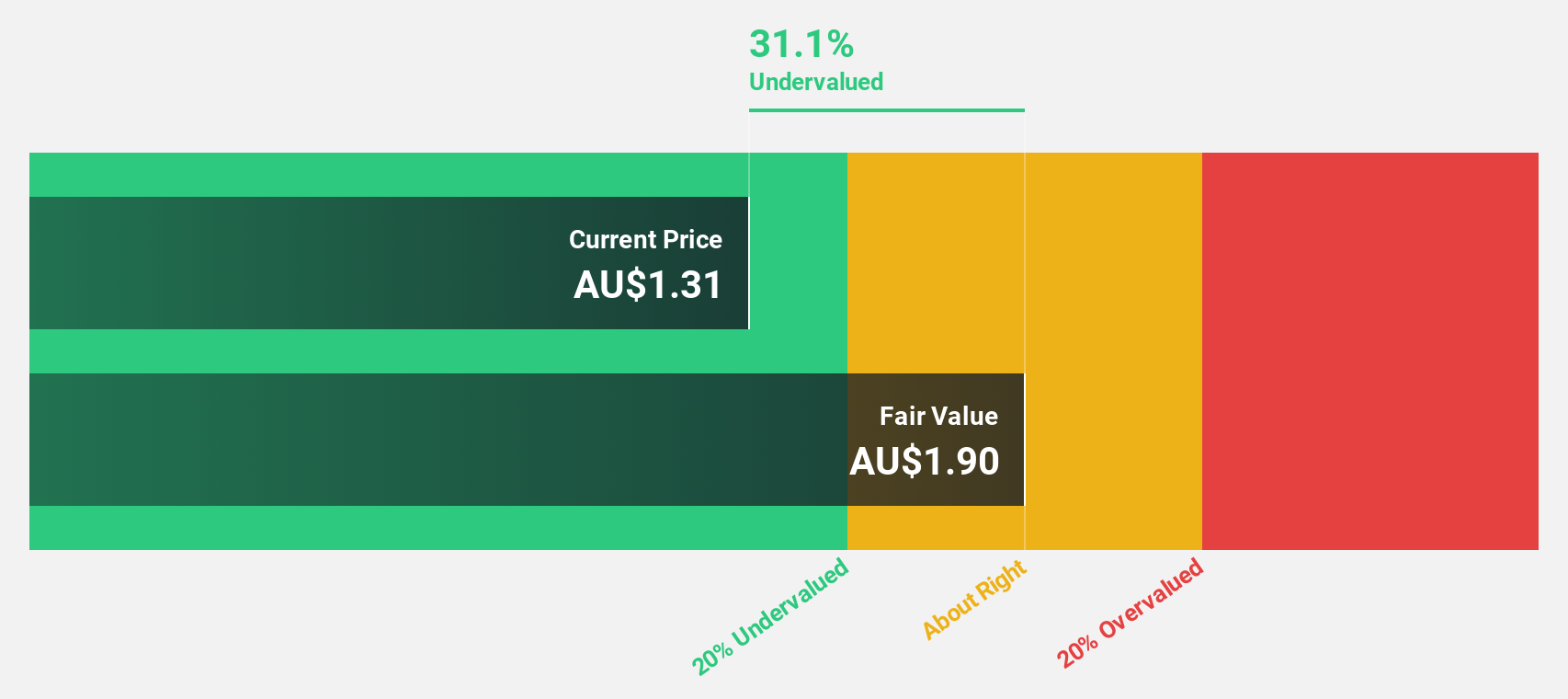

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several regions including Australia, New Zealand, the United States, and others, with a market cap of A$867.01 million.

Operations: The company's revenue primarily comes from the development, manufacturing, and commercialization of NovoSorb Technology, amounting to A$128.70 million.

Estimated Discount To Fair Value: 21.6%

PolyNovo is trading 21.6% below its fair value estimate of A$1.6, highlighting its potential as an undervalued stock based on cash flows. The company's earnings are projected to grow significantly at 27.37% annually over the next three years, surpassing the Australian market's growth rate of 12.1%. Recent board appointments may bolster governance and strategic direction, but investors should consider the high level of non-cash earnings in their assessments.

- The growth report we've compiled suggests that PolyNovo's future prospects could be on the up.

- Navigate through the intricacies of PolyNovo with our comprehensive financial health report here.

