Intel (INTC) Valuation Check After 88% One-Year Rally and Turnaround Momentum

Intel (INTC) has quietly put together a solid run, with the stock up roughly 7% over the past month and almost 90% over the past year, outpacing much of the semiconductor space.

See our latest analysis for Intel.

At a share price of $36.82, Intel’s 30 day share price return of 6.7% and sharply stronger 1 year total shareholder return of 88.6% suggest momentum is still building as investors reassess its turnaround and foundry ambitions.

If you are watching Intel’s revival and wondering what else might be in the pipeline, this is a good moment to explore high growth tech and AI stocks for other potential semiconductor and AI beneficiaries.

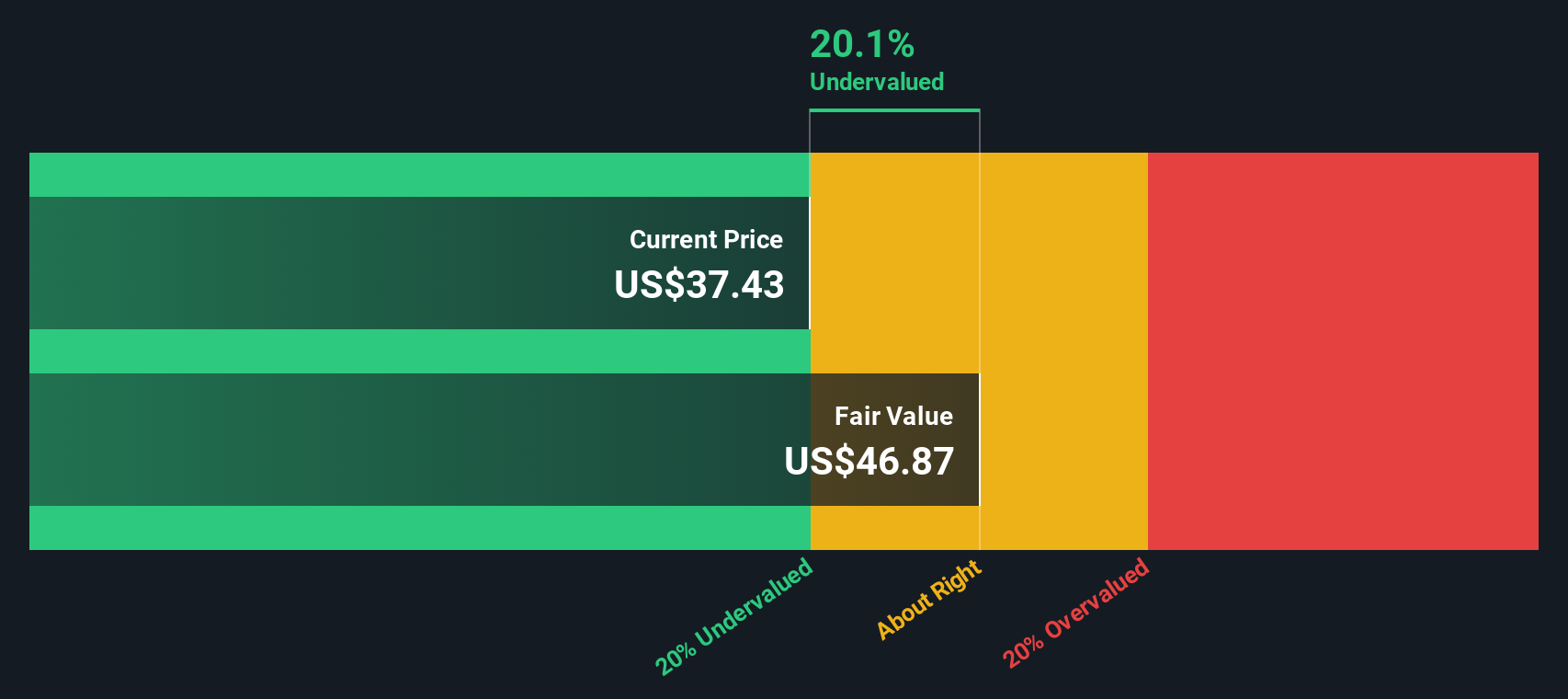

Yet with Intel trading near analyst targets after an 88 percent 1 year surge, the key question now is simple: is this still a mispriced turnaround story, or has the market fully baked in its next leg of growth?

Most Popular Narrative Narrative: 1.2% Undervalued

With Intel last closing at $36.82 against a narrative fair value of about $37.27, the story rests on a finely balanced upside case.

Supportive balance sheet actions and aggressive investment in product and foundry buildout are viewed as increasing the probability that Intel can narrow its technology and scale gap with leading foundry peers over time, which underpins higher valuation multiples.

Curious what kind of revenue runway, margin rebuild, and future earnings multiple it takes to justify this near full valuation re rating? The underlying projections may surprise you.

Result: Fair Value of $37.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering execution risks in Intel’s AI roadmap and potential foundry margin pressure could quickly challenge today’s nearly full turnaround valuation.

Find out about the key risks to this Intel narrative.

Another Angle on Value

Our SWS DCF model paints a very different picture, suggesting Intel’s shares are trading well above an estimated fair value of about $14.71. That would imply the stock is significantly overvalued on cash flow grounds, raising the question: which story do you trust more, narrative multiples or hard discounted cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intel Narrative

If you see Intel’s story differently or simply want to stress test the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Intel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winners using the Simply Wall Street Screener, so you are not relying on just one turnaround story.

- Uncover overlooked value by targeting these 913 undervalued stocks based on cash flows, where strong cash flow analysis suggests the market has not fully appreciated them yet.

- Ride the next wave of innovation by zeroing in on these 24 AI penny stocks positioned to benefit from advances in artificial intelligence.

- Boost your income potential by focusing on these 12 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报