Middle East Undiscovered Gems Highlighted By These 3 Promising Stocks

As most Gulf markets experience gains driven by rising oil prices and expectations of U.S. interest rate cuts, the Middle East is becoming an increasingly attractive region for investors seeking new opportunities. In this environment, identifying promising stocks involves looking at companies that can leverage these favorable conditions to drive growth and resilience in their respective sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Yayla Agro Gida Sanayi ve Ticaret (IBSE:YYLGD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yayla Agro Gida Sanayi ve Ticaret A.S. is engaged in the production and sale of various food and grain products both within Turkey and internationally, with a market capitalization of TRY10.91 billion.

Operations: Yayla Agro generates revenue primarily from its food business, amounting to TRY15.09 billion.

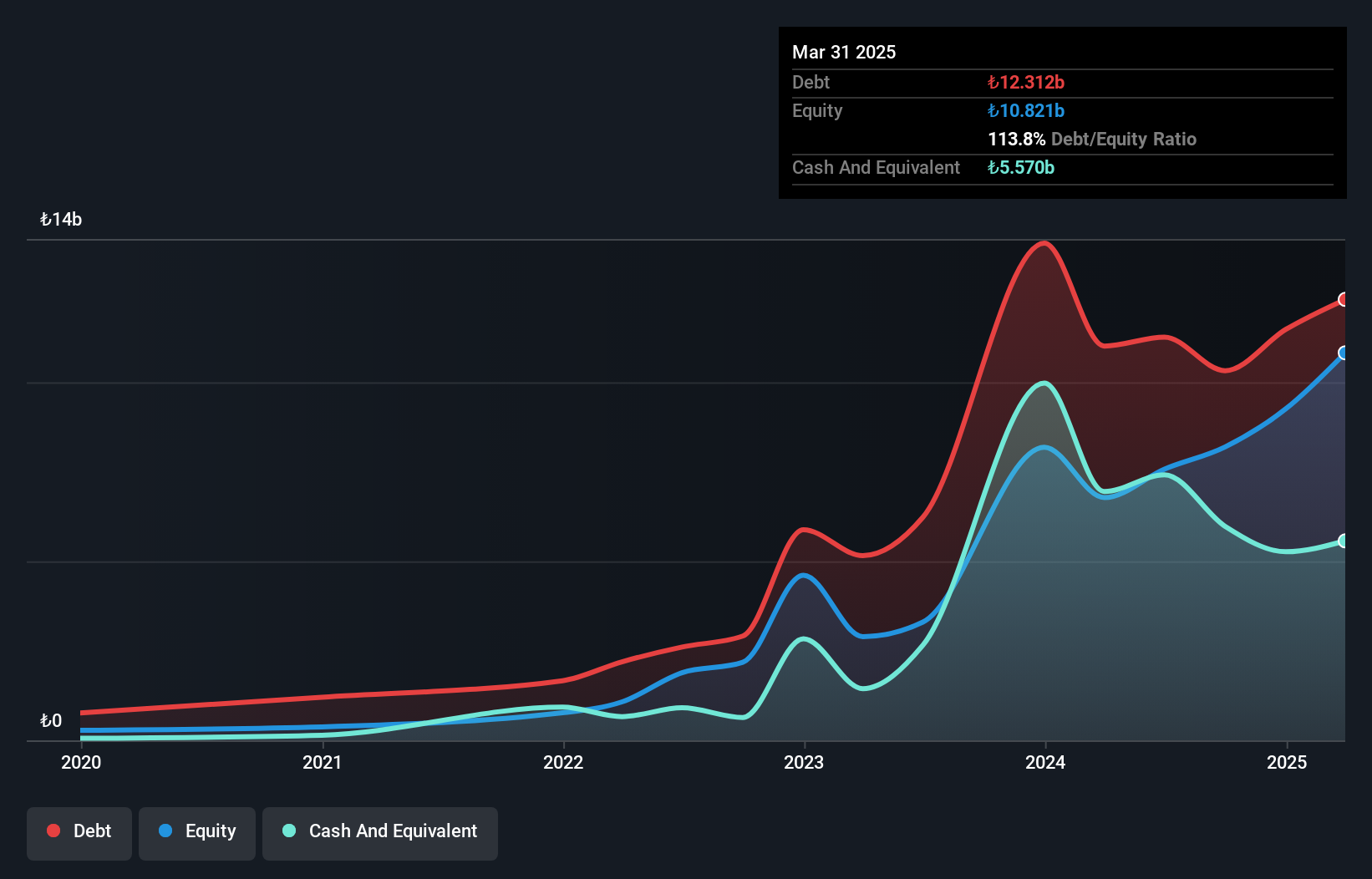

Yayla Agro Gida Sanayi ve Ticaret, a promising player in the Middle East's food sector, has seen its debt to equity ratio improve significantly from 310.6% to 80.6% over five years, indicating better financial health. Despite a robust earnings growth of 43.8% last year, surpassing the industry average of -17.7%, recent reports show challenges with a net loss of TRY 84 million in Q3 compared to a profit previously. The price-to-earnings ratio stands at an attractive 14.2x against the TR market's 18.5x, suggesting potential value for investors despite current profitability pressures and high net debt levels at 49%.

