3 Promising Penny Stocks In Global With Market Caps Up To US$3B

The global markets recently experienced mixed movements, with U.S. stocks showing varied results and Japan's interest rate hike marking a significant economic shift. In this context, the term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. These typically smaller or newer companies can offer affordability and growth potential when supported by strong financials, making them intriguing options for investors looking to uncover under-the-radar opportunities.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.655 | MYR348.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.49 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.155 | £476.67M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$441.09M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6875 | $399.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.78 | NZ$233.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £183.46M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,633 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Suzhou Gold Mantis Construction Decoration (SZSE:002081)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suzhou Gold Mantis Construction Decoration Co., Ltd. specializes in interior decoration, curtain walls, furniture, and landscape design and construction in China, with a market cap of CN¥8.66 billion.

Operations: The company generates CN¥16.98 billion in revenue from its operations within China.

Market Cap: CN¥8.66B

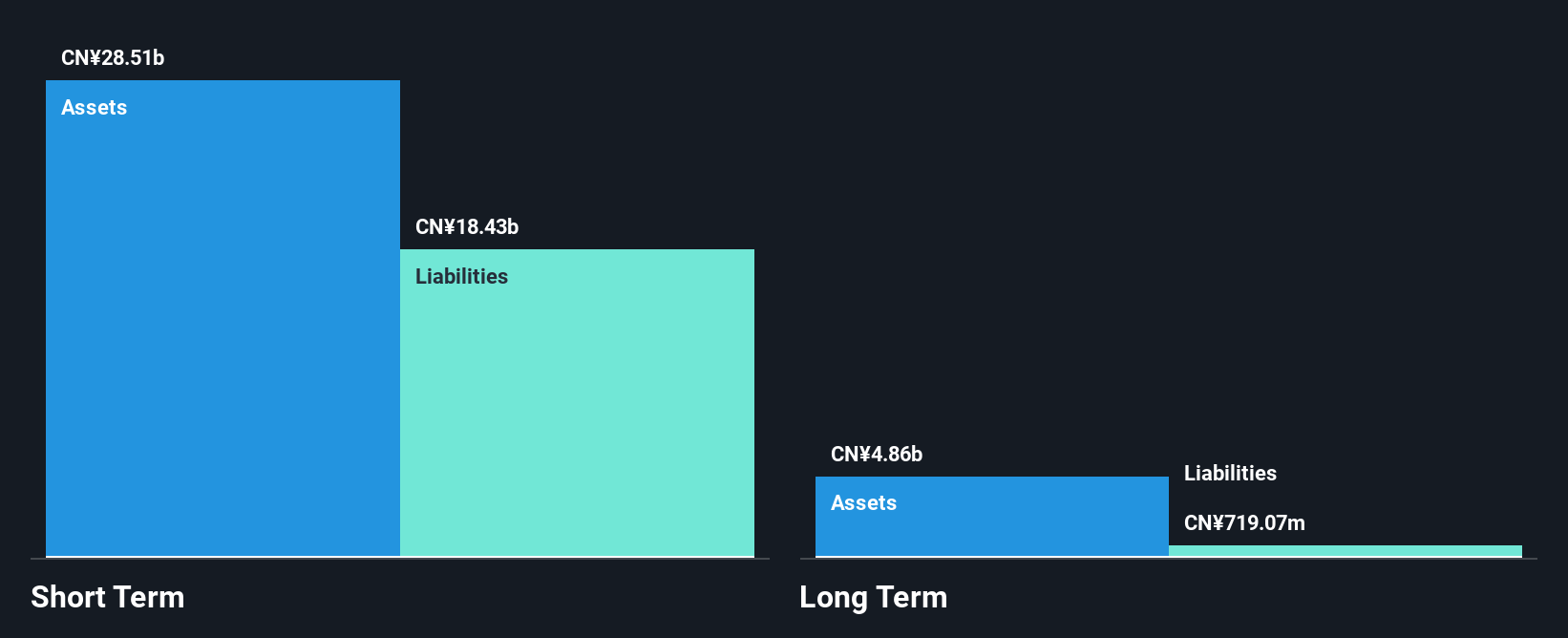

Suzhou Gold Mantis Construction Decoration Co., Ltd. shows a mixed outlook in the penny stock realm. While its debt management is robust, with short-term assets significantly exceeding liabilities and debt well-covered by cash flow, earnings have faced challenges, showing a decline over the past year. The company's Return on Equity remains low at 3.4%, and recent financials reveal decreased revenue and net income compared to last year, impacted by significant one-off losses. Despite these hurdles, analysts anticipate a 33% rise in stock price, suggesting potential value if earnings growth forecasts materialize at 12.09% annually.

- Take a closer look at Suzhou Gold Mantis Construction Decoration's potential here in our financial health report.

- Gain insights into Suzhou Gold Mantis Construction Decoration's future direction by reviewing our growth report.

Tinergy Chemical (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tinergy Chemical Co., Ltd. operates in the research, development, production, and sale of titanium dioxide and other products both in China and internationally, with a market cap of CN¥17.57 billion.

Operations: No revenue segments have been reported for Tinergy Chemical Co., Ltd.

