Discover 3 Elite Growth Stocks With Significant Insider Ownership

As the U.S. stock market begins a holiday-shortened week with gains across major indexes, driven by advancements in tech shares and record highs in gold and silver, investors are keenly observing the shifts and opportunities within this vibrant economic landscape. In such an environment, growth companies with significant insider ownership can offer unique insights into potential long-term value creation, as insiders often have strong confidence in their firm's prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.7% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Let's uncover some gems from our specialized screener.

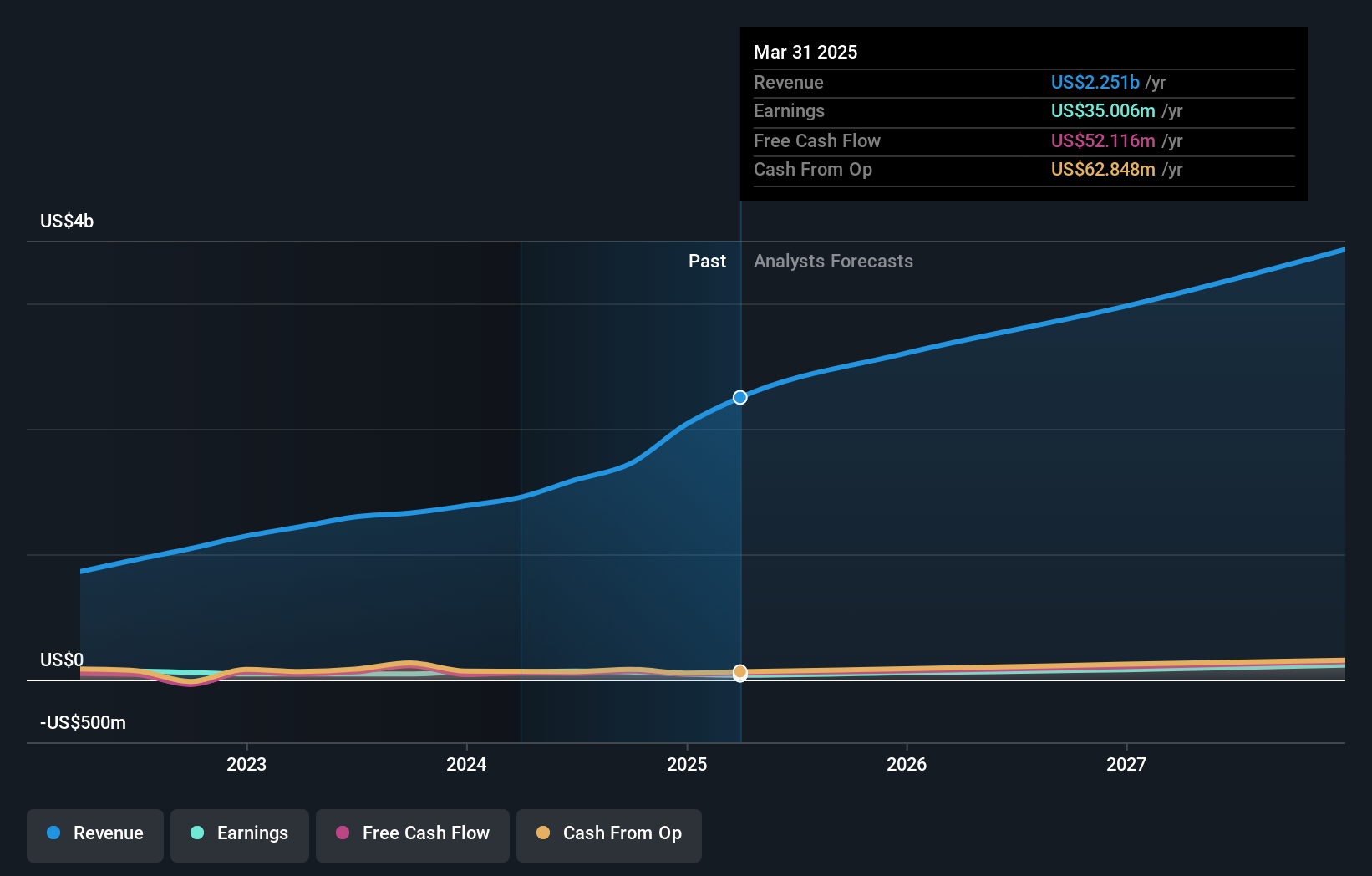

Astrana Health (ASTH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Astrana Health, Inc. is a healthcare management company offering medical care services in the United States with a market cap of approximately $1.20 billion.

Operations: Astrana Health's revenue is primarily derived from its Care Partners segment at $2.78 billion, followed by Care Delivery at $195.02 million and Care Enablement at $212.87 million.

Insider Ownership: 12.5%

Earnings Growth Forecast: 39.9% p.a.

Astrana Health is positioned for significant earnings growth, forecasted at 39.9% annually, outpacing the US market. Despite trading well below its estimated fair value, challenges persist with profit margins declining to 0.3% from 3.6% last year and interest payments not fully covered by earnings. Recent results showed a substantial revenue increase to US$956 million in Q3 2025 but a sharp drop in net income to US$0.373 million compared to the previous year.

- Unlock comprehensive insights into our analysis of Astrana Health stock in this growth report.

- Our expertly prepared valuation report Astrana Health implies its share price may be too high.

Niagen Bioscience (NAGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Niagen Bioscience, Inc. is a bioscience company focused on developing healthy aging products with a market cap of $522.18 million.

Operations: The company generates revenue through three main segments: Ingredients ($28.74 million), Consumer Products ($92.87 million), and Analytical Reference Standards and Services ($3.10 million).