Arabian Pipes (SASE:2200)

Simply Wall St Value Rating: ★★★★★★

Overview: Arabian Pipes Company specializes in producing and marketing steel tubes in Saudi Arabia, with a market capitalization of SAR982 million.

Operations: The company generates revenue primarily from its steel pipe production, amounting to SAR895.51 million.

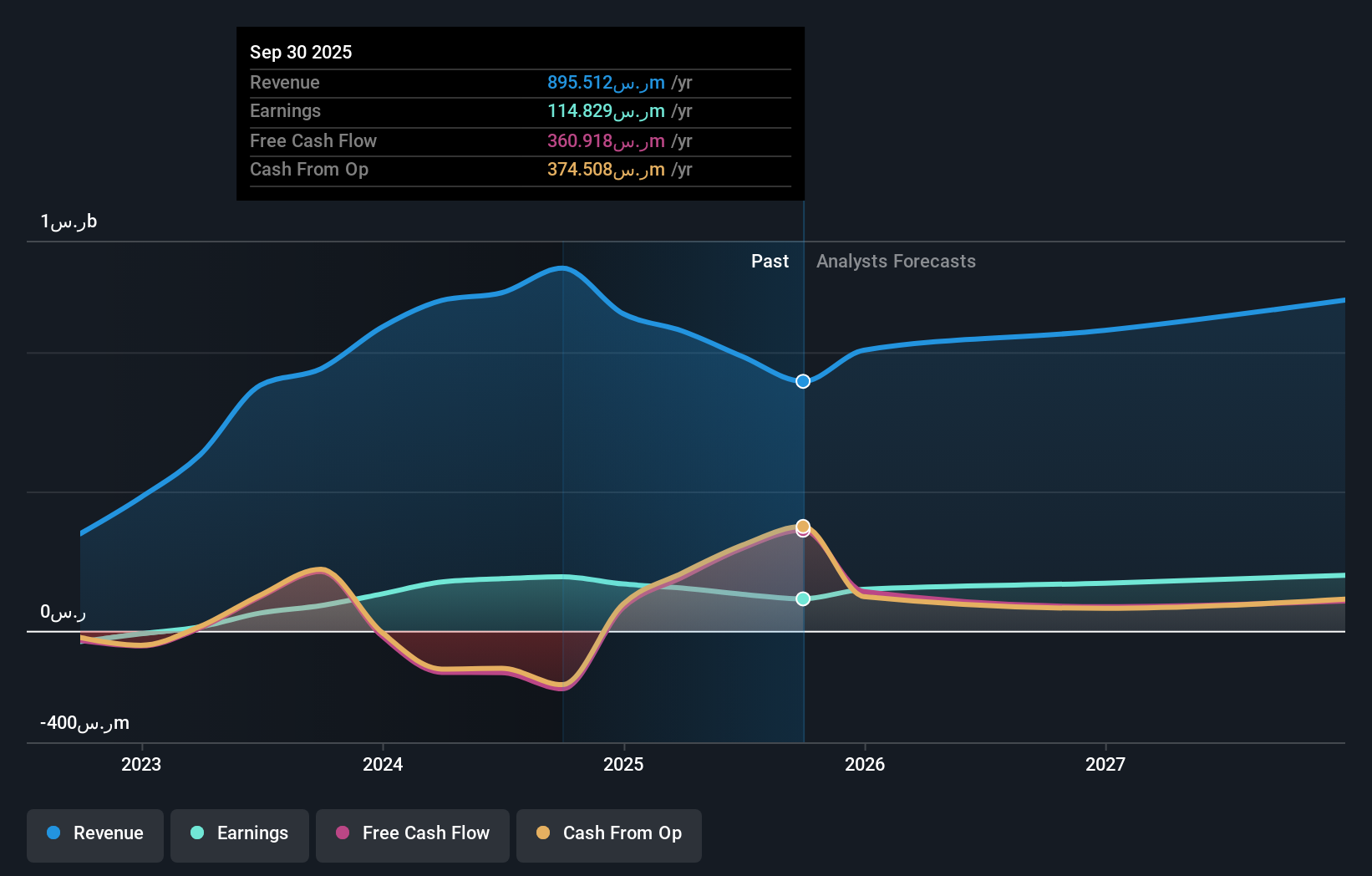

Arabian Pipes, a smaller player in the industry, showcases a satisfactory net debt to equity ratio of 6.8%, reflecting prudent financial management. Trading at 45.4% below its estimated fair value suggests potential for appreciation, though recent earnings reveal challenges with third-quarter sales dropping to SAR 233 million from SAR 322 million the previous year. Despite this dip, interest payments are well covered by EBIT at four times coverage, indicating financial resilience. While revenue is forecasted to grow annually by 6.72%, last year's negative earnings growth of -40.9% highlights hurdles in outperforming industry peers averaging a growth of 5.6%.

- Click to explore a detailed breakdown of our findings in Arabian Pipes' health report.

Gain insights into Arabian Pipes' historical performance by reviewing our past performance report.

