Kinder Morgan (KMI): Valuation Check After New 2025–2026 Profit Outlook and Higher 2026 Dividend Guidance

Kinder Morgan (KMI) just tightened the picture for income investors, issuing fresh 2025 and 2026 profit guidance alongside plans for a higher 2026 dividend that extends its long running payout growth streak.

See our latest analysis for Kinder Morgan.

At a recent share price of $26.49, Kinder Morgan’s year to date share price return of minus 5.76 percent contrasts with its 5 year total shareholder return of 159.74 percent. This suggests that longer term income focused momentum remains firmly intact despite short term noise around the new guidance and dividend outlook.

If Kinder Morgan’s updated profit and dividend plans have you rethinking your income strategy, this is also a good moment to discover fast growing stocks with high insider ownership.

With analysts still seeing upside to Kinder Morgan’s share price and fresh guidance pointing to higher profits and payouts, is the current weakness an opportunity to buy into mispricing, or is the market already discounting that growth?

Most Popular Narrative Narrative: 14.7% Undervalued

With the most popular narrative pointing to a fair value near $31.06 versus Kinder Morgan’s $26.49 last close, the story leans toward upside from here.

The surging U.S. LNG export market, with U.S. gas feed to export terminals projected to double by 2030 and Kinder Morgan already transporting about 40% of this feed gas, is likely to significantly increase future earnings, especially as additional U.S. capacity comes online and new contracts are signed.

Curious how steady revenue growth, rising margins and a richer future earnings multiple all work together in this outlook? The narrative’s projections hide some bold assumptions about where profits, cash flows and valuation could land a few years from now, and how that compares to today’s more cautious market pricing.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high leverage and the risk of overbuilt pipelines or weaker recontracting terms could quickly challenge today’s upside narrative and valuation assumptions.

Find out about the key risks to this Kinder Morgan narrative.

Another Take on Valuation

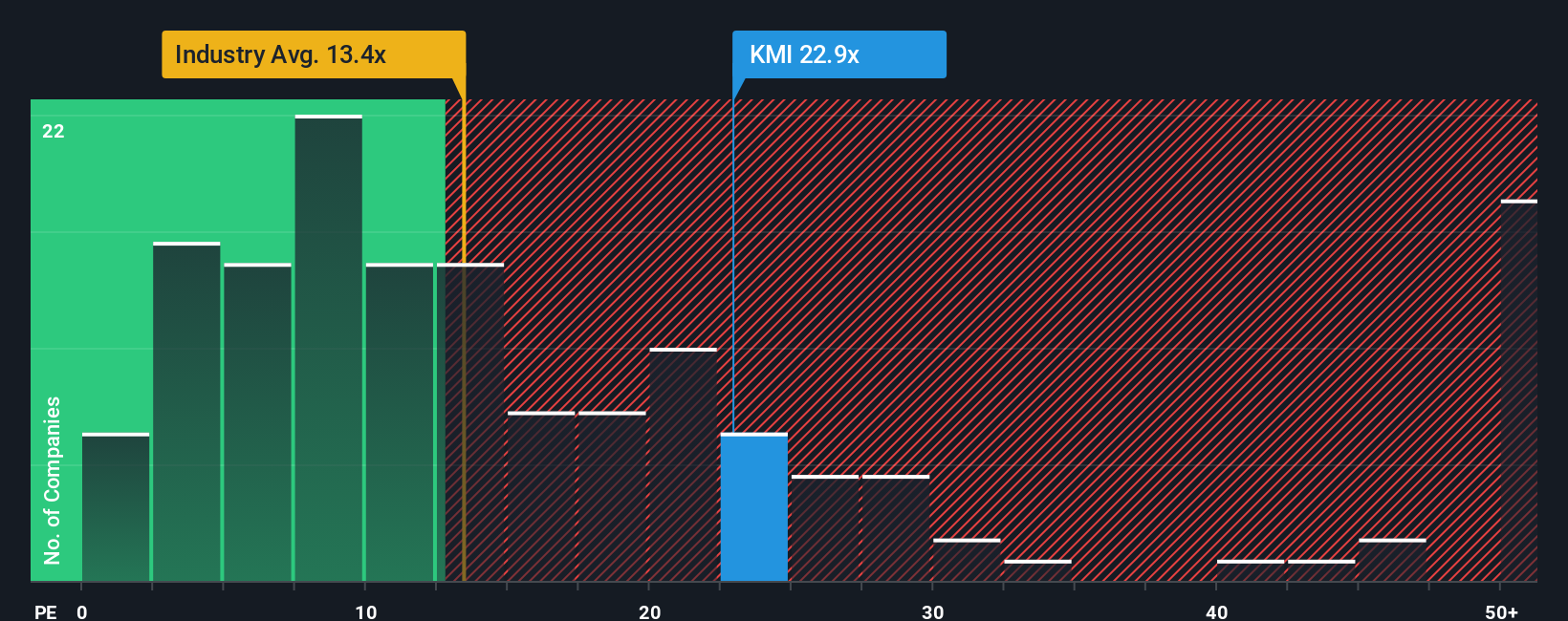

While the narrative points to upside, Kinder Morgan’s 21.7x earnings multiple already sits above both its peer average of 16.6x and the US Oil and Gas industry at 12.8x. It is also slightly above its 21.1x fair ratio. That premium suggests less margin for error if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If you would rather stress test these assumptions yourself, you can dig into the numbers and build a fully customised view in just a few minutes: Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunities using the Simply Wall St Screener so you are not relying on just one income story.

- Identify potential multi baggers early by scanning these 3632 penny stocks with strong financials that already show financial strength instead of just speculative hype.

- Position yourself at the front of the next tech trend by targeting these 24 AI penny stocks involved in automation, analytics and intelligent infrastructure.

- Find possible value opportunities with these 903 undervalued stocks based on cash flows that trade below what their cash flows indicate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报