Is It Too Late to Consider Microsoft After Its Massive AI Fueled Run?

- If you are wondering whether Microsoft is still worth buying after its massive run, or if the smart money is already taking profits, you are not alone.

- With the stock recently closing around $485.92 and posting gains of 2.3% over the last week, 2.9% over the past month, 16.1% year to date, and 12.5% over the last year, longer term holders have seen a powerful 108.4% 3 year and 125.1% 5 year rally that raises the bar for future returns.

- Recent headlines have focused on Microsoft doubling down on AI infrastructure, deepening its partnership ecosystem, and expanding cloud offerings that keep it at the center of digital transformation. At the same time, regulatory and competitive scrutiny in both AI and cloud have been front of mind for investors, adding nuance to how the market prices its growth story.

- On our valuation checks, Microsoft currently scores 3/6, suggesting it looks undervalued on some metrics but far from a screaming bargain on others. Next, we will unpack what different valuation approaches say about that price tag, then finish with an even more intuitive way to think about its true worth.

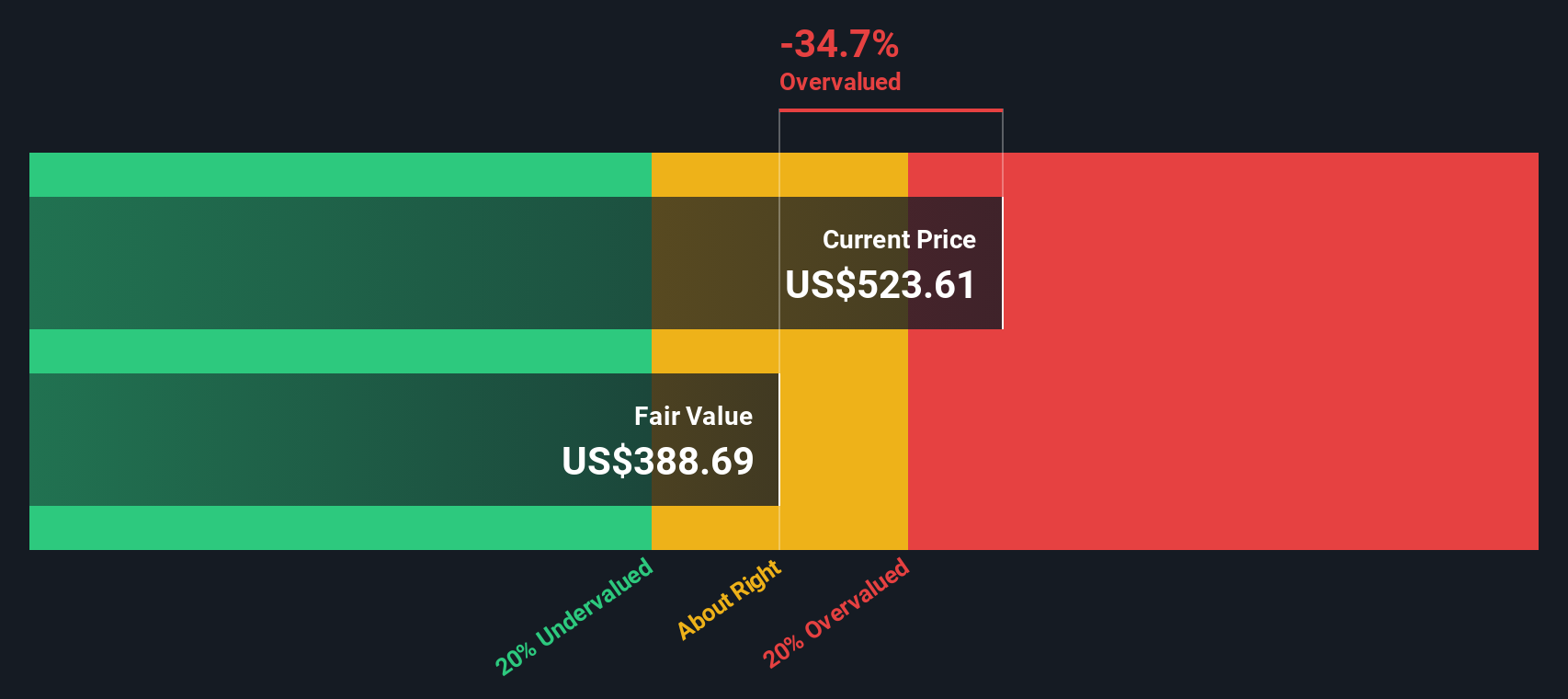

Approach 1: Microsoft Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

For Microsoft, the latest twelve month Free Cash Flow is about $89.4 billion. Analysts and internal estimates project this to grow steadily, reaching roughly $206.2 billion by 2030, with further growth extrapolated out to 2035 using a 2 stage Free Cash Flow to Equity framework. These projections, all in $, are discounted back to today to account for risk and the time value of money.

On this basis, the DCF model arrives at an intrinsic value of about $601.65 per share, compared with the recent market price of around $485.92. That implies Microsoft trades at roughly a 19.2% discount to its estimated fair value, suggesting the market is not fully pricing in its long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Microsoft is undervalued by 19.2%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

