Goldman Sachs (GS): Weighing Valuation After Strategic Expansion, Tech Push and Regulatory Overhang Eases

Goldman Sachs Group (GS) heads into 2026 with several tailwinds converging at once, from a strong M&A and equity underwriting pipeline to a cleaner regulatory backdrop and fresh strategic bets on tech driven growth.

See our latest analysis for Goldman Sachs Group.

Those moves are landing against a powerful backdrop, with Goldman’s 1 month share price return of 15.43 percent helping lift the stock to around 893.48 dollars and a 5 year total shareholder return of 292.79 percent. This suggests momentum is still firmly building rather than fading.

If this kind of deal driven run from Goldman has you thinking more broadly about the next wave of financial and tech winners, it is a good time to explore fast growing stocks with high insider ownership.

The rally has pushed Goldman Sachs beyond most analyst targets and well above many traditional valuation markers. This raises a key question for investors: Is this still an attractive entry point, or is future growth already priced in?

Most Popular Narrative: 11.3% Overvalued

With Goldman Sachs last closing at 893.48 dollars, the most followed narrative pegs fair value materially lower at 802.53 dollars, implying a stretched setup that still leans on multi year growth and margin assumptions.

Record growth and momentum in Asset and Wealth Management, including strong fee based net inflows for 30 consecutive quarters and rising demand for alternative assets from high net worth and institutional clients, are shifting the revenue mix toward less volatile, high margin streams supporting higher and more durable net margins.

Curious how steady fee inflows, rising margins, and a richer future earnings multiple all combine into that fair value line? Want to see the full playbook?

Result: Fair Value of $802.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical uncertainty and tougher capital rules could squeeze advisory pipelines and margins, challenging assumptions behind today’s upbeat valuation narrative.

Find out about the key risks to this Goldman Sachs Group narrative.

Another Angle on Value

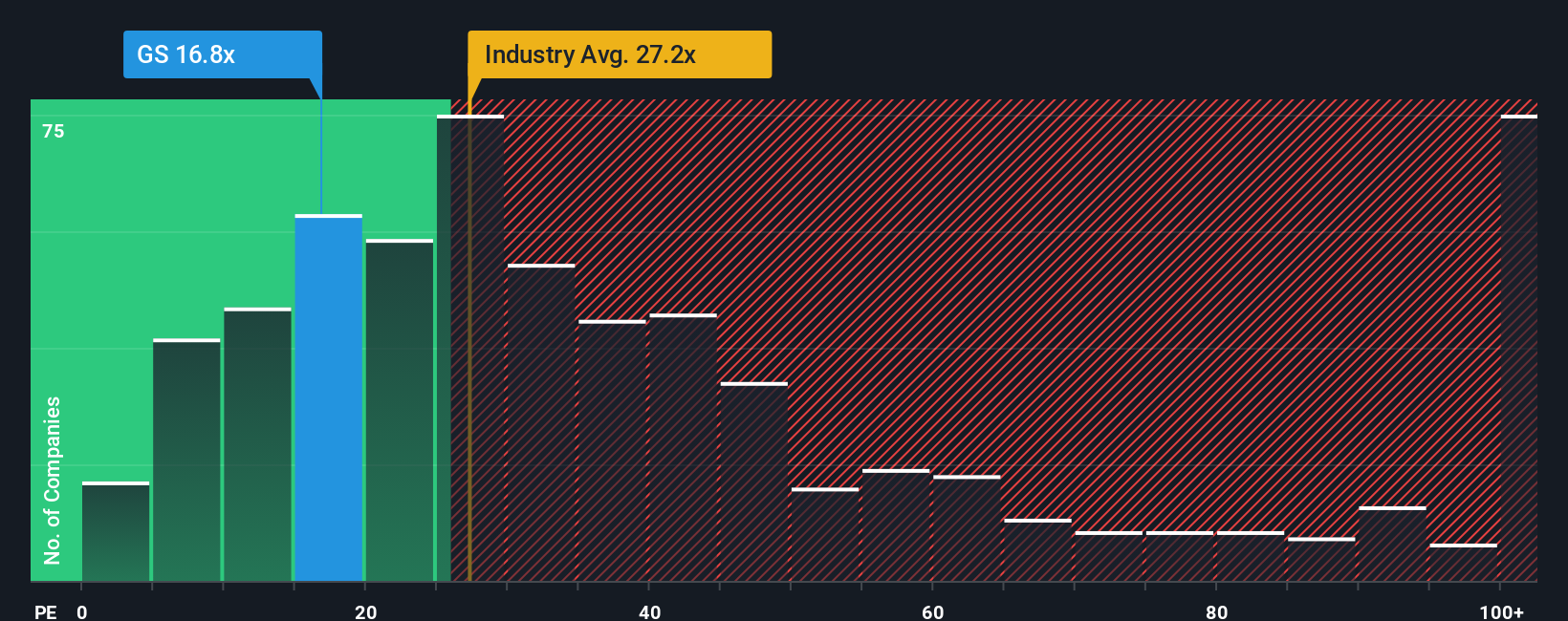

On earnings, Goldman Sachs actually looks restrained, trading at 17.8 times profits versus 25.1 times for the wider US capital markets group and a 30.4 times peer average. Our 19.2 times fair ratio hints the market could still re rate the stock even from here. Are investors underestimating how long this cycle can run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goldman Sachs Group Narrative

If this view does not match your own, or you would rather analyze the numbers firsthand, you can create a custom narrative in minutes using Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Goldman Sachs Group.

Ready for your next investment move?

Do not stop at one idea. Use the Simply Wall Street Screener to uncover focused opportunities other investors could overlook and to help position your portfolio ahead of the crowd.

- Consider early stage momentum by targeting these 3632 penny stocks with strong financials that already show robust balance sheets and improving fundamentals before broader markets notice.

- Explore the next productivity wave by backing these 24 AI penny stocks that harness machine learning breakthroughs to reshape industries and earnings potential.

- Look for possible upside with these 912 undervalued stocks based on cash flows that trade below their cash flow based fair value while financials still appear solid.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报