Asian Growth Companies With High Insider Ownership December 2025

As Asian markets navigate a landscape marked by mixed economic signals and evolving monetary policies, investors are increasingly focusing on companies that demonstrate resilience and growth potential. In this context, stocks with high insider ownership often stand out as they can indicate strong management confidence and alignment with shareholder interests, making them attractive considerations in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.3% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Growth Rating: ★★★★★★

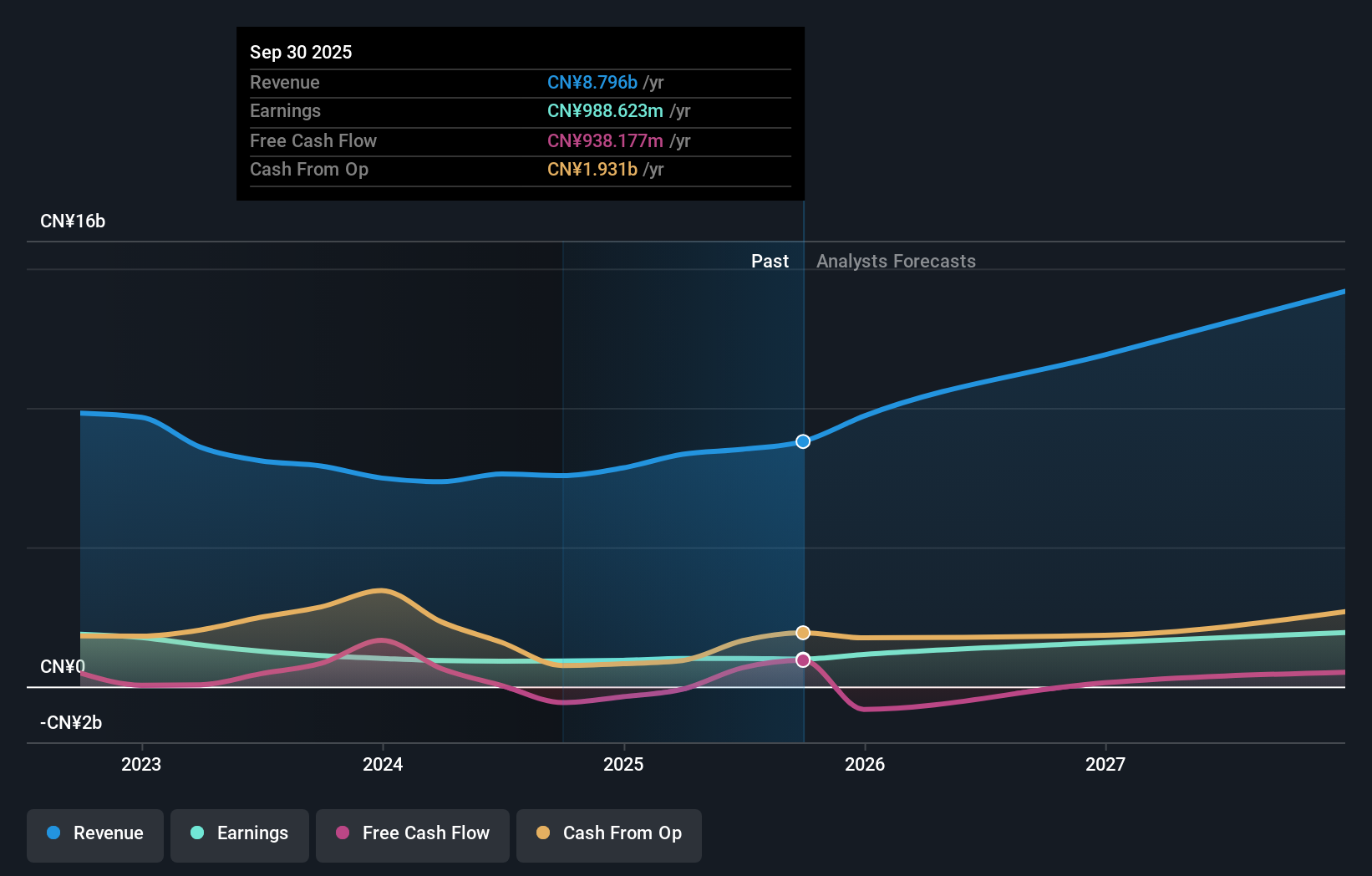

Overview: Shanghai Chicmax Cosmetic Co., Ltd. is a multi-brand cosmetics company involved in the research, development, manufacture, and sale of cosmetic products both in Mainland China and internationally, with a market cap of approximately HK$35.03 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of cosmetic products, amounting to CN¥7.40 billion.

Insider Ownership: 39.3%

Earnings Growth Forecast: 23.9% p.a.