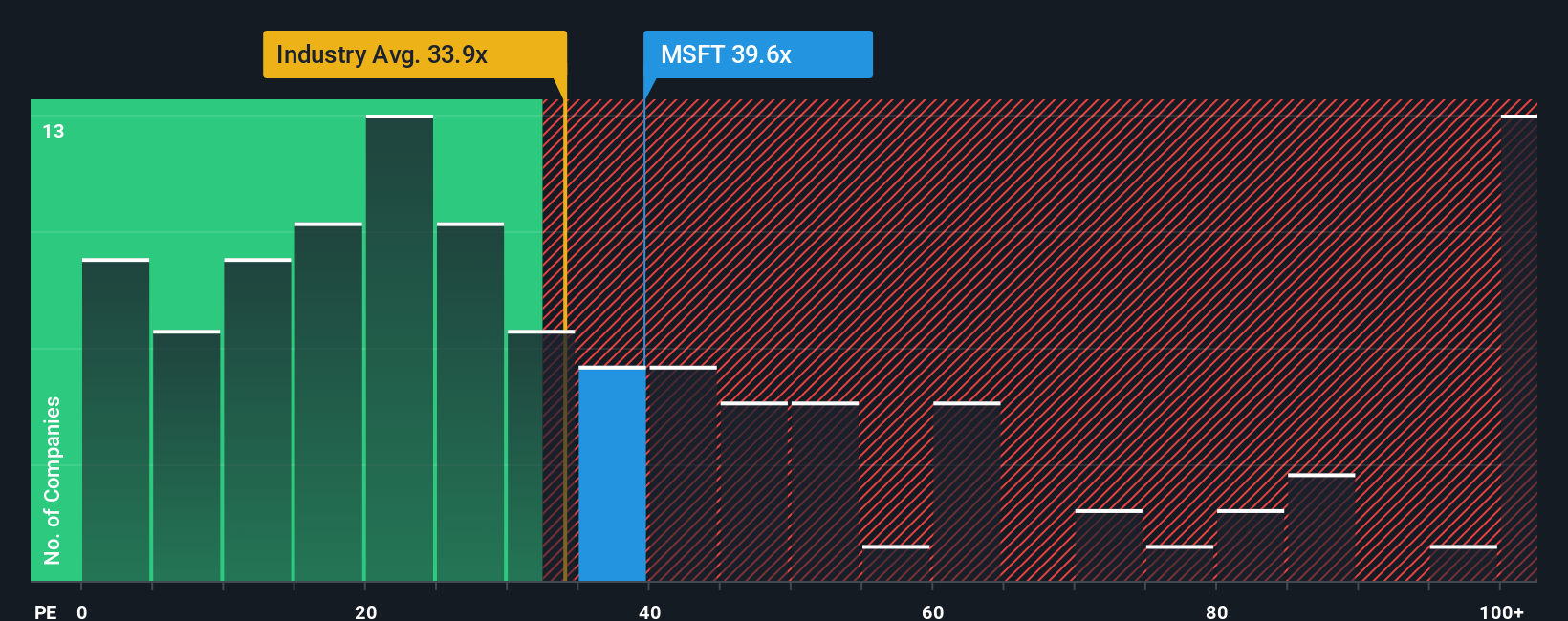

Approach 2: Microsoft Price vs Earnings

For a mature, highly profitable business like Microsoft, the Price to Earnings ratio is a practical way to gauge what investors are willing to pay for each dollar of current profit. The higher the expected growth and the lower the perceived risk, the more investors are usually comfortable paying in the form of a higher PE multiple.

Microsoft currently trades on a PE of about 34.4x, slightly above both the Software industry average of around 32.4x and a peer group average of roughly 32.5x. That premium indicates that the market already recognizes Microsoft as a higher quality, higher growth franchise than the typical software name.

Simply Wall St’s Fair Ratio metric goes a step further by estimating what PE multiple a company might reasonably command given its earnings growth profile, profitability, industry, market cap and risk characteristics. For Microsoft, this Fair Ratio comes out at about 52.7x, above today’s 34.4x market multiple. This suggests investors may not be fully paying up for its strengths and growth outlook despite the apparent premium to peers.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microsoft Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a story about Microsoft to the numbers behind its fair value by linking your view of its future revenue, earnings and margins to a forecast and then to a price target.

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors to spell out their thesis in plain language, connect it to explicit financial assumptions, and then see the resulting Fair Value they believe the stock is worth today, which can be compared directly with the current Price to clarify whether they see Microsoft as a buy, hold or sell.

Because Narratives are dynamically updated when new information such as earnings, guidance or major AI news is released, they stay relevant as the story changes. For example, one investor can reasonably argue that Microsoft is worth around $360 based on more cautious AI returns and margin pressure. Another investor can justify a value closer to $625 by assuming durable cloud leadership, stronger AI monetization and premium valuation multiples.

