UL Solutions (ULS): Valuation Check After Strong Q3 Beat and Positive Cybersecurity, AI and Sustainability Outlook

UL Solutions (ULS) just delivered a stronger than expected third quarter, with revenue and earnings coming in ahead of forecasts, and that performance is a big part of why the stock has been moving.

See our latest analysis for UL Solutions.

That backdrop helps explain why, even after a recent 1 month share price return of minus 10.21% and a pullback to 76.95 dollars, UL Solutions still boasts a powerful year to date share price return of 54.98% and a 1 year total shareholder return of 53.20%. This suggests that momentum is cooling in the short term but remains firmly positive over the longer run.

If this kind of steady compounding appeals to you, it is worth comparing UL Solutions with other high quality businesses exposed to structural growth trends by exploring fast growing stocks with high insider ownership.

With earnings beating forecasts, structural growth drivers and a modest discount to analyst targets, is UL Solutions quietly trading below its true potential, or are investors already paying upfront for years of future expansion?

Most Popular Narrative Narrative: 16.1% Undervalued

With the most followed narrative pointing to a fair value of 91.71 dollars against a 76.95 dollar close, the implied upside rests heavily on long term growth assumptions and resilient profitability.

The analysts have a consensus price target of $71.27 for UL Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $78.0, and the most bearish reporting a price target of just $59.0.

Want to see why this narrative still lands above today’s price? The story leans on firm revenue expansion and rising margins supported by sustained earnings momentum. Curious which forward profit multiple and growth runway need to hold up for that upside to materialize? The full narrative breaks down the projections driving that 16.1 percent undervaluation call.

Result: Fair Value of $91.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty and higher global tax burdens could delay customer spending and compress earnings, challenging those optimistic long term growth and valuation assumptions.

Find out about the key risks to this UL Solutions narrative.

Another Lens on Valuation

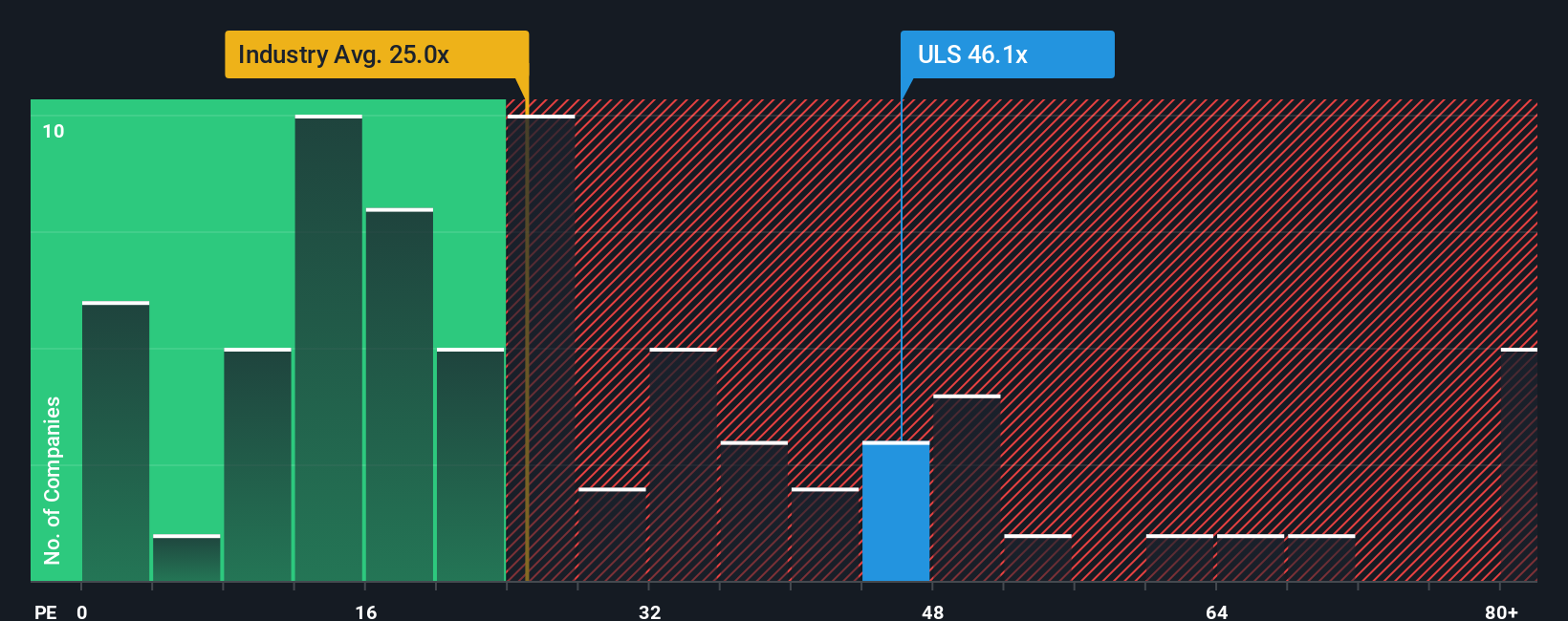

On raw price to earnings, UL Solutions looks far from cheap, trading at 48.5 times earnings versus 24.4 times for the US Professional Services industry and 32.9 times for peers, and even above a 29.2 times fair ratio that the market could eventually gravitate toward. That gap signals meaningful de rating risk if growth or sentiment cools. Are investors stretching too far for quality here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UL Solutions Narrative

If you want to dig into the numbers yourself, challenge these assumptions and shape the story your way, you can build a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding UL Solutions.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall Street Screener to lock onto fresh, data backed opportunities that match your next smart move.

- Identify potential multi baggers early by targeting fast growing businesses trading below intrinsic value through these 910 undervalued stocks based on cash flows.

- Explore the AI theme by focusing on companies involved in automation, analytics and intelligent software via these 24 AI penny stocks.

- Find potential income opportunities by examining businesses offering appealing dividend yields through these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报