3 UK Growth Companies With High Insider Ownership Growing Earnings At 59%

Amidst the backdrop of a faltering FTSE 100, impacted by weak trade data from China and declining commodity prices, investors are navigating a challenging landscape in the United Kingdom market. In such an environment, growth companies with high insider ownership can offer potential resilience and alignment of interests between management and shareholders, making them appealing to those seeking robust earnings growth despite broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| Quantum Base Holdings (AIM:QUBE) | 33.9% | 93.2% |

| Plexus Holdings (AIM:POS) | 11.5% | 140% |

| Manolete Partners (AIM:MANO) | 34.9% | 38.1% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Hochschild Mining (LSE:HOC) | 38.4% | 40.8% |

| Energean (LSE:ENOG) | 19% | 21.1% |

| B90 Holdings (AIM:B90) | 21.3% | 157.2% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 21.9% | 102.9% |

Let's uncover some gems from our specialized screener.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★☆☆

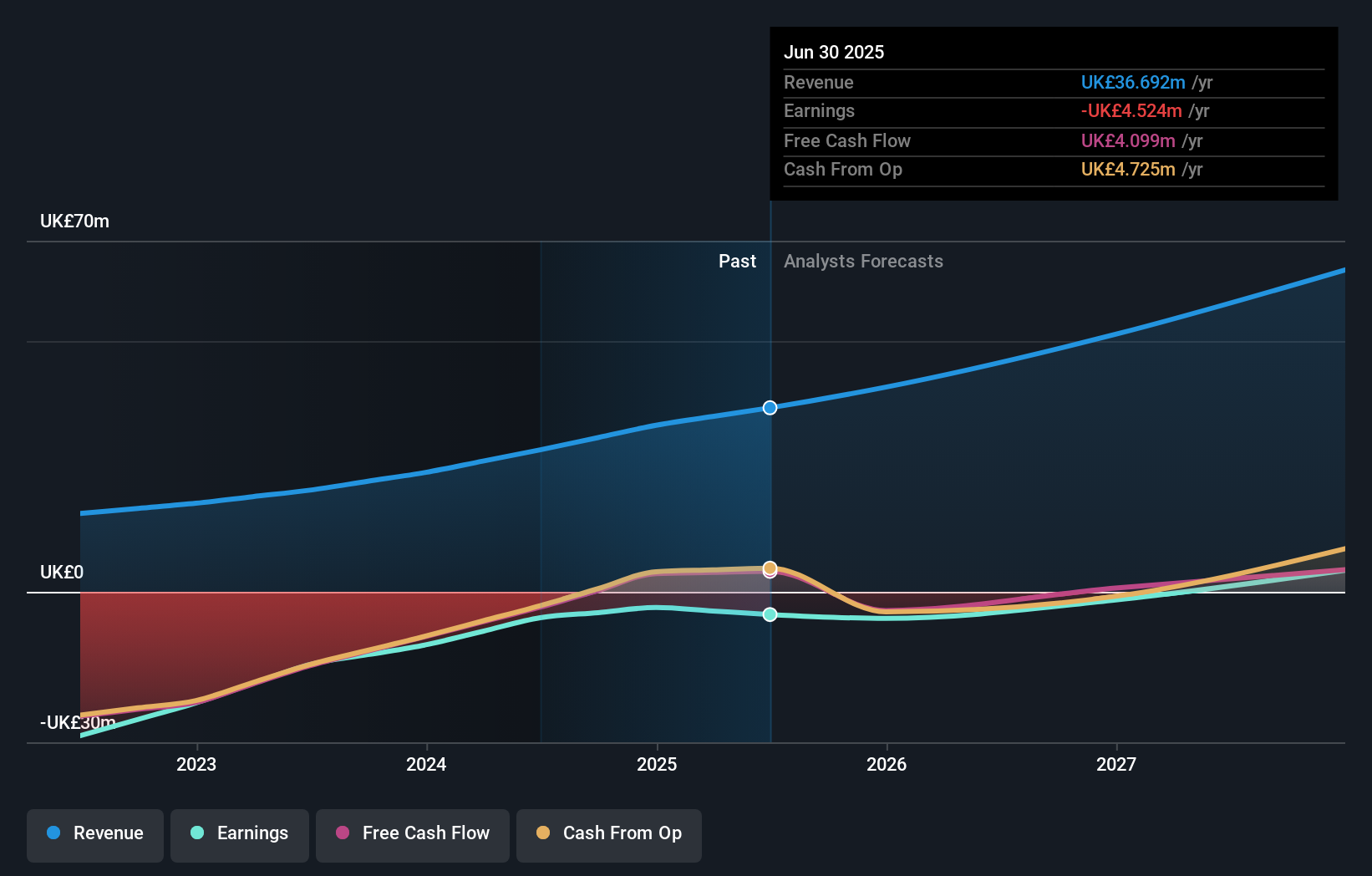

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market capitalization of £385.41 million.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, which generated £36.69 million.

Insider Ownership: 37.8%

Earnings Growth Forecast: 59.8% p.a.

PensionBee Group, with strong insider ownership, is poised for growth with earnings forecasted to increase by 59.81% annually. The company expects to become profitable within three years, outpacing UK market revenue growth at 18.3% per year. Recent initiatives include a $10 million program encouraging Americans to consolidate retirement accounts with a 1% match incentive and a partnership with Madison Square Garden Entertainment to enhance financial education visibility during college basketball games.