For Microsoft, however, we will make it really easy for you with previews of two leading Microsoft Narratives:

Fair value: $624.45 per share

Trading at around 22.2% below this fair value based on the latest closing price

Forecast revenue growth: 15.30%

- Analysts expect AI driven demand across Azure, Copilot, Dynamics, GitHub and Fabric to sustain double digit revenue growth and reinforce Microsoft’s position at the center of enterprise digital transformation.

- High margin, recurring revenues from cloud, security and subscriptions, backed by a $368 billion backlog, are projected to support rising earnings, improving margins and strong free cash flow even with elevated AI infrastructure spending.

- Consensus price targets around $650, with some as high as $700, reflect confidence that Microsoft can balance heavy AI CapEx with software efficiency gains and maintain a premium PE multiple versus the broader software sector.

Fair value: $420.00 per share

Trading at around 15.8% above this fair value based on the latest closing price

Forecast revenue growth: -0.78%

- Critics argue that Microsoft’s AI strategy is overhyped, capital intensive and increasingly commoditized, leaving the company exposed if OpenAI loses its edge or if rivals like Google and open source models erode pricing power.

- Massive AI datacenter CapEx and a potentially self cannibalizing Copilot model, which could reduce per seat Office demand, risk turning a high margin software franchise into a lower return infrastructure business.

- Structural headwinds in PCs, a struggling Xbox console business, and deteriorating Windows consumer experience raise concerns that Microsoft is undermining the ecosystem flywheel that historically fed Azure and enterprise dominance.

Do you think there's more to the story for Microsoft? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报