Gulf Insurance Group (SASE:8250)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gulf Insurance Group offers a range of insurance and reinsurance products and services to corporate, SME, and individual clients in Saudi Arabia, with a market capitalization of SAR1.17 billion.

Operations: The company's primary revenue streams include Motor insurance at SAR 626.63 million, Health insurance at SAR 364.36 million, and Property and Casualty insurance at SAR 382.94 million.

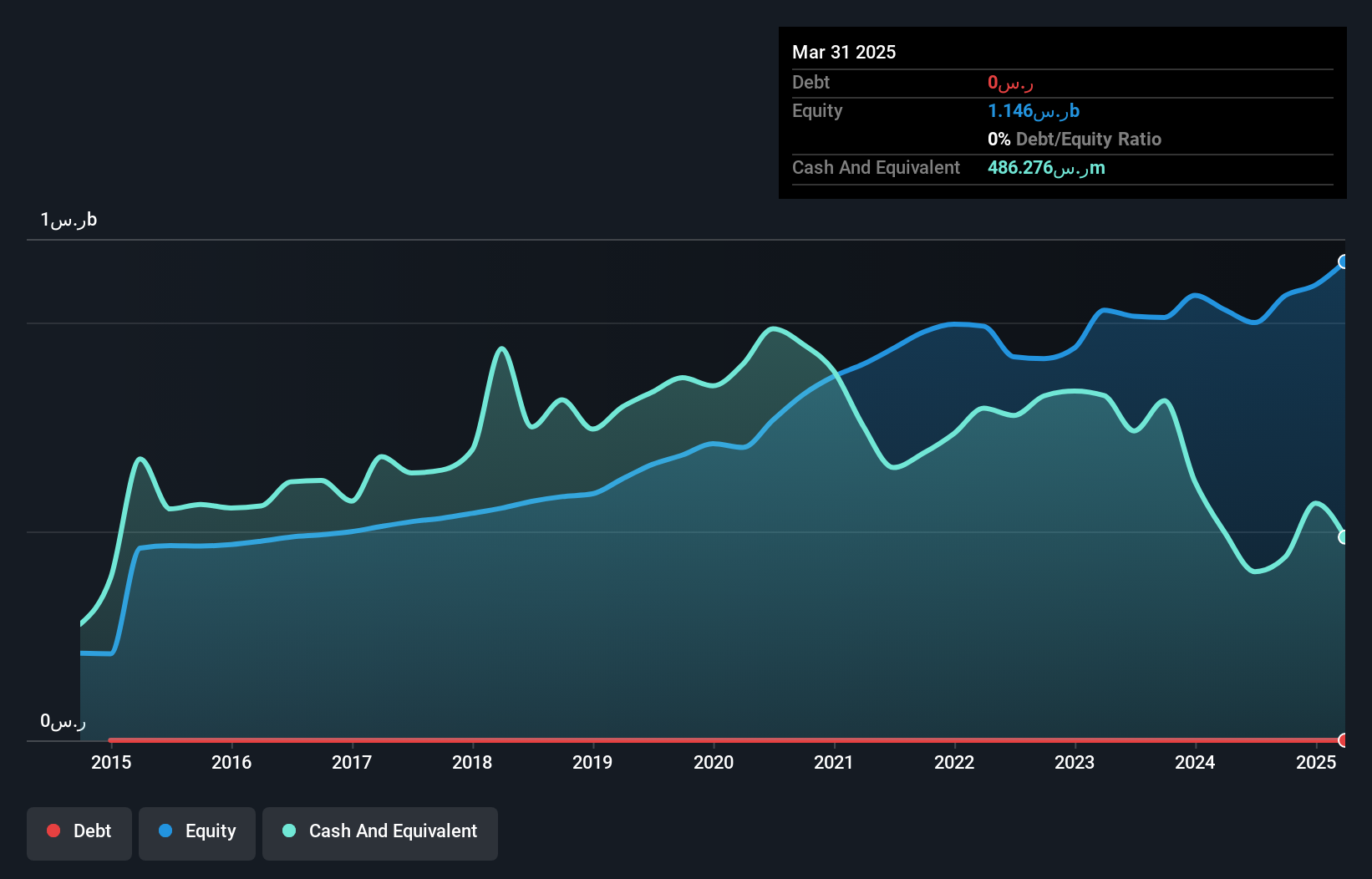

Gulf Insurance Group, a nimble player in the Middle East insurance market, has shown impressive earnings growth of 84% over the past year, outpacing the industry average of -12.2%. With no debt on its books for five years and a solid price-to-earnings ratio of 8.4x compared to the SA market's 17.6x, it offers an attractive valuation proposition. Recent results highlight net income for Q3 at SAR 34.43 million, up from SAR 21.81 million last year, with basic earnings per share rising to SAR 0.66 from SAR 0.42, underscoring its strong performance trajectory amidst competitive pressures.

- Get an in-depth perspective on Gulf Insurance Group's performance by reading our health report here.

Explore historical data to track Gulf Insurance Group's performance over time in our Past section.

Key Takeaways

- Take a closer look at our Middle Eastern Undiscovered Gems With Strong Fundamentals list of 182 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报