A Look at Performance Food Group’s Valuation as CEO Succession Plan for 2026 Is Set Out

Performance Food Group (PFGC) just laid out a long planned leadership handoff, with COO Scott McPherson set to become CEO while veteran chief George Holm shifts to Executive Chair in early 2026.

See our latest analysis for Performance Food Group.

The leadership update comes after a more volatile period for the shares, with a recent double digit 3 month share price decline tempering an otherwise strong multiyear total shareholder return record. This suggests that longer term momentum may still be intact.

If this kind of succession planning has you thinking more broadly about leadership driven growth stories, it could be worth exploring fast growing stocks with high insider ownership as you look for the market’s next potential standout.

With shares now trading well below analyst targets despite solid growth in revenue and profits, investors face a key question: Is this a mispriced food distribution leader, or is the market already baking in the next leg of expansion?

Most Popular Narrative Narrative: 24.4% Undervalued

With the narrative fair value at $121.25 against a last close of $91.66, the valuation case hinges on ambitious growth and margin upgrades.

Ongoing investments in digital ordering platforms and e-commerce capabilities, particularly in the rapidly growing specialty and convenience divisions, are driving higher order frequency, increased client stickiness, and double-digit e-commerce sales growth, contributing to recurring revenue and improved customer lifetime value.

Want to see how a low starting margin can still justify a rich future multiple? The narrative leans on accelerating revenue, rising profitability, and a bold re-rating story. Curious which forecasts truly carry that fair value?

Result: Fair Value of $121.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained work from home trends and fiercer independent distribution competition could pressure Convenience segment growth and challenge the market share and margin expansion story.

Find out about the key risks to this Performance Food Group narrative.

Another Angle on Valuation

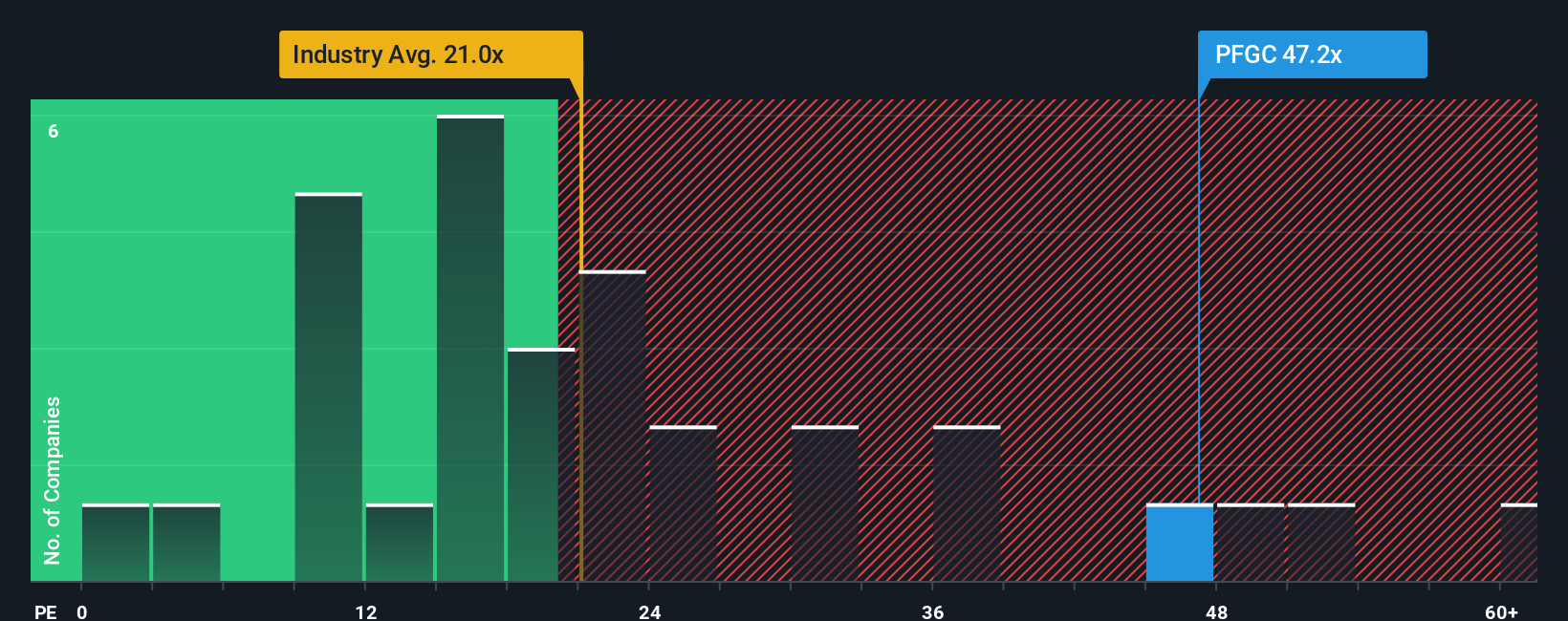

While the narrative suggests Performance Food Group is undervalued, a simple price to earnings lens tells a tougher story. The stock trades at about 44 times earnings, sharply above the industry at roughly 22 times and a fair ratio of around 33 times. This raises real de rating risk if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Performance Food Group Narrative

If you see the story differently or would rather dive into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Performance Food Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Turn your curiosity into an edge and let high quality data surface fresh stock ideas before everyone else, so you are never caught reacting late again.

- Explore early-stage opportunities in innovative names by targeting these 3633 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Position your portfolio within technological change by focusing on these 24 AI penny stocks that may be positioned to benefit from accelerating AI adoption.

- Seek reliable income streams by zeroing in on these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报