We Think Shakti Pumps (India) (NSE:SHAKTIPUMP) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Shakti Pumps (India) Limited (NSE:SHAKTIPUMP) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is Shakti Pumps (India)'s Debt?

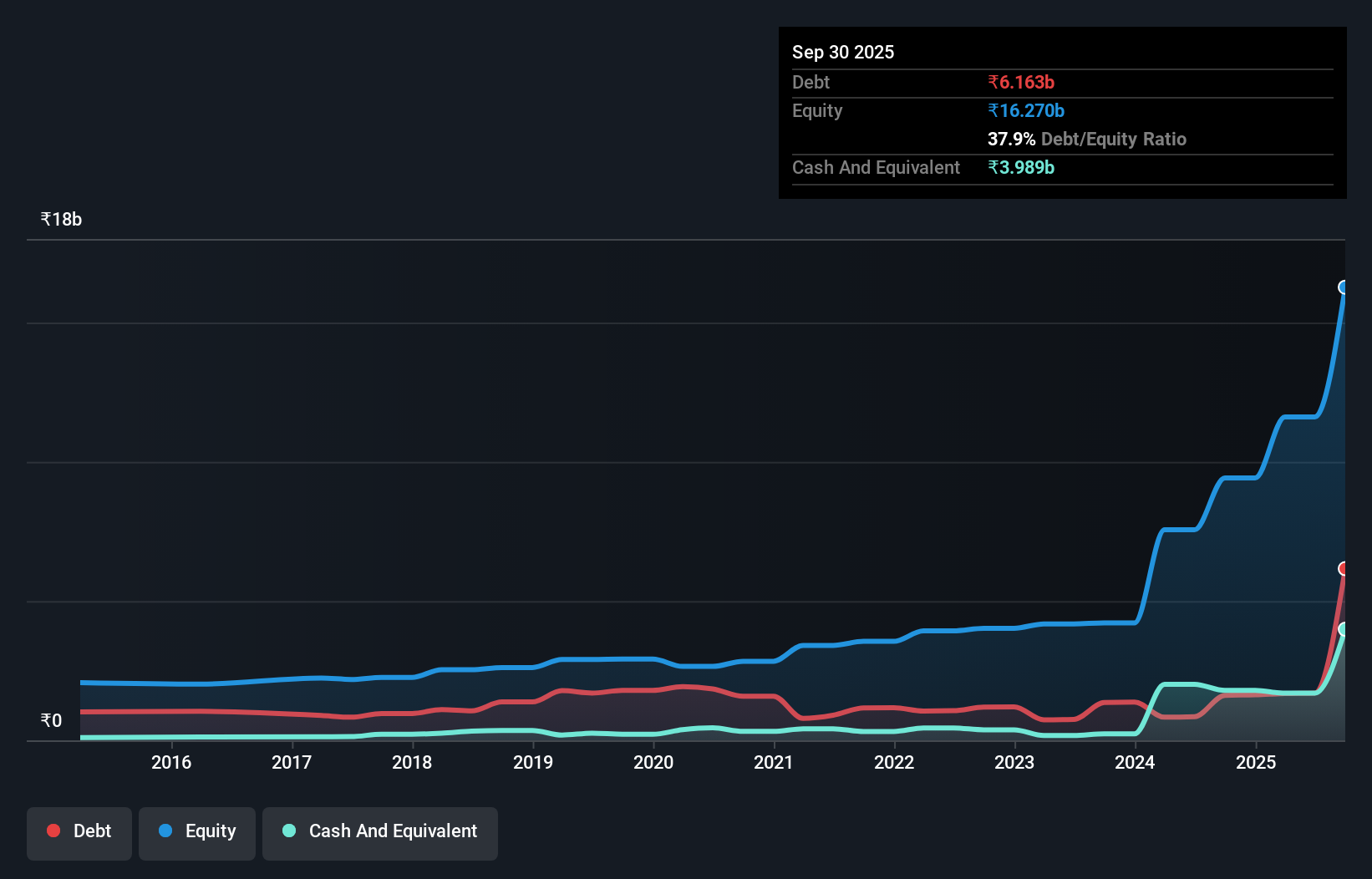

You can click the graphic below for the historical numbers, but it shows that as of September 2025 Shakti Pumps (India) had ₹6.16b of debt, an increase on ₹1.61b, over one year. However, because it has a cash reserve of ₹3.99b, its net debt is less, at about ₹2.17b.

How Healthy Is Shakti Pumps (India)'s Balance Sheet?

The latest balance sheet data shows that Shakti Pumps (India) had liabilities of ₹12.7b due within a year, and liabilities of ₹1.01b falling due after that. On the other hand, it had cash of ₹3.99b and ₹16.7b worth of receivables due within a year. So it actually has ₹6.95b more liquid assets than total liabilities.

This short term liquidity is a sign that Shakti Pumps (India) could probably pay off its debt with ease, as its balance sheet is far from stretched.

View our latest analysis for Shakti Pumps (India)

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Shakti Pumps (India)'s net debt is only 0.36 times its EBITDA. And its EBIT easily covers its interest expense, being 29.0 times the size. So we're pretty relaxed about its super-conservative use of debt. Also positive, Shakti Pumps (India) grew its EBIT by 21% in the last year, and that should make it easier to pay down debt, going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Shakti Pumps (India) will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Shakti Pumps (India) burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

The good news is that Shakti Pumps (India)'s demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that Shakti Pumps (India) can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Shakti Pumps (India) (including 1 which makes us a bit uncomfortable) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报