Astronics (ATRO): Reassessing Valuation After Upgraded Earnings Forecasts and Fresh Strong Buy Analyst Calls

Astronics (ATRO) has been on investors radar after a wave of upward earnings revisions and fresh Strong Buy calls, a combination that often signals shifting expectations rather than just short term trading noise.

See our latest analysis for Astronics.

Those upbeat earnings revisions and bullish calls are landing on a stock that already has the wind at its back, with a 30 day share price return of about 15 percent, strong recent gains, and a powerful multi year total shareholder return that suggests momentum still looks more like a rerating than a spike.

If Astronics has you rethinking aerospace and defense exposure, this could be a good moment to explore aerospace and defense stocks for other names riding similar upgrades and momentum shifts.

Yet with the stock already up sharply and trading only modestly below analyst targets, the real question is whether Astronics remains undervalued based on its recovery potential, or if the market has largely priced in future growth.

Most Popular Narrative Narrative: 10.4% Undervalued

With Astronics last closing at $54.79 against a most popular narrative fair value near $61, the story leans toward upside driven by future earnings power.

Forecasts for approximately 30 percent earnings growth in 2026 followed by double digit growth in 2027, on more than 7 percent annual sales expansion, underpin the view that the current multiple does not fully reflect the company’s medium term growth algorithm.

Want to see what powers that growth algorithm? The narrative quietly stacks revenue, margin, and earnings assumptions into one bold valuation leap. Curious which levers matter most?

Result: Fair Value of $61.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on clean execution. Tariff exposure, Test segment missteps, and heavy reliance on commercial aerospace cycles are all capable of derailing the recovery.

Find out about the key risks to this Astronics narrative.

Another Angle on Value

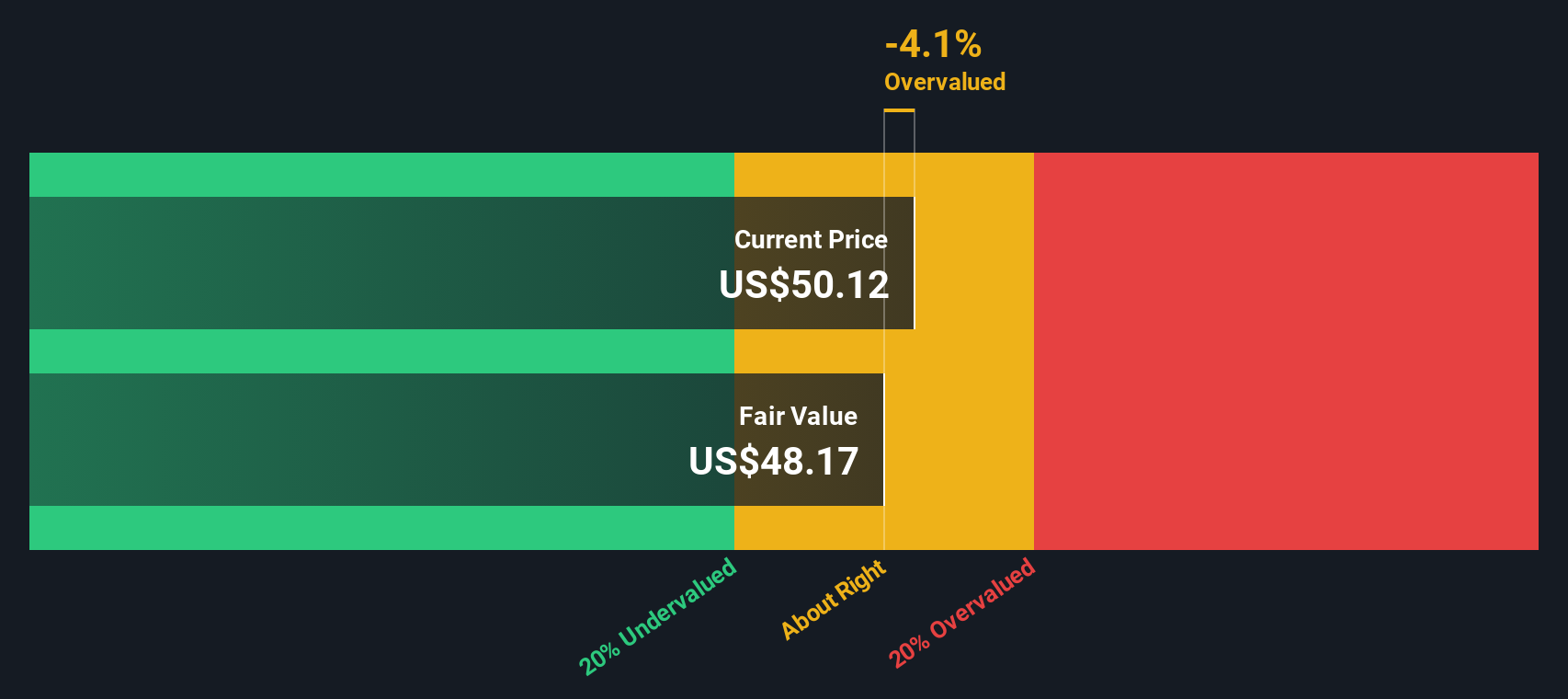

While the narrative fair value suggests Astronics is about 10 percent undervalued, our DCF model is less generous. It indicates the shares are trading above a roughly $47.61 fair value and therefore look overvalued. Which story do you trust more, the growth narrative or the cash flow math?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Astronics Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your Astronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart lead by using the Simply Wall St Screener to uncover stocks that match your strategy and sharpen your edge.

- Capture early stage growth potential with these 3633 penny stocks with strong financials, surfacing smaller companies that already back their stories with improving fundamentals.

- Position ahead of the next productivity wave through these 24 AI penny stocks, focusing on businesses commercializing real world AI solutions rather than just buzzwords.

- Lock in quality at sensible prices using these 903 undervalued stocks based on cash flows, filtering for companies whose cash flows signal mispriced opportunity in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报