Could the Bull Market Roar Higher in 2026? History Offers an Answer That's Remarkably Clear.

Key Points

The S&P 500 is heading for another increase this year after two consecutive years of gains of more than 20%.

Artificial intelligence stocks have been fueling the current bull market.

The S&P 500 bull market entered its third year a couple of months ago -- and at the same time, the benchmark is racking up significant annual gains too. The index climbed more than 20% in each of the two past years, and it's heading for yet another increase in 2025. Though you'll find winning stocks across sectors, one in particular has driven this bull market. That's technology, led by players in the artificial intelligence (AI) space.

Investors have flocked to AI stocks with the idea that the technology may save companies time and money -- and fuel game-changing discoveries and progress, from the development of new drugs to the powering of autonomous vehicles. All of this could supercharge corporate earnings growth over time, and investors have wanted to get in early to benefit.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Now, though, after the S&P 500 has reached multiple record highs and after some market participants have questioned whether AI stocks may have what it takes to keep surging, it's logical to ask the following question: Could the bull market roar higher in 2026? History offers an answer that's remarkably clear.

Image source: Getty Images.

The S&P 500 and the AI boom

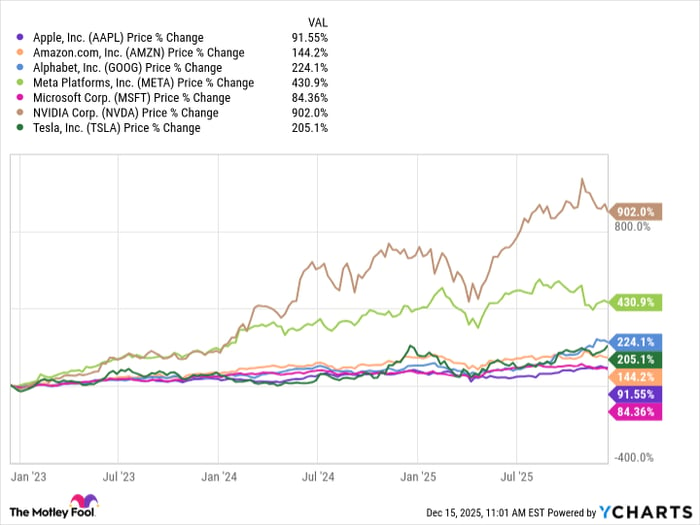

Before considering the question, though, let's take a closer look at the S&P 500's performance during this AI boom. As mentioned, tech stocks driving the AI revolution have played a big role in the index's performance -- in fact, the tech powerhouses known as the Magnificent Seven have seen their shares climb in the double and triple digits over the past three years.

Magnificent Seven stocks are among the most heavily weighted in the S&P 500, so if they're making big moves, they'll offer the index direction.

Most of these players have put a focus on AI, and in some cases, they're already generating growth from the technology. Amazon, for example, in the most recent quarter said its cloud computing business, Amazon Web Services (AWS), reached an annual revenue run rate of $132 billion -- and this is due to the enormous demand it's seeing for AI products and services. Nvidia, the world's leading AI chip designer, has seen revenue surge to record levels -- $130 billion in the latest fiscal year -- amid demand for its systems.

Worries about a bubble

All of this has pushed valuations of these stocks higher, prompting some analysts in recent weeks to question whether an AI bubble may be forming. Meanwhile, we've seen a pullback among tech stocks in recent days with major names like Oracle and Broadcom tumbling in the first two weeks of December. At the same time, stocks outside of the AI industry have climbed, prompting some to ask whether we're seeing a rotation into a broader range of players ahead of the new year.

Now, let's get back to our question: Will the bull market continue in 2026? A look at history offers us valuable clues. Over the past 50 years, five other bull markets made it as far as the current bull market -- and each one lasted at least five years, according to Ryan Detrick, chief market strategist at Carson Group.

| Bull market | Duration |

|---|---|

| October 1974 – November 1980 | 6.2 years |

| August 1982 – August 1987 | 5 years |

| December 1987 -- March 2000 | 12.3 years |

| October 2002 – October 2007 | 5 years |

| March 2009 – February 2020 | 11 years |

Data source: Carson Group |

So, with the S&P 500 now in the third year of a bull market, this data offers us a remarkably clear answer to our question. If history is right, the S&P 500 bull market will continue in 2026 and possibly beyond.

Is history always right?

Before cheering, though, it's important to remember that history isn't always right. It's possible that on certain occasions, the market will do something unexpected -- and that means it's possible the S&P 500 will surprise us and exit the bull market. Still, historical trends are valuable as they offer us a view of what may be the most likely scenario.

What does this mean for you as an investor? Right now, history points to this bull market continuing in 2026, and strong AI demand, as well as earnings growth and a lower interest rate environment, support this. So, there's reason to be optimistic about 2026. But here's the best news of all: Regardless of what direction the S&P 500 takes in the coming year, the index has always advanced over the long term, meaning buying stocks and holding them for a number of years may be your ticket to a big investing win.

Adria Cimino has positions in Amazon, Oracle, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq 华尔街日报

华尔街日报