How Bank of America’s (BAC) Capital Moves and Branding Push Have Quietly Reframed Its Investment Story

- In recent days, Bank of America announced regular cash dividends across multiple preferred share series and completed several fixed-income offerings totaling over US$92.50 million, while also expanding its workplace benefits platform and deepening community partnerships such as the Portland Timbers jersey deal.

- These moves together highlight how Bank of America is pairing balance-sheet funding and preferred capital management with investments in digital benefits platforms and community-focused branding that may support franchise strength over time.

- Next, we’ll examine how Bank of America’s enhanced workplace benefits platform could influence its previously outlined investment narrative and growth assumptions.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bank of America Investment Narrative Recap

To own Bank of America, you need to believe it can convert its scale, digital investments and credit discipline into steady earnings growth and resilient returns. The latest preferred dividends and roughly US$92.5 million in new fixed income issuance look incremental rather than game changing, so they do not materially alter the near term focus on net interest income trends as a key catalyst or the ongoing risk that funding costs and credit quality could be pressured by macro volatility.

The recent launch of Bank of America’s enhanced Workplace Benefits platform is most relevant here, because it connects directly to the bank’s existing push into digital engagement and fee based services. If this offering gains traction with small and mid sized businesses, it could reinforce the longer term catalyst of higher non interest income and deeper client relationships, partly balancing the risk that higher deposit competition compresses net interest income.

Yet even as these digital and benefits initiatives develop, investors should be aware that rising competition for deposits could still...

Read the full narrative on Bank of America (it's free!)

Bank of America's narrative projects $122.0 billion revenue and $32.9 billion earnings by 2028. This requires 7.4% yearly revenue growth and a $6.3 billion earnings increase from $26.6 billion.

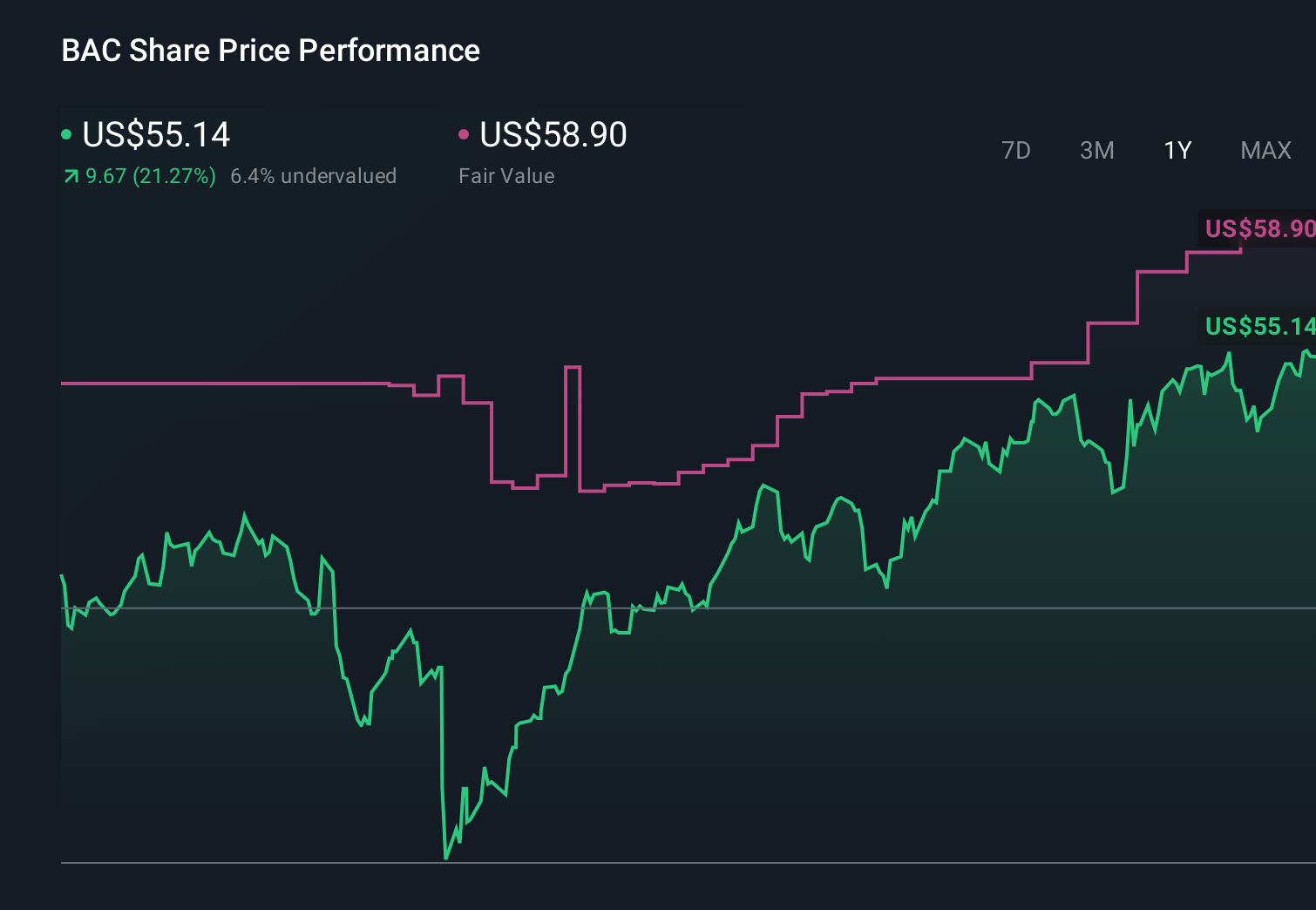

Uncover how Bank of America's forecasts yield a $58.98 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Fifteen members of the Simply Wall St Community currently see Bank of America’s fair value between US$43.34 and US$58.98, underlining how far views can spread. Before recent news on new funding and workplace benefits, many were already weighing deposit competition as a key earnings risk, so it is worth comparing several of these perspectives side by side.

Explore 15 other fair value estimates on Bank of America - why the stock might be worth 22% less than the current price!

Build Your Own Bank of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of America research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Bank of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of America's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报