Shanghai Chicmax Cosmetic is positioned for robust growth, with revenue expected to rise 21.8% annually, outpacing the Hong Kong market's 8.5%. Despite significant insider selling recently, the company trades at a discount to its estimated fair value and boasts high-quality earnings. Recent board changes include appointing Mr. Sun Hao and Ms. Zhou Wei as directors, potentially enhancing strategic management and operational oversight amid anticipated profit growth of 23.9% per year over three years.

- Dive into the specifics of Shanghai Chicmax Cosmetic here with our thorough growth forecast report.

- Our valuation report here indicates Shanghai Chicmax Cosmetic may be overvalued.

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Capchem Technology Co., Ltd. engages in the research, development, production, sale, and servicing of electronic chemicals and functional materials both in China and internationally, with a market cap of CN¥36.84 billion.

Operations: Shenzhen Capchem Technology Co., Ltd. generates revenue through its operations in electronic chemicals and functional materials across domestic and international markets.

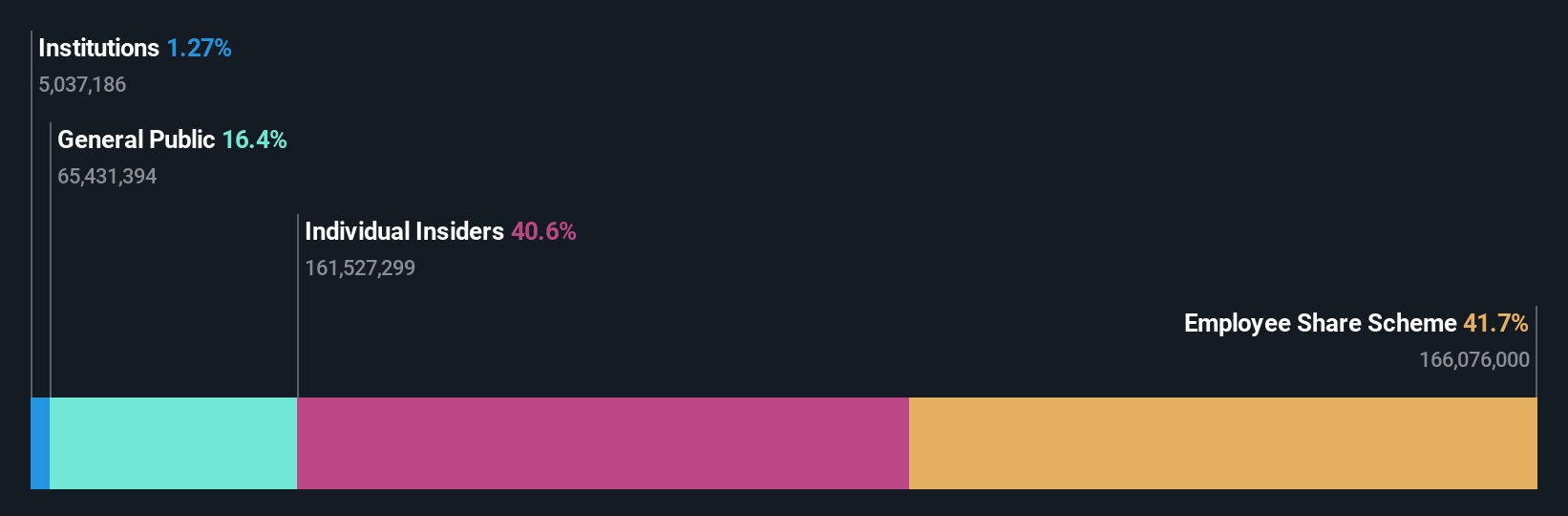

Insider Ownership: 38.4%

Earnings Growth Forecast: 30.4% p.a.

Shenzhen Capchem Technology is poised for significant growth, with projected earnings and revenue increases of 30.4% and 21.1% annually, respectively, surpassing the broader Chinese market's expectations. The company's recent amendments to its articles of association may signal strategic shifts to support this expansion. Despite a volatile share price and low forecasted return on equity (14.7%), its current price-to-earnings ratio (37.3x) remains attractive compared to the local market average of 43.5x.

- Click here to discover the nuances of Shenzhen Capchem Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Shenzhen Capchem Technology's current price could be inflated.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

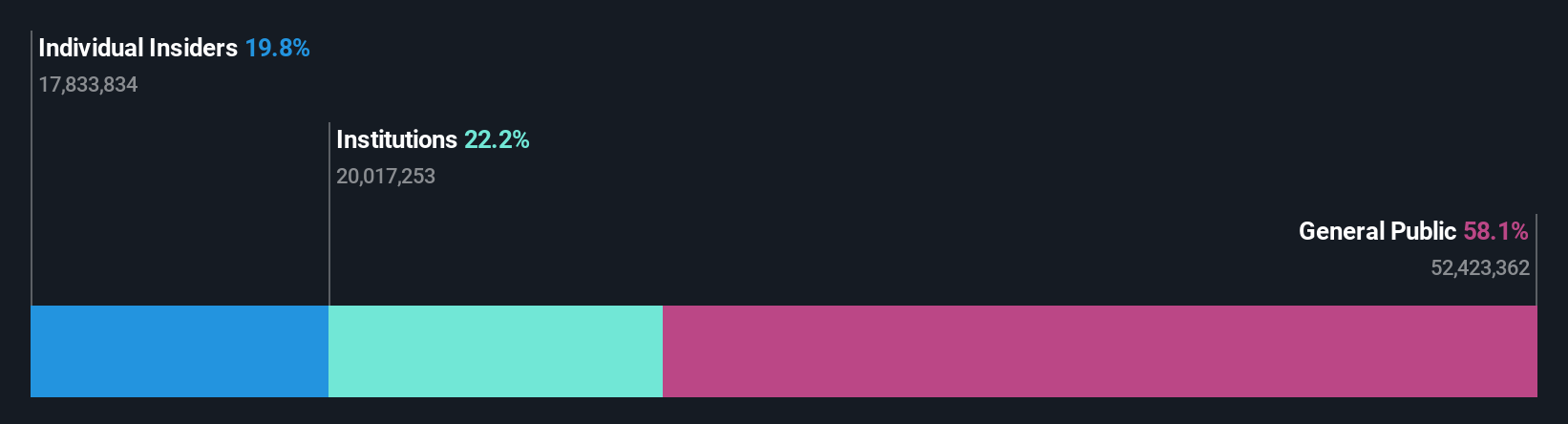

Overview: Auras Technology Co., Ltd. operates in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and internationally with a market cap of NT$88.87 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, which generated NT$19.80 billion.

Insider Ownership: 19.5%

Earnings Growth Forecast: 44.1% p.a.

Auras Technology demonstrates robust growth potential, with earnings projected to increase by 44.1% annually, outpacing the TW market. Revenue is also expected to rise significantly at 32.5% per year. The company's recent financial performance supports this outlook, with third-quarter sales reaching TWD 5.96 billion and net income of TWD 973.81 million, both showing substantial year-over-year growth. Despite a highly volatile share price recently, Auras maintains high-quality earnings and significant insider ownership stability.

- Get an in-depth perspective on Auras Technology's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Auras Technology's share price might be on the expensive side.

Next Steps

- Click this link to deep-dive into the 636 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报