Vestas (CPSE:VWS): Valuation Check After Major Global Wind Orders and 828 MW Brazil Partnership

Vestas Wind Systems (CPSE:VWS) just padded its order book with fresh wind projects across Australia, Europe, and Brazil, capped by an 828 MW partnership in Brazil that underlines growing confidence in large scale renewables.

See our latest analysis for Vestas Wind Systems.

All of this new deal flow is landing at a time when sentiment has clearly swung back in Vestas' favour, with a roughly 66% year to date share price return and a 77% one year total shareholder return signalling strong, rebuilding momentum after a weaker multi year stretch.

If these contracts have you thinking more broadly about the energy transition, it could be a good moment to scout other renewable names via high growth tech and AI stocks.

But with the shares already beating most clean energy peers and now trading above the average analyst target, is Vestas still flying under the radar, or is the market already baking in the next leg of growth?

Most Popular Narrative: 11% Overvalued

With Vestas Wind Systems last closing at DKK173.8 against a narrative fair value of DKK156.26, the current rally sits ahead of consensus expectations.

Stabilizing raw material and logistics costs, combined with improved onshore execution and reduced warranty expenses, are already contributing to better gross margins and EBIT. These operational efficiencies are expected to be further leveraged as scale increases, supporting future earnings growth.

Want to see what kind of revenue trajectory and margin rebuild could justify paying up today? The narrative leans on bolder earnings and valuation assumptions than you might expect.

Result: Fair Value of DKK156.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering policy uncertainty and persistent offshore ramp up losses could still derail the margin rebuild that underpins today’s optimistic valuation narrative.

Find out about the key risks to this Vestas Wind Systems narrative.

Another Way To Look At Valuation

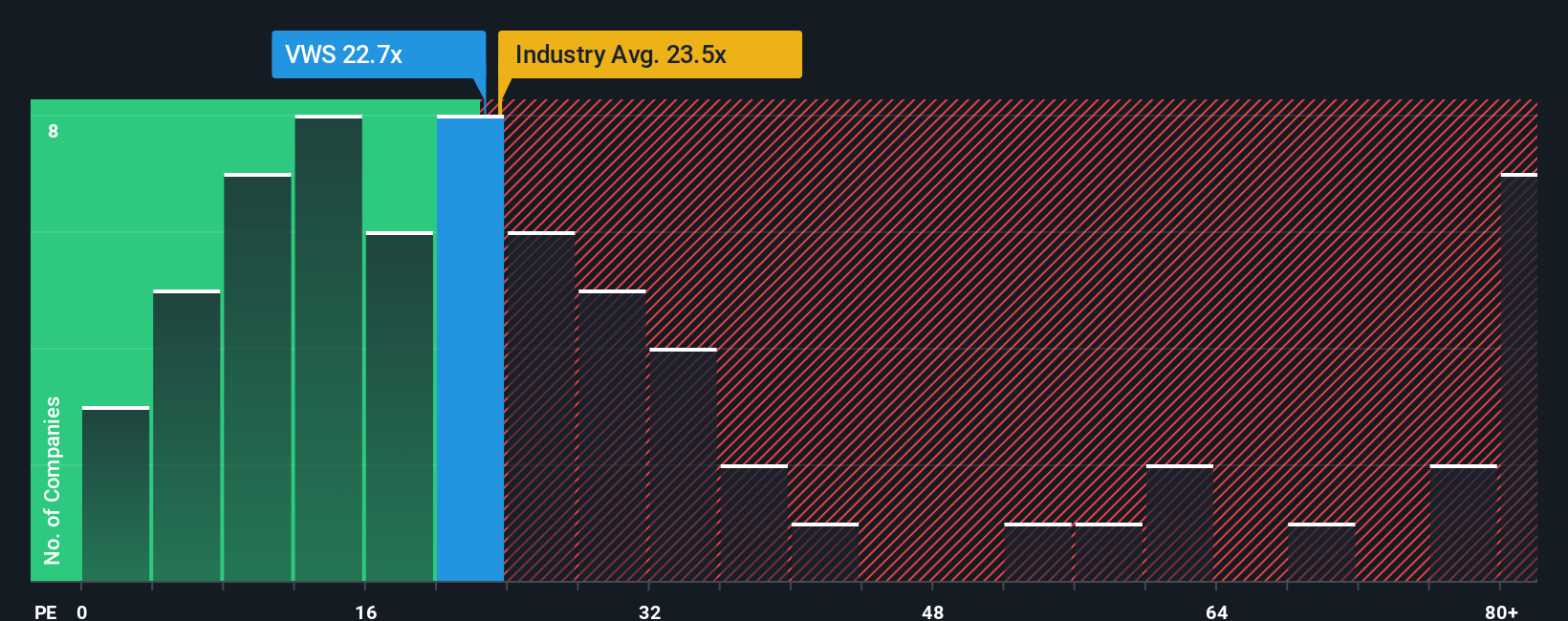

Step back from the narrative fair value, and Vestas trades on a 24.6x price to earnings ratio versus 23.6x for the European electrical sector and a 27x fair ratio. That signals the stock is not obviously cheap or stretched. The question is where the market re rates from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vestas Wind Systems Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom Vestas view in just minutes. Do it your way.

A great starting point for your Vestas Wind Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop with a single idea when the market is full of potential. Use the Simply Wall St Screener to explore and uncover your next move.

- Explore early stage potential with these 3633 penny stocks with strong financials before the crowd identifies which smaller companies have the strongest fundamentals.

- Participate in the structural shift toward intelligent automation by focusing on these 29 healthcare AI stocks, which is influencing developments in diagnostics, treatment, and patient outcomes.

- Seek income and stability by reviewing these 12 dividend stocks with yields > 3%, which can help anchor a portfolio with potential cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报