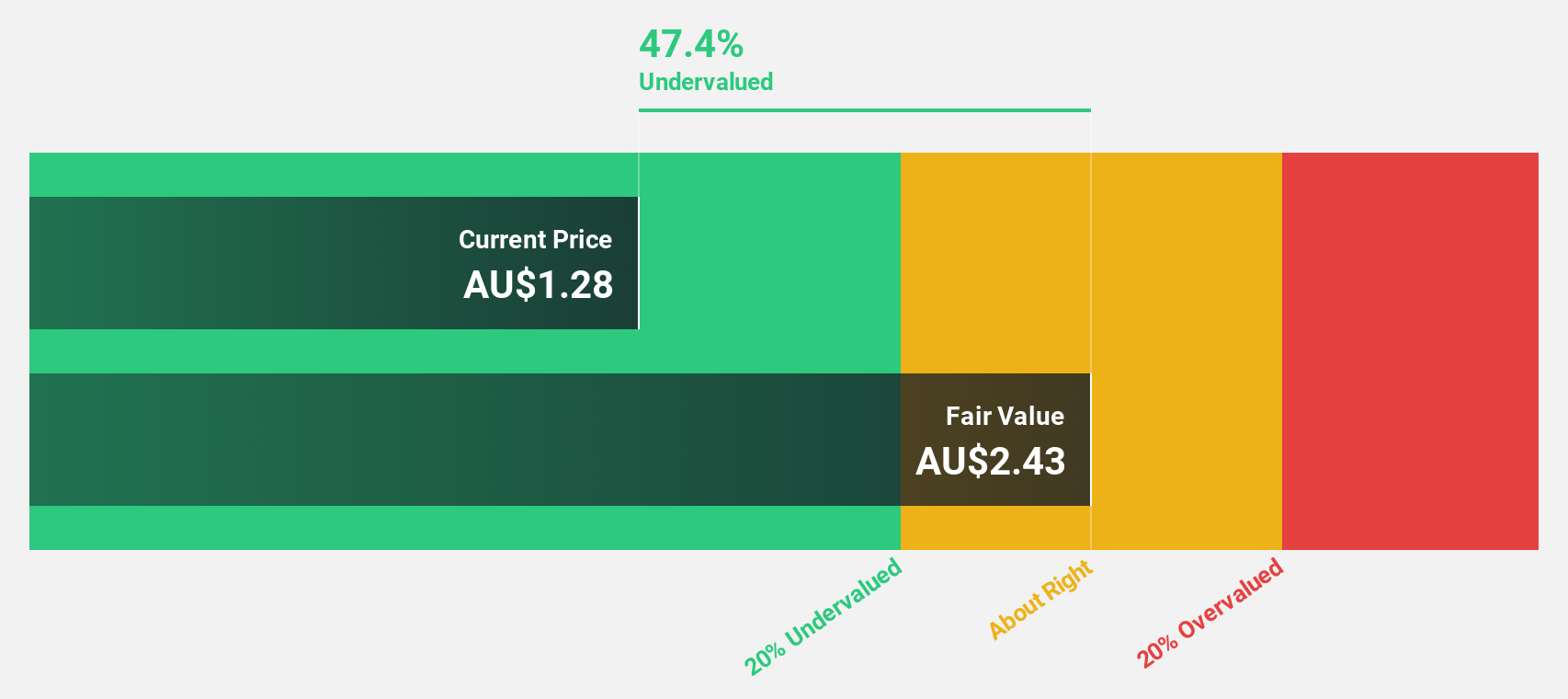

Resolute Mining (ASX:RSG)

Overview: Resolute Mining Limited is involved in the mining, prospecting, and exploration of mineral properties in Africa with a market capitalization of A$2.73 billion.

Operations: The company's revenue is primarily derived from its operations in Africa, with Syama in Mali contributing $557.22 million and Mako in Senegal generating $349.76 million.

Estimated Discount To Fair Value: 47.4%

Resolute Mining is trading at A$1.28, significantly below its fair value estimate of A$2.43, indicating potential undervaluation based on cash flows. Earnings are forecast to grow substantially at 50.67% annually over the next three years, outpacing the Australian market's growth rate of 12.1%. Recent inclusion in the S&P/ASX 200 Index and updates to projects like Doropo highlight strategic advancements, though increased capital costs and lower profit margins warrant careful consideration by investors.

- Insights from our recent growth report point to a promising forecast for Resolute Mining's business outlook.

- Click to explore a detailed breakdown of our findings in Resolute Mining's balance sheet health report.

Where To Now?

- Dive into all 37 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报