Alto Ingredients, Inc.'s (NASDAQ:ALTO) Shares Leap 41% Yet They're Still Not Telling The Full Story

Alto Ingredients, Inc. (NASDAQ:ALTO) shares have continued their recent momentum with a 41% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 80% in the last year.

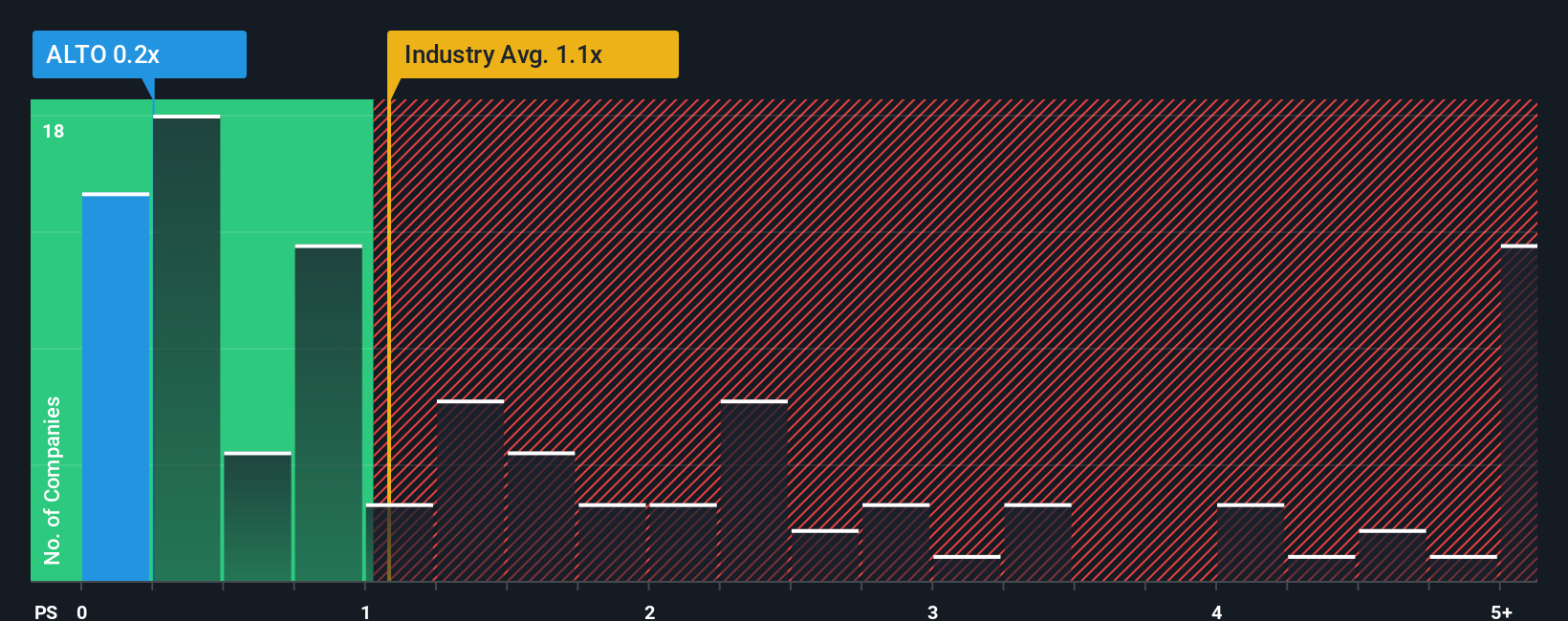

Although its price has surged higher, considering around half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Alto Ingredients as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Alto Ingredients

What Does Alto Ingredients' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Alto Ingredients' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Alto Ingredients will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Alto Ingredients?

The only time you'd be truly comfortable seeing a P/S as low as Alto Ingredients' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.0%. This means it has also seen a slide in revenue over the longer-term as revenue is down 34% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.9% over the next year. With the industry predicted to deliver 5.7% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Alto Ingredients' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Alto Ingredients' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Alto Ingredients' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Alto Ingredients currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 2 warning signs for Alto Ingredients that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报