Market Cap: CN¥17.57B

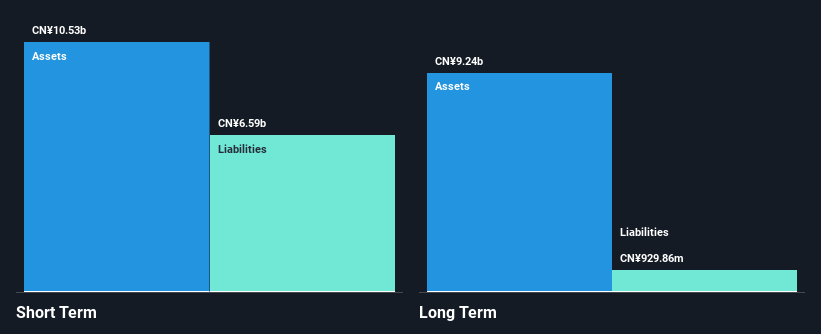

Tinergy Chemical Co., Ltd. presents a nuanced picture within the penny stock landscape. The company has demonstrated stable weekly volatility and maintains more cash than its total debt, indicating sound liquidity management. However, challenges persist with a declining earnings trend over the past five years and an increased debt-to-equity ratio from 12.3% to 31%. Recent earnings reveal a drop in net income despite revenue growth, partly due to large one-off gains affecting results. The management team is relatively inexperienced, which may influence strategic direction as they navigate financial complexities and shareholder interests in upcoming meetings.

- Navigate through the intricacies of Tinergy Chemical with our comprehensive balance sheet health report here.

- Learn about Tinergy Chemical's historical performance here.

B-SOFTLtd (SZSE:300451)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: B-SOFT Co., Ltd. operates in the medical and health informatization industry in China with a market cap of CN¥7.86 billion.

Operations: The company's revenue from China amounts to CN¥1.12 billion.

Market Cap: CN¥7.86B

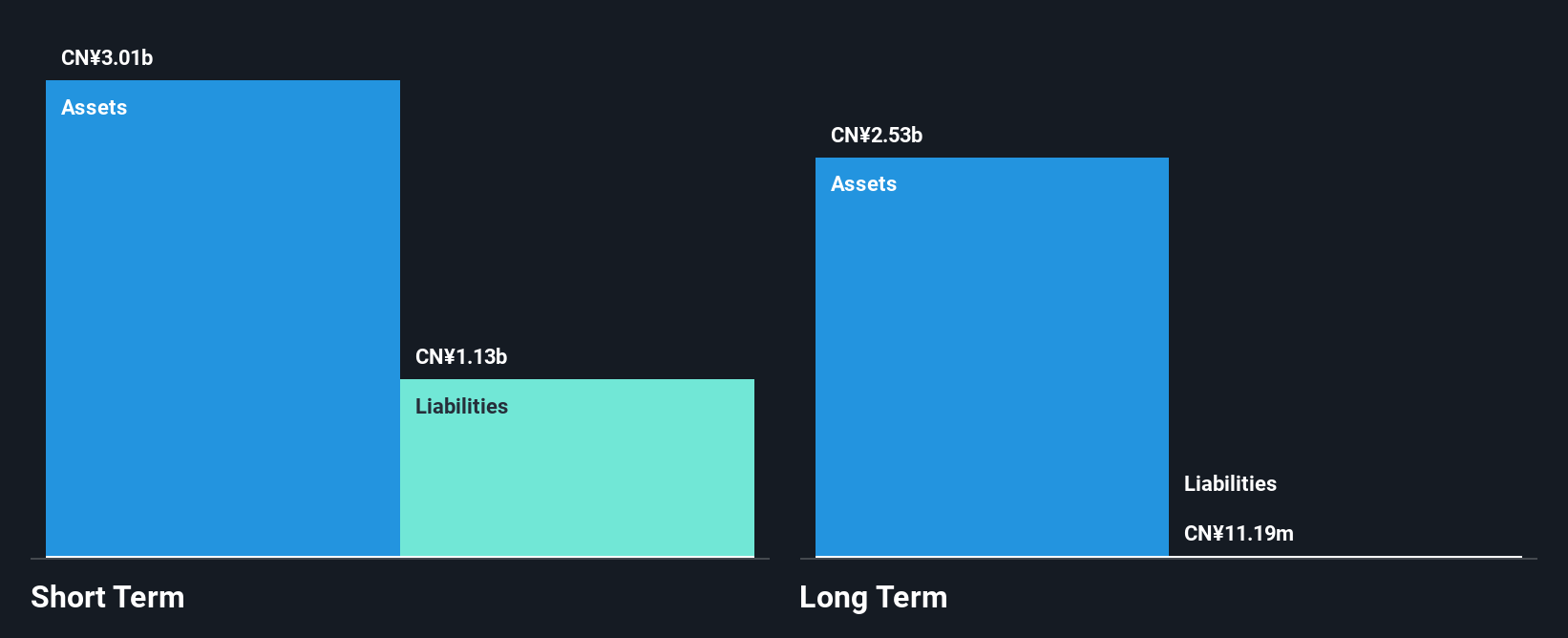

B-SOFT Co., Ltd. navigates the penny stock domain with a seasoned board and management team, boasting more cash than its total debt, which suggests prudent financial oversight. Despite these strengths, the company faces profitability challenges with recent earnings showing a net loss of CN¥122.22 million for the first nine months of 2025, down from a profit in the previous year. A significant transaction involves Hangzhou Better Smart Investment acquiring a 6.23% stake and gaining voting rights over an additional 12.64%, potentially influencing future corporate decisions amid ongoing strategic adjustments and regulatory approvals.

- Dive into the specifics of B-SOFTLtd here with our thorough balance sheet health report.

- Explore B-SOFTLtd's analyst forecasts in our growth report.

Taking Advantage

- Reveal the 3,633 hidden gems among our Global Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报