Prosperity Bancshares (PB): Assessing Valuation After Recent Share Price Gains

Prosperity Bancshares (PB) has been quietly grinding higher, with the stock up about 5% over the past month and 9% in the past 3 months, even as year-to-date returns remain slightly negative.

See our latest analysis for Prosperity Bancshares.

That recent 1 month share price return of around 5% sits against a slightly negative year to date share price performance. At the same time, the 5 year total shareholder return of just over 21% suggests momentum is gradually rebuilding rather than breaking down.

If Prosperity Bancshares has you watching regional banks more closely, it could be a good time to broaden your radar with fast growing stocks with high insider ownership.

With earnings still growing double digits and the share price trading only slightly below analyst targets and intrinsic value estimates, is Prosperity Bancshares quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 9.2% Undervalued

With Prosperity Bancshares last closing at $71.40 against a narrative fair value of about $78.67, the storyline points to a modest valuation gap that hinges heavily on future growth and efficiency assumptions.

Repricing of a sizable bond portfolio and rollover of existing loans at higher yields, combined with a disciplined deposit pricing strategy and low cost core deposit base, are set to meaningfully increase net interest margin and net interest income through 2026.

Want to see what happens when accelerating margins, steady double digit growth, and a richer future earnings multiple all come together in one forecast? The full narrative reveals the exact roadmap behind that valuation call.

Result: Fair Value of $78.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising nonperforming assets and ongoing loan and deposit declines could pressure margins and undermine the steady growth path embedded in this valuation.

Find out about the key risks to this Prosperity Bancshares narrative.

Another Angle on Valuation

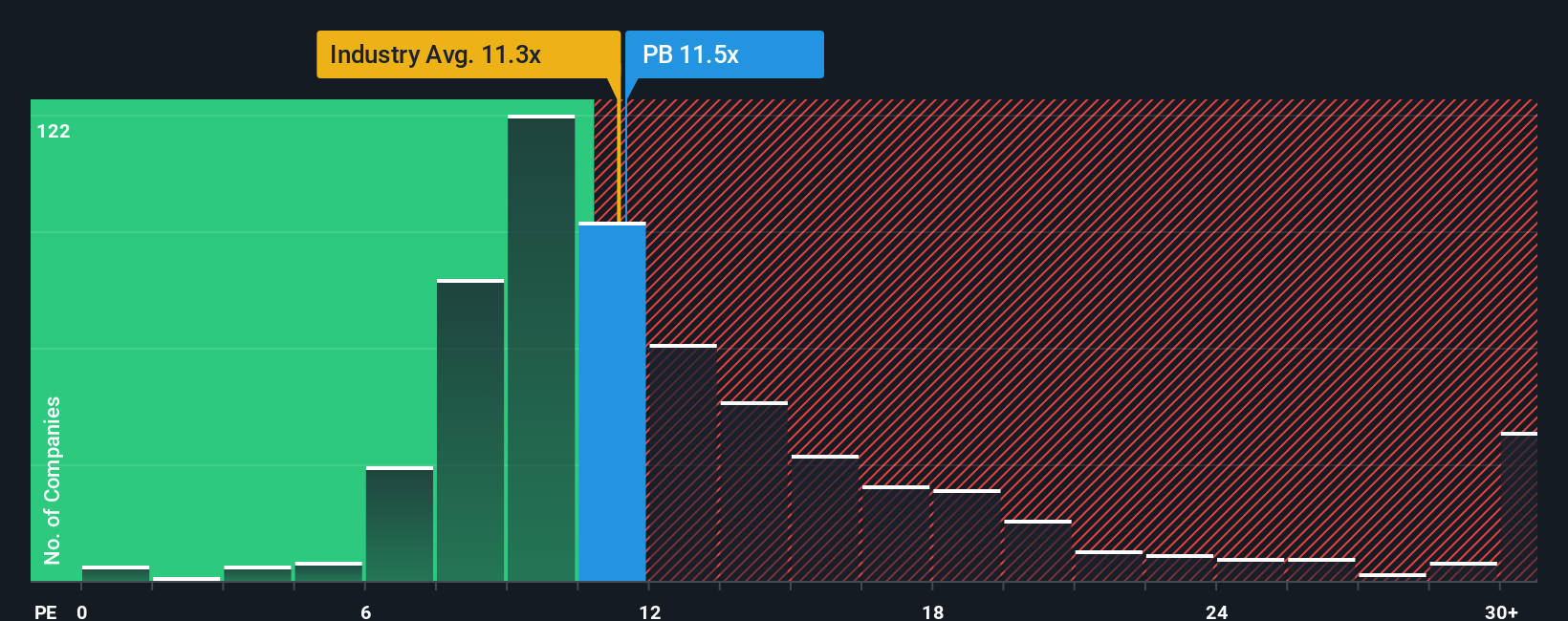

On earnings, the picture is less generous. Prosperity Bancshares trades at about 12.7 times earnings, slightly richer than the US banks average of 11.9 times, but below its fair ratio of 13.1 times and the 13.9 times peer average. Is that a slim margin of safety or a warning on upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prosperity Bancshares Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Prosperity Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover focused, data driven stock ideas that match your strategy.

- Target steady income growth by scanning these 12 dividend stocks with yields > 3% that aim to reward shareholders with reliable cash flows.

- Position yourself in the next wave of innovation by reviewing these 24 AI penny stocks gaining momentum from breakthroughs in artificial intelligence.

- Explore valuation gaps by focusing on these 913 undervalued stocks based on cash flows where prices may not yet reflect future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报