Is Cognizant (CTSH) Still Fairly Valued After Its Recent Share Price Rally?

Cognizant Technology Solutions (CTSH) has quietly pushed higher lately, with the stock up around 12% over the past month and roughly 25% in the past 3 months, outpacing many large tech peers.

See our latest analysis for Cognizant Technology Solutions.

That recent surge builds on an 11.78% year to date share price return and a much stronger 60.18% three year total shareholder return. This suggests momentum is picking up as investors lean into Cognizant’s improving growth profile and perceived execution upside.

If Cognizant’s renewed momentum has your attention, this could be a good moment to explore other established and emerging names in high growth tech and AI stocks for fresh ideas.

Yet with shares now hovering just below Wall Street’s target despite solid double digit earnings growth, investors have to ask: is Cognizant still trading at a discount, or is the market already pricing in its next chapter?

Most Popular Narrative Narrative: 20% Overvalued

Compared to the last close of $85.41, the most popular narrative pegs Cognizant’s fair value slightly lower at about $85, framing a modest premium in today’s price.

Analysts are assuming Cognizant Technology Solutions's revenue will grow by 4.7% annually over the next 3 years.

Analysts assume that profit margins will increase from 11.9% today to 12.5% in 3 years time.

Want to see how steady revenue growth, firmer margins, and a richer future earnings multiple combine to justify this valuation view? Unpack the full narrative playbook.

Result: Fair Value of $85.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential US visa cost hikes and intensifying AI driven competition could squeeze margins and slow Cognizant’s growth, challenging this upbeat valuation narrative.

Find out about the key risks to this Cognizant Technology Solutions narrative.

Another Lens on Value

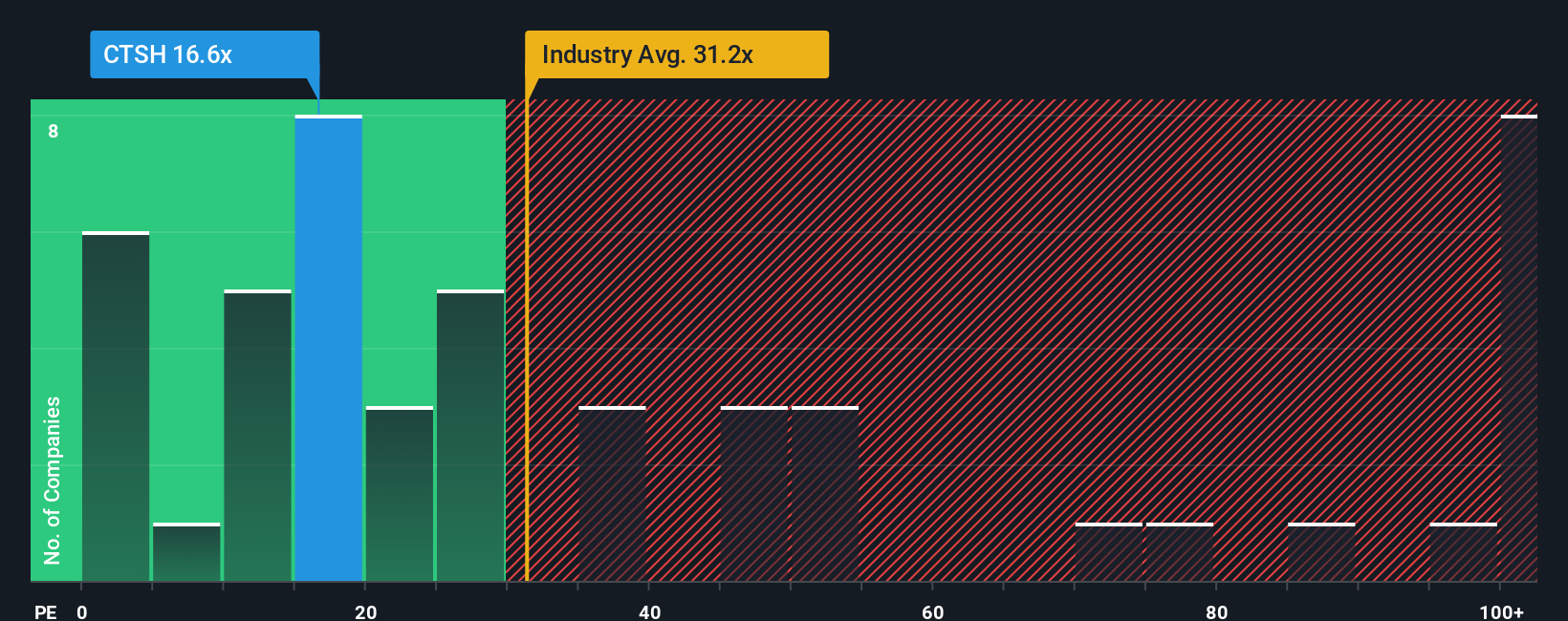

On earnings multiples, Cognizant looks much cheaper than it first appears. The stock trades on about 19.4 times earnings, versus 29.8 times for the US IT industry and 25.2 times for peers. Our fair ratio sits even higher at 33.9 times. Is the market underestimating how far sentiment could catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognizant Technology Solutions Narrative

If this perspective does not fully align with your own or you would rather dig into the numbers independently, you can build a personalized view in under three minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cognizant Technology Solutions.

Looking for more investment ideas?

Do not stop with Cognizant when the market is full of opportunities. Use the Simply Wall Street Screener to pinpoint high potential stocks that match your strategy.

- Capture early stage growth potential by scanning these 3633 penny stocks with strong financials that already show resilient financial strength.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned at the heart of artificial intelligence breakthroughs.

- Lock in value opportunities by focusing on these 913 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报