Sunac China (SEHK:1918) Valuation Check as Offshore Debt Restructuring Nears Key Completion Step

Sunac China Holdings (SEHK:1918) is back on investors radar as its long running offshore debt overhaul nears a key milestone, with markets eyeing the effective date of its multi billion dollar restructuring plan.

See our latest analysis for Sunac China Holdings.

The debt overhaul narrative is now clearly showing up in the tape, with the share price at HK$1.31 after a steep year to date share price return of minus 42.29 percent and a one year total shareholder return of minus 46.31 percent. This suggests sentiment is improving at the margin, but long term holders are still sitting on deep losses.

If this turnaround story has your attention, it could be a good moment to scan the market for other potential comeback names through fast growing stocks with high insider ownership.

With the balance sheet set to look radically different and the share price still deep in the red over one and five years, is the market underestimating a cleaner Sunac or already pricing in its recovery potential?

Price-to-Sales of 0.2x: Is it justified?

On a price-to-sales basis, Sunac China Holdings looks deeply discounted, with the HK$1.31 last close implying a 0.2x multiple that screens as undervalued versus peers.

The price-to-sales ratio compares the company’s market value to its annual revenue. It can be a useful gauge for loss-making or highly cyclical real estate developers where earnings are volatile or negative.

For Sunac, a 0.2x price-to-sales ratio stands well below both the Hong Kong real estate industry average of 0.7x and the peer average of 0.3x. It also comes in under the SWS estimated fair price-to-sales ratio of 0.4x, which suggests the market may be assigning a heavy discount that could narrow if sentiment and cash flow visibility improve.

Explore the SWS fair ratio for Sunac China Holdings

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, risks remain, including ongoing revenue contraction and deep net losses, which could derail the recovery if refinancing or property demand disappoints.

Find out about the key risks to this Sunac China Holdings narrative.

Another View: Our DCF Lens

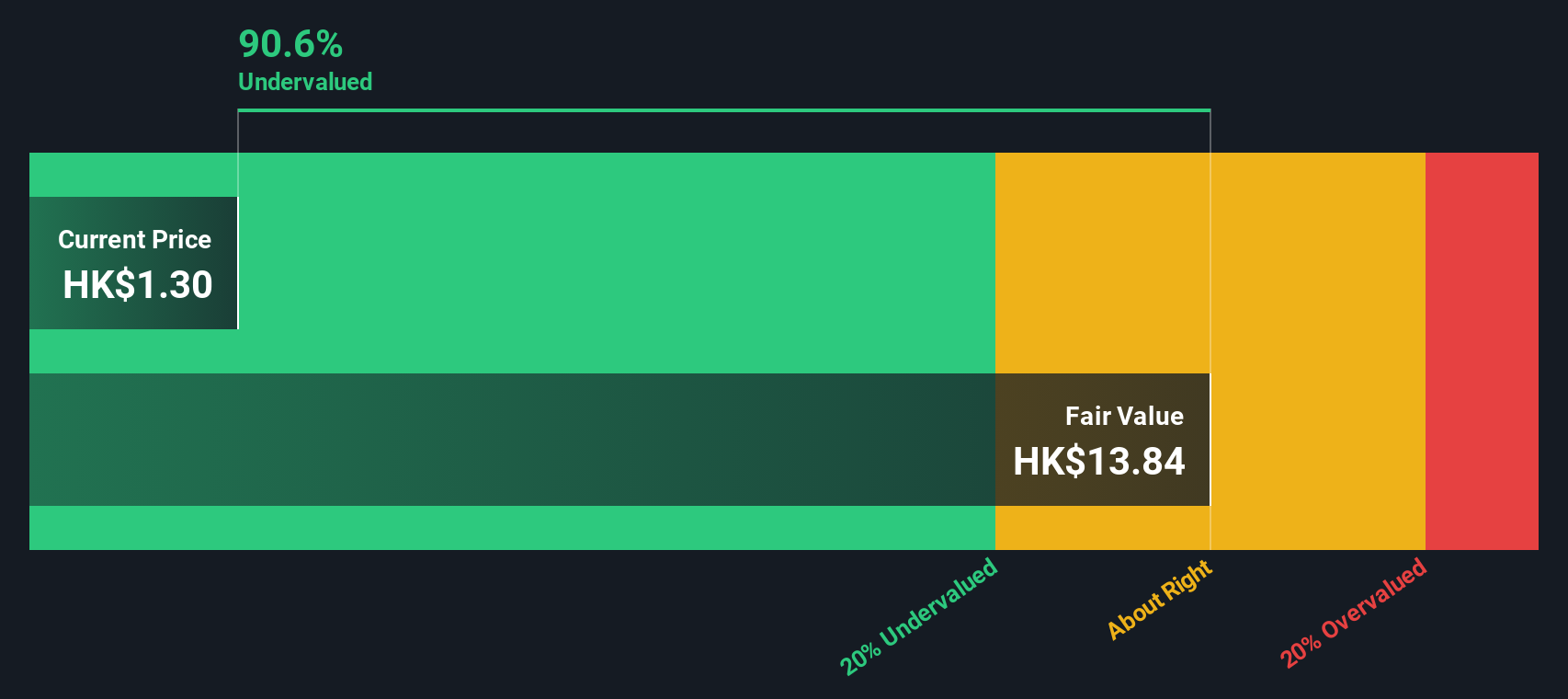

While the low price to sales hints at value, our DCF model paints an even starker picture, suggesting Sunac China Holdings could be trading around 90.5 percent below its estimated fair value of HK$13.83. That implies potential upside if, and it is a big if, the turnaround sticks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sunac China Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sunac China Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Sunac China Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Now is the time to broaden your watchlist, compare new opportunities, and stay ahead of the crowd with powerful screeners that surface focused, high potential ideas.

- Capture early stage potential with these 3633 penny stocks with strong financials that already show solid fundamentals instead of chasing hype at the top.

- Position your portfolio for structural growth by targeting these 29 healthcare AI stocks at the intersection of technology and long term medical demand.

- Lock in more reliable income streams by zeroing in on these 12 dividend stocks with yields > 3% that can strengthen your returns when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报