Insider Ownership: 29.4%

Earnings Growth Forecast: 29.7% p.a.

Niagen Bioscience demonstrates strong growth potential with earnings expected to increase significantly at 29.7% annually, surpassing the US market average. The company recently launched Tru Niagen® Beauty, expanding its NAD+ skincare leadership and reported promising clinical trial results for long COVID treatment. Despite trading 60.6% below estimated fair value, revenue growth is forecasted at a slower rate of 17.4%. Insider activity shows more buying than selling recently, indicating confidence in future prospects.

- Get an in-depth perspective on Niagen Bioscience's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Niagen Bioscience is trading behind its estimated value.

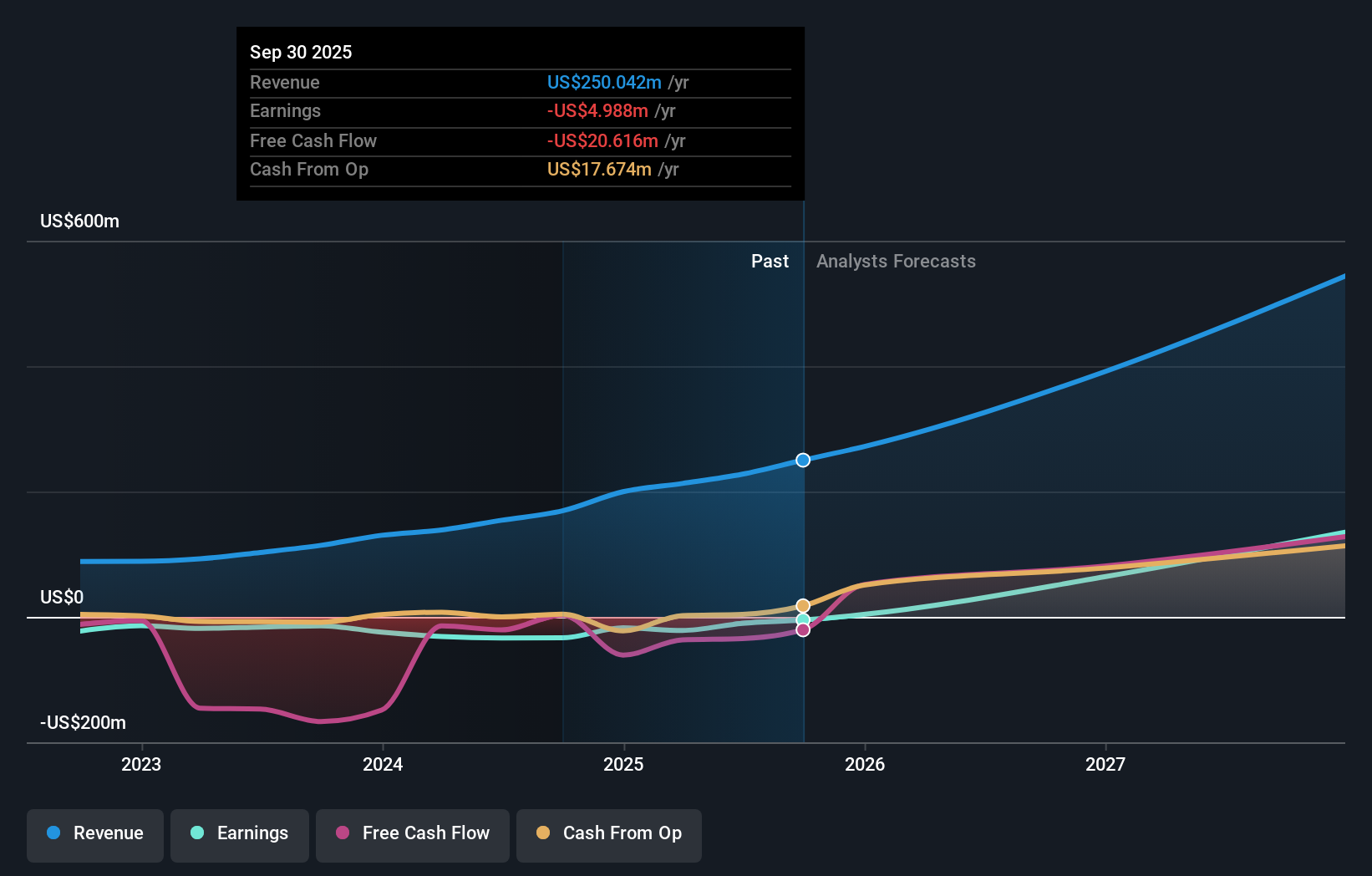

Harrow (HROW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harrow, Inc. is an eyecare pharmaceutical company focused on the discovery, development, and commercialization of ophthalmic products with a market cap of $1.72 billion.

Operations: The company generates revenue from two primary segments: Branded products, contributing $167.97 million, and Compounding products, adding $82.07 million.

Insider Ownership: 16.2%

Earnings Growth Forecast: 56.7% p.a.

Harrow, Inc. shows robust growth potential with forecasted revenue growth of 30.1% annually, outpacing the US market average. The company recently adjusted its revenue guidance to US$270-280 million for 2025 and reported Q3 earnings of US$71.64 million, a significant increase from the previous year. Despite trading well below estimated fair value, analysts expect a stock price rise of over 50%. Harrow's HAFA initiative aims to enhance patient access and affordability for its ophthalmic medications.

- Dive into the specifics of Harrow here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Harrow's current price could be quite moderate.

Seize The Opportunity

- Gain an insight into the universe of 207 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报