- Click to explore a detailed breakdown of our findings in PensionBee Group's earnings growth report.

- The valuation report we've compiled suggests that PensionBee Group's current price could be inflated.

QinetiQ Group (LSE:QQ.)

Simply Wall St Growth Rating: ★★★★★☆

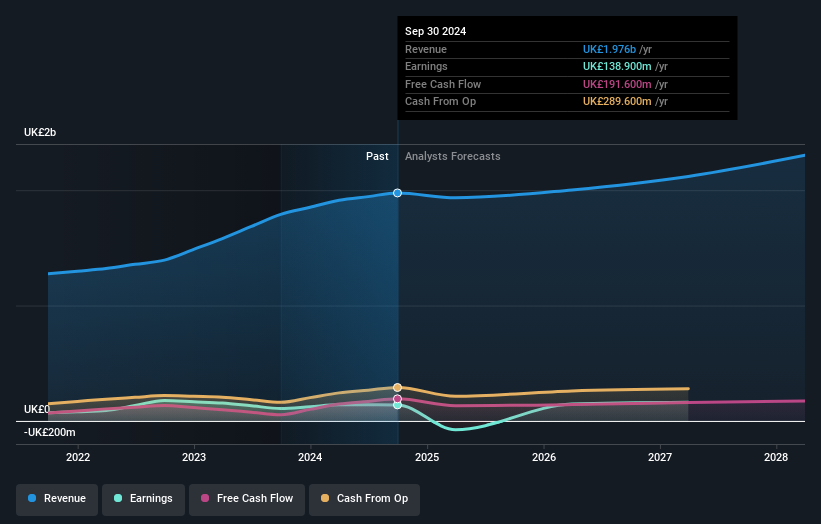

Overview: QinetiQ Group plc offers science and technology solutions in the defense, security, and infrastructure sectors across the UK, US, Australia, and globally with a market cap of £2.34 billion.

Operations: The company's revenue is derived from two main segments: EMEA Services, contributing £1.47 billion, and Global Solutions, accounting for £417 million.

Insider Ownership: 14.4%

Earnings Growth Forecast: 74.4% p.a.

QinetiQ Group, with significant insider ownership, is positioned for growth despite recent earnings decline. The company's revenue is projected to grow faster than the UK market at 5.6% annually, and it aims to become profitable within three years. Recent board additions of experienced leaders Brad Feldmann and John Kavanaugh may bolster strategic direction. An interim dividend increase reflects confidence in future prospects, while analysts anticipate a stock price rise by 21.9%.

- Click here and access our complete growth analysis report to understand the dynamics of QinetiQ Group.

- Insights from our recent valuation report point to the potential undervaluation of QinetiQ Group shares in the market.

Stelrad Group (LSE:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £192.30 million.

Operations: The company's revenue segment is derived entirely from the manufacture and distribution of radiators, amounting to £283.94 million.

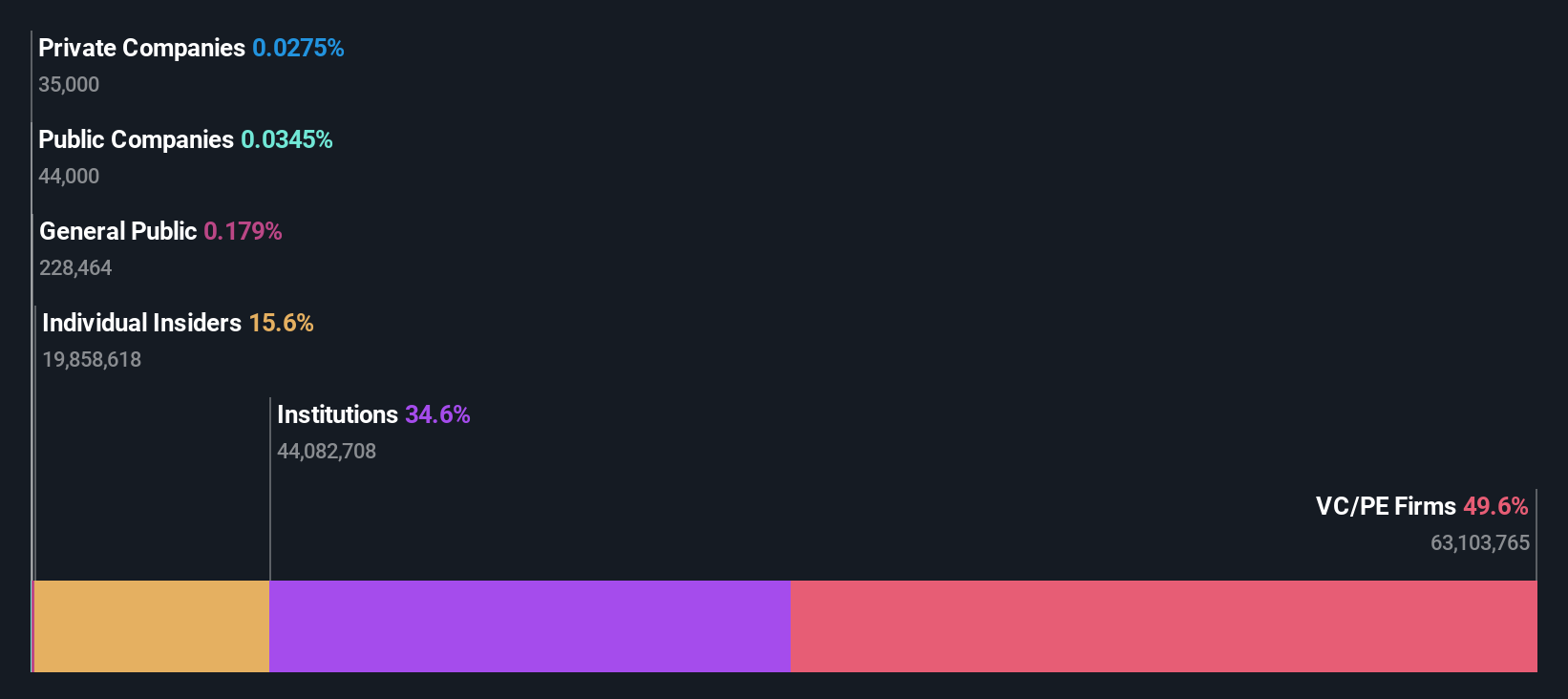

Insider Ownership: 15.6%

Earnings Growth Forecast: 63.2% p.a.

Stelrad Group, with high insider ownership, is poised for substantial earnings growth, forecasted at 63.2% annually, outpacing the UK market. Despite a decline in profit margins and a high debt level, the company recently secured an improved £100 million multicurrency facility to bolster liquidity for strategic investments. Trading below estimated fair value by 32.9%, analysts predict a stock price increase of 28.5%. However, revenue growth lags behind market expectations at 2.8% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Stelrad Group.

- Our valuation report unveils the possibility Stelrad Group's shares may be trading at a discount.

Seize The Opportunity

- Investigate our full lineup of 53 Fast Growing UK Companies With High Insider Ownership right here.

- Seeking Other